SEC Greenlights Bitcoin ETF Options, and DBS Introduces Tokenized Services - October 21, 2024

Also, BTC hovers around $68K, and SEC has ongoing legal battles.

TL;DR: Crypto Insights in Seconds

SEC: The SEC has given NYSE the go-ahead for options trading on multiple Bitcoin ETFs.

DBS Bank: Singapore’s largest bank introduces token services.

U.S. spot Bitcoin ETFs: Reach $1 billion in a six-day streak of inflows.

Crypto.com: Sued the SEC in a high-stakes "bet the company" case.

Ripple: The SEC questions if the Court made a mistake in judgment during XRP case.

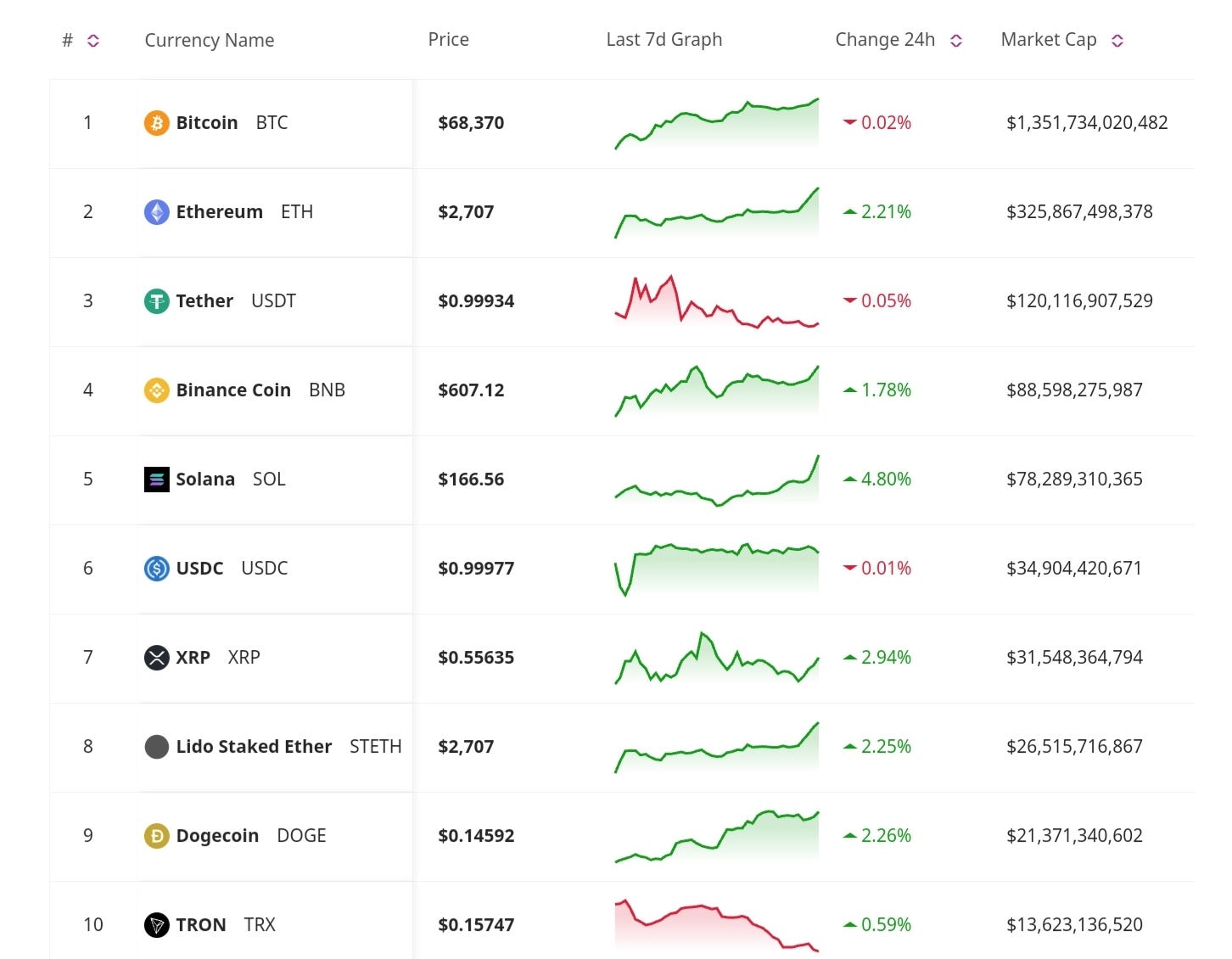

Price Update

Bitcoin Around $68K and Record ETF Inflows

Bitcoin is flirting with the $68,000 mark as institutional inflows into U.S. spot Bitcoin ETFs continue to encourage the market. This comes after a six-day streak of inflows reaching $1 billion, pushing overall ETF asset values to record highs. Analysts expect this momentum to continue as the market anticipates further ETF approvals and expanded options trading.

Regulatory and Legal Updates

SEC Approves Options Trading for Bitcoin ETFs

The U.S. SEC has approved the NYSE to list options trading for several Bitcoin ETFs, taking a significant step forward for the market. This new trading option will allow investors more flexibility in managing their positions and could further expand institutional participation.

Crypto.com Takes Bold Step in SEC Legal Battle

Crypto.com has sued the SEC in a high-stakes "bet the company" case, seeking to prevent the SEC from regulating secondary-market sales of network tokens. The company’s argument challenges the SEC's authority to classify certain digital assets as “crypto asset securities.” If successful, this lawsuit could significantly impact the SEC’s regulatory framework for the crypto industry.

SEC Continues Appeal in Ripple Case

The SEC filed a "Civil Appeal Pre-Argument Statement," questioning whether the U.S. District Court for the Southern District of New York made an error in its judgment, specifically concerning Ripple’s offers and sales of XRP and the involvement of Ripple executives Brad Garlinghouse and Chris Larsen. The SEC is asking the court to reassess how the law was applied. Ripple’s Chief Legal Officer Stuart Alderoty clarified that the ruling that "XRP is not a security" is not being appealed and remains intact.

Business Developments

DBS Bank Introduces Tokenized Services for Blockchain Banking

DBS, Singapore’s largest bank, has rolled out new token services, allowing clients to tokenize real-world assets using blockchain technology. This service will offer clients access to blockchain-enabled financial products.

BlackRock’s Spot Bitcoin ETF Attracts $1 Billion This Week

BlackRock’s spot Bitcoin ETF has attracted $1 billion in inflows this week alone, underscoring the growing confidence of institutional investors in regulated Bitcoin products. The success of BlackRock’s ETF has been the main factor behind Bitcoin’s recent rally.

Analysis and Commentaries

DeFi Can Complement Traditional Finance, Says Federal Reserve Official

Federal Reserve Governor Christopher Waller has stated that decentralized finance could complement centralized financial systems, emphasizing the potential for DeFi to improve efficiency and innovation in the traditional financial world.

ECB Economists Warn of Risks from Constant Bitcoin Price Increases

Economists at the European Central Bank have issued a warning that perpetually rising Bitcoin prices could lead to societal impoverishment. They argue that the continuous appreciation of Bitcoin could cause wealth concentration and destabilize economic systems.

Bitcoin’s march toward $70K and the record-breaking inflows into U.S. spot Bitcoin ETFs show the growing institutional demand for crypto assets. Meanwhile, regulatory developments, such as the SEC’s approval of options trading for Bitcoin ETFs and its ongoing legal battles, are shaping the future of the industry. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Great one 💜🚀