XRP Grows 300%, and BTC Hovers Around $99K - January 17, 2025

Also, Trump wants a U.S. crypto reserve, and Coinbase introduces loans.

TL;DR: Crypto Insights in Seconds

BTC: The token holds around $99K, and analyst are considering what could keep the price above $100K.

XRP: Grows 300% and reaches an all-time high, touching $3.4.

FDIC: Senator Lummis accuses the FDIC of destroying important crypto documents.

Solana: Bloomerg considers that ETFs approval could be delayed until 2026.

Trump: Considering creating a U.S. crypto reserve including BTC, SOL, and XRP.

Tether: Deployed its first cross-chain stablecoin, USDT0, on Kraken’s INK Layer 2.

Coinbase: Introduces Bitcoin-backed loans.

Crypto: Illicit activity now accounts for just 0.4% of blockchain transactions.

Ethereum: Validators are pushing for higher block gas limits.

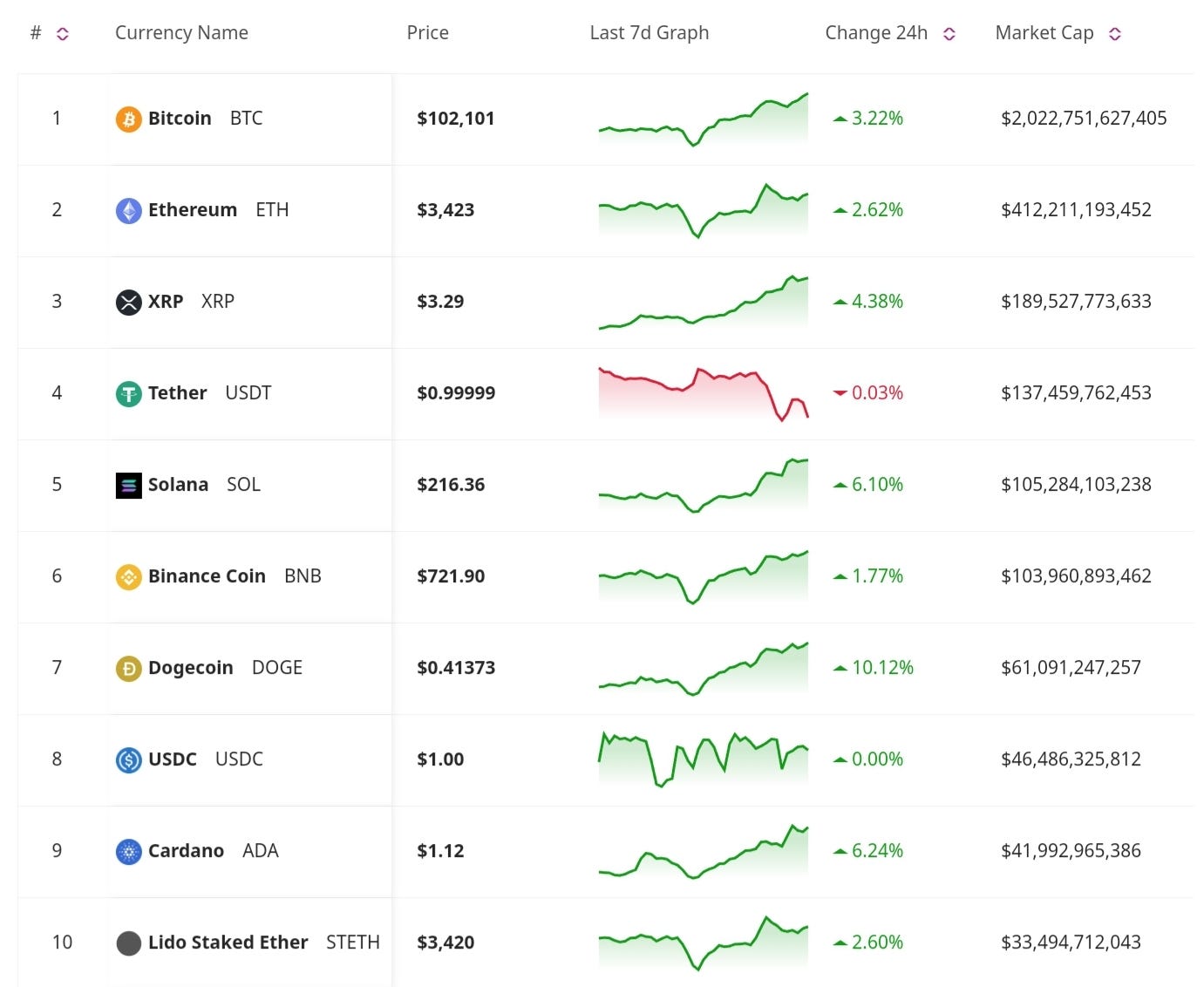

Price Update

Bitcoin's Path to a Stable $100K

The token has been holding around the $100K. Some traders expect a drop in the next days due to price correction. However, on the long term, analysts outline three key catalysts required for Bitcoin to consistently hold the $100K level: global regulatory clarity, the U.S. presidential election's crypto policies, and widespread institutional participation. These factors are expected to maintain BTC price above the mark and even beyond.

XRP's Breakout: A Record-Setting Rally

XRP is enjoying a historic rally, with a key price metric up by 300% in 2025. The surge has pushed XRP to new all-time highs because of growing institutional adoption and speculation about the approval of spot ETFs, which analysts predict could drive its price to $10.50.

Regulatory and Legal News

Senator Lummis Accuses FDIC of Document Destruction

U.S. Senator Cynthia Lummis alleged that the FDIC may have destroyed key documents related to Operation Chokepoint 2.0. This program was purportedly centered on cutting off banking services for crypto firms. The senator's accusations add to concerns about government transparency and its role in crypto policy enforcement.

Solana ETFs Delayed Until 2026

Bloomberg analysts predict that Solana-based ETFs will not be approved before 2026, citing ongoing regulatory uncertainties. Currently, there are about 4 different applications for Solana ETFs near their dateline. On January 23-25, the SEC will state if they are approved or not. If approved, this could encourage a rally for the token.

Strategic Reserve Proposed by Trump

Donald Trump has floated the idea of a U.S. "Strategic Crypto Reserve," potentially comprising Bitcoin, Solana, and XRP. The proposal seeks to solidify America’s position as a global crypto leader and reduce reliance on foreign reserves.

New Developments

Tether Expands Cross-Chain Solutions with Kraken's Layer 2

Tether has deployed its first cross-chain stablecoin, USDT0, on Kraken’s INK Layer 2. This integration serves to improve the interoperability of stablecoins, improving their use cases in decentralized finance and beyond.

Coinbase Introduces Bitcoin-Backed On-Chain Loans

Coinbase is now offering loans backed by Bitcoin through Morpho, targeting DeFi users looking to access liquidity without selling their holdings. This is a significant innovation in integrating traditional finance with DeFi protocols.

Don’t Miss Anything

Blockchain's Role in Illicit Finance Shrinks

A report by TRM Labs reveals that illicit activity now accounts for just 0.4% of blockchain transactions, marking a significant reduction in crypto's use for illegal purposes. This statistic demonstrates the industry's strides in compliance and law enforcement cooperation.

Ethereum Validators Push for Higher Block Gas Limits

Data shows that 30% of Ethereum validators are signaling support for raising the block gas limit, which would increase the network’s throughput. While this could further improve scalability, it raises questions about potential centralization risks.

This week highlights the crypto market's rapid evolution, with XRP and Bitcoin reaching milestones while innovation in blockchain infrastructure continues to flourish. However, regulatory challenges and macroeconomic uncertainties persist, shaping the industry's trajectory. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Xpr now is gold XPR growth day by day is massive