XRP Overtakes Tether, and Coinbase Integrates Apple Pay - December 02, 2024

Also, ETH might rally, and BTC dominance has dipped.

TL;DR: Crypto Insights in Seconds

XRP: Climbs to third place, overtaking USDT as the largest cryptocurrency by market cap. Also, ETFs might come soon.

ETH: Price chart is mirroring BTC legendary rally, and investor hopes for strong upward trajectory.

Altcoins: The market shifts from BTC to altcoins to take profit.

Trading: November saw the biggest trading volume since May 2021.

Digital Euro: ECB released second report detailing efforts about digital euro.

Coinbase: Integrates Apple Pay.

RTFKT: Nike-owned NFT project to close in 2025.

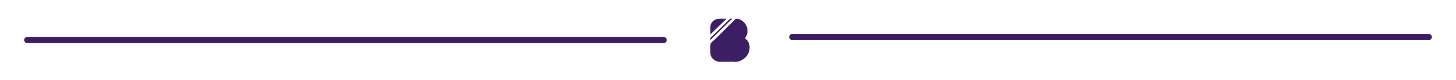

Price Update

XRP Overtakes Tether, Climbs to Third Place

XRP has surpassed Tether to become the third-largest cryptocurrency by market cap, showing its growing dominance in the crypto market. Ripple’s token now accounts for significant market activity amid increasing institutional interest, even as Bitcoin struggles with a $384 million sell wall that has capped its rally.

Ethereum Charts Mirror Bitcoin’s Legendary Rally

Ethereum’s price chart is drawing parallels to Bitcoin’s record-breaking run from previous years. Analysts note a similar pattern, raising hopes for a strong upward trajectory for ETH. This optimism coincides with global Ethereum investment products hitting an all-time high in annual inflows, underscoring robust institutional confidence in the network.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

Altcoins Surge, Reducing Bitcoin Dominance

Bitcoin’s dominance in the crypto market has dipped as altcoins experience renewed interest. With projects like XRP and Ethereum gaining traction, investors appear to be diversifying portfolios in search of higher returns, marking a notable shift in market dynamics.

Spot Trading Booms in November

November saw global spot trading volume hit $2.7 trillion, which is the highest level since May 2021, reflecting growing interest across major exchanges. The movement was fueled by pro-crypto candidate Donald Trump was elected as president.

Regulatory News

WisdomTree Joins XRP ETF Race

WisdomTree has filed with the SEC to launch a spot XRP ETF, following the success of Bitcoin and Ethereum ETFs. If approved, the product could further boost XRP's market prominence by providing easier access for institutional investors.

ECB Advances Digital Euro Project with Updated Rulebook and Innovation Partnerships

The European Central Bank (ECB) has released its second progress report on the digital euro, detailing developments in creating a unified CBDC payment system for the eurozone. Key updates include enhancements to the rulebook with minimum user experience standards and a risk management framework. Additionally, the ECB plans to collaborate with merchants, fintechs, and others to test conditional payments and innovative use cases. User research findings and provider selection is set for 2025.

Don’t Miss Anything

Coinbase Integrates Apple Pay for Seamless Fiat-to-Crypto Conversion

Coinbase continues its push for accessibility by integrating Apple Pay into its fiat-to-crypto onramp. This move simplifies the buying process for users and strengthens Coinbase’s position as the the top option for mainstream crypto adoption.

Nike-Owned RTFKT to Close in 2025

RTFKT, the NFT-focused brand acquired by Nike in 2021, announced it will end operations in January 2025. Before closing, RTFKT will release one final collection, the "BLADE DROP," symbolizing its commitment to innovation in the NFT space. The brand plans to transition into an "Artifact of cultural revolution," showcasing its pioneering work on a new website. Its closure coincides with fluctuating NFT sales trends and declining sneaker demand.

The crypto market continues to evolve with XRP's meteoric rise and Ethereum showing potential for a record rally. Meanwhile, Bitcoin faces headwinds as profit-taking slows its momentum. As institutional inflows increase and regulators take pivotal steps toward crypto integration, the market is poised for further transformation heading into 2025.As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

impressive