Crypto Market Slumps, and Trump Appoints Head Crypto Council - December 23, 2024

Also, BTC falls to $93K, and ETH ETFs shine during volatility.

TL;DR: Crypto Insights in Seconds

BTC: Falls to $93K and drags the crypto market with it.

U.S. Spot Bitcoin ETFs: Experience daily record outflows with $680 million.

ETH ETFs: See significant inflows in December, logging $1.66 billion.

SEC: Approves Bitcoin-Ethereum combo ETFs.

Trump: Appoints Bo Hines to lead Crypto Council.

BUIDL: Securitize proposes BUIDL for stablecoin collateral.

Tether: Invests $775 million in Rumble.

Usual: DeFi protocol Usual surpasses BlackRock's BUIDL in tokenized treasuries.

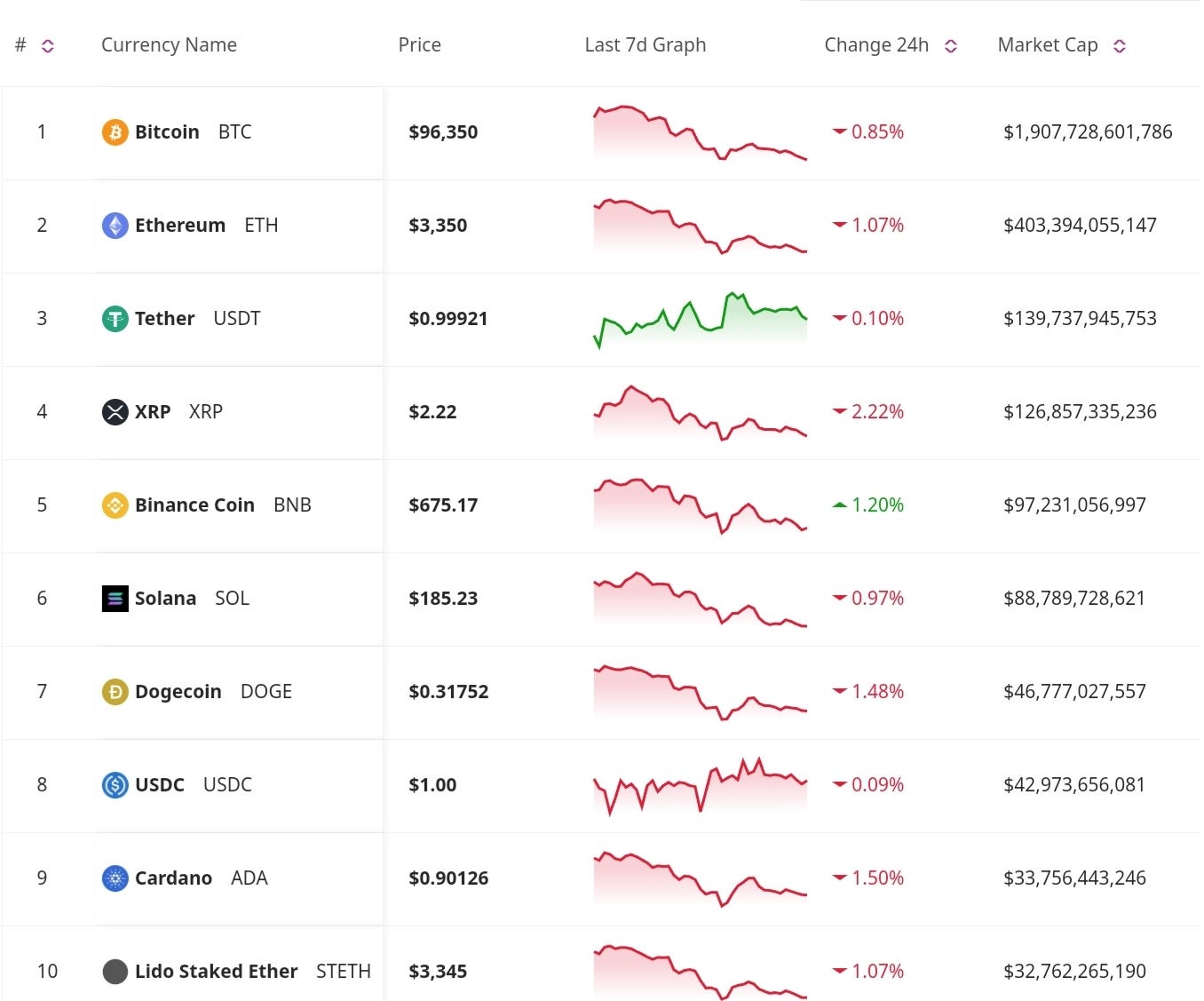

Price Update

Bitcoin Tumbles to $93K Following a Market Slump

Bitcoin experienced a sharp drop to $93,000, marking a continued downturn in crypto markets. Dogecoin plunged 27%, just one example of the massive selloff triggered by macroeconomic uncertainties. Analysts attribute this decline to the Federal Reserve’s hawkish signals regarding rate cuts for 2025, which have shaken investor confidence.

ETFs News

Record Outflows Hit U.S. Spot Bitcoin ETFs

U.S. spot Bitcoin ETFs faced $680 million in daily outflows, ending a long streak of positive inflows. This shift coincides with the growing market anxiety, likely driven by macroeconomic factors and profit-taking at recent price peaks.

Ethereum ETFs Shine During Crypto Volatility

Despite the market downturn, Ethereum ETFs saw significant inflows in December, totaling $1.66 billion. BlackRock’s ETHA product led the charge, solidifying Ethereum’s position as a favored asset among institutional investors.

SEC Approves Bitcoin-Ethereum Combo ETFs

The SEC has greenlit Bitcoin and Ethereum combo ETFs from providers Hashdex and Franklin Templeton. This approval expands access to diversified crypto investment products, potentially attracting a wider investor base even with fluctuating market conditions.

Regulatory and Legal News

Trump Appoints Bo Hines to Head Crypto Council

Former college football player and GOP House nominee Bo Hines has been appointed by Donald Trump to lead the new Crypto Advisory Council. This decision is another step in Trump’s push to solidify the U.S. as a leader in crypto policy.

Securitize Proposes BUIDL Token for Stablecoin Collateral

Securitize has proposed using BlackRock’s BUIDL token as collateral for the Frax USD stablecoin. The initiative is part of a trend toward integrating traditional financial instruments with crypto-native projects to optimize stability and compliance.

Don’t Miss Anything

Tether Makes Strategic Investment in Rumble

Tether has invested $775 million in Rumble, a video-sharing platform, marking another move into diverse industries. Rumble plans to use $250 million for growth initiatives and the rest for a stock buyback. This partnership aligns with Tether CEO Paolo Ardiono’s focus on censorship-resistant tech. Following the news, Rumble’s stock surged over 44% in aftermarket trading.

DeFi Protocol Usual Overtakes BlackRock's BUIDL in Tokenized Treasuries

Hashnote’s USYC token has soared to over $1.2 billion in market cap, outpacing BlackRock’s BUIDL token. Its rapid growth highlights the demand for composable, yield-generating tokenized products in DeFi ecosystems. Key to its success has been Usual’s USD0 stablecoin, which leverages USYC as a primary reserve asset. Meanwhile, USD0’s governance token, USUAL, has spiked 50% since listing on Binance, drawing further investor interest.

This week highlights a turbulent yet transformative period for the crypto market. With regulatory advancements, new ETF approvals, and innovative DeFi products gaining traction, the ecosystem continues to evolve. However, volatility remains a defining feature, requiring investors to stay vigilant in navigating this dynamic landscape. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

great 👍