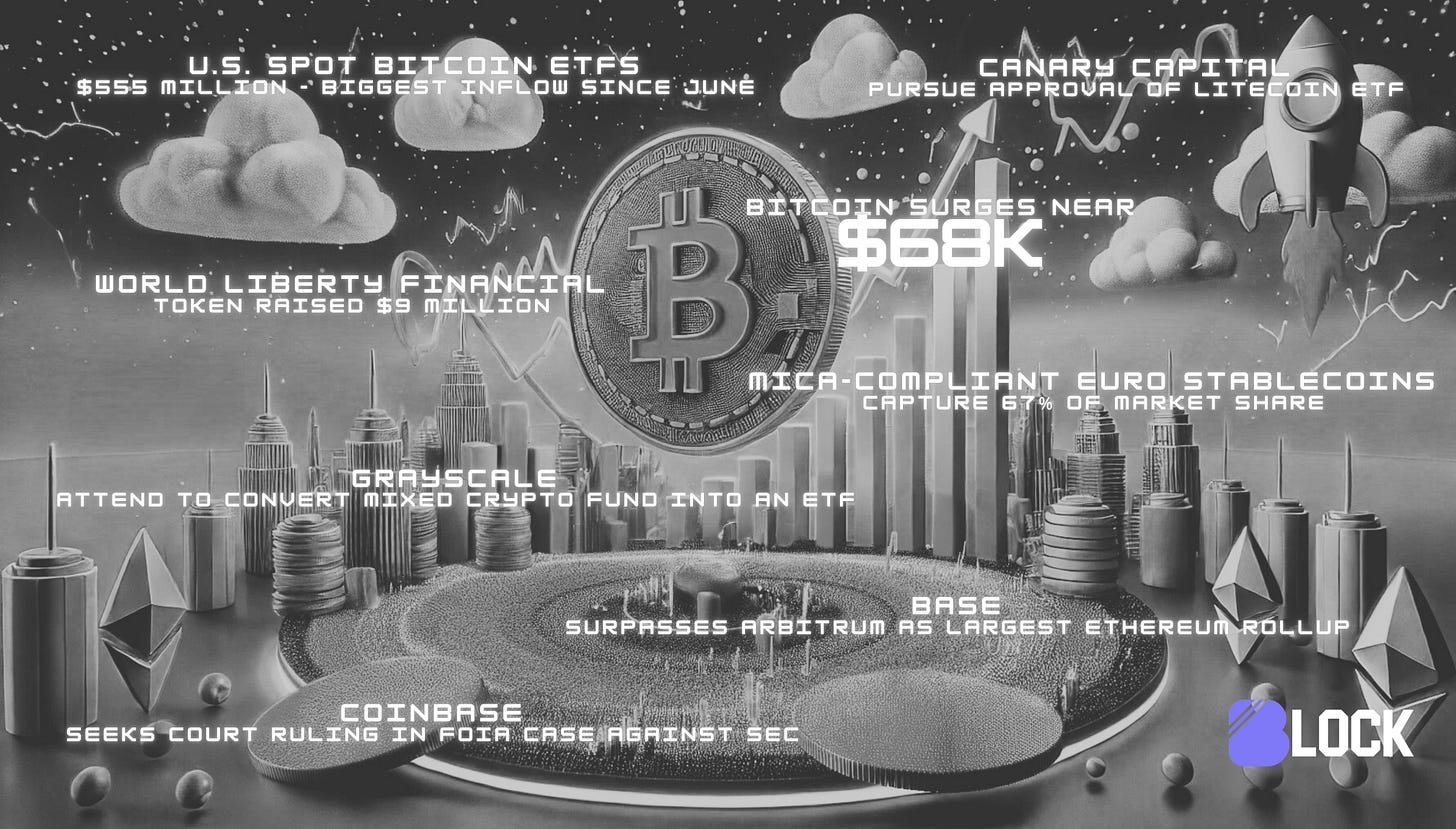

WLF Token Sales Underwhelm, Grayscale New ETF, and BTC Reach $68K - October 16, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: Hits $68K, its highest point since late July.

WLF: Generates just $9 million in token sales on the first day.

Grayscale: Files to convert a mixed crypto fund featuring Bitcoin, Ethereum, and Solana into an ETF.

U.S. spot Bitcoin ETFs: See $555 million, the biggest inflow since June.

Coinbase: Seeks court ruling in FOIA case against SEC.

Stablecoins: MiCA-compliant Euro stablecoins capture 67% of market share.

Base: Surpasses Arbitrum as largest Ethereum rollup.

Ripple and Bitstamp: Explore stablecoin developments.

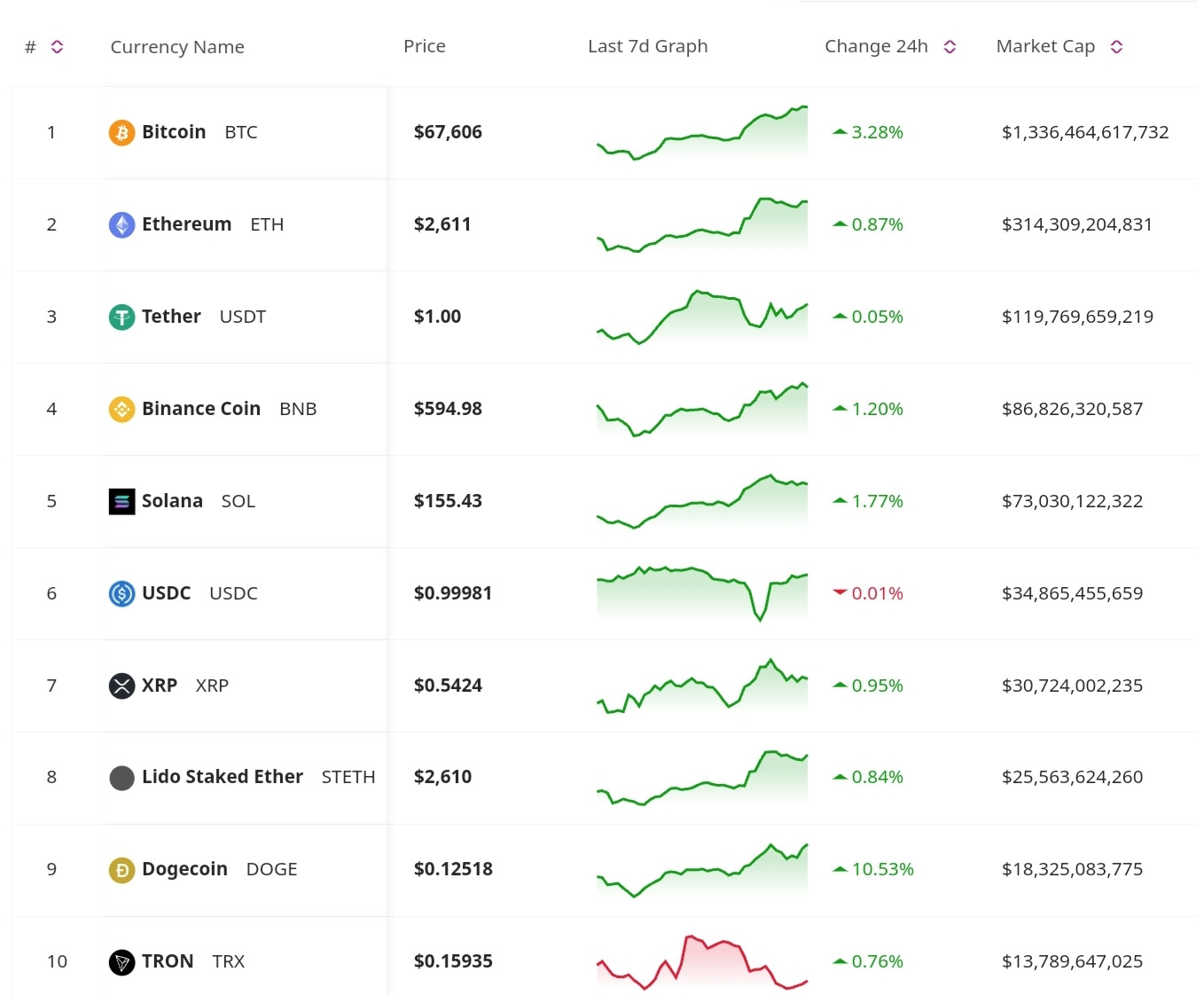

Price Update

Bitcoin Surges Near $68K, Highest Since July

Bitcoin briefly touched nearly $68,000, marking its highest level since July. Motivated by growing institutional interest and U.S. spot Bitcoin ETFs inflows, the token soared high and currently remains around the $67K mark.

Regulatory Updates

Coinbase Seeks Court Ruling in FOIA Case Against SEC

Coinbase has filed a request for a court ruling to compel the SEC to provide documents regarding how securities laws apply to crypto in an ongoing FOIA case. This legal battle could bring much-needed clarity to the regulatory status of cryptocurrencies in the U.S.

Market Trends

MiCA-Compliant Euro Stablecoins Capture 67% of Market Share

Following the EU’s MiCA regulations, MiCA-compliant euro stablecoins like Circle's EURC and Société Générale's EURCV now hold 67% of the market, according to Kaiko Research. Coinbase has surpassed Binance as the leading platform for trading these assets, while trading volumes remain stable at around $30 million weekly.

Base Surpasses Arbitrum as Largest Ethereum Rollup by Total Value Locked

Base has become the largest Ethereum rollup with $2.49 billion in total value locked (TVL), surpassing Arbitrum’s $2.39 billion, according to DeFiLlama. With 1.5 million daily active addresses, it leads in user activity among Layer 2 rollups. Although still in its early stages, Base plans to integrate fraud-proof systems as part of its decentralization roadmap.

ETFs News

Grayscale Looking to Convert Mixed Crypto Fund into an ETF

Grayscale has filed to convert its mixed crypto fund, which includes Bitcoin, Ethereum, and Solana, into an exchange-traded fund (ETF). Grayscale continues to push for more regulated and accessible crypto investment vehicles supported by rising institutional demand.

Litecoin ETF Filing: Canary Capital Seeks for Spot Approval

Canary Capital is seeking approval for a spot Litecoin ETF, another show of the growing interest in expanding the range of crypto-backed ETFs. This filing suggests that more altcoins may soon have similar investment vehicles.

U.S. spot Bitcoin ETFs See $555 Million, Biggest Inflow Since June

Market sentiment is riding high on institutional inflows and increased confidence in the approval of U.S. spot Bitcoin ETFs. With $555 million in net inflows into U.S. spot Bitcoin ETFs yesterday, the market is seeing significant interest from institutional players.

Business Developments

World Liberty Financial Token Sales Underwhelm, Raising $9 Million

Despite bold proclamations from Donald Trump that "crypto is the future," World Liberty Financial’s token sales generated only $9 million on their first day. This relatively modest figure fell short of expectations, showing that the market is still cautious about newer token offerings.

Network State Project "Praxis" Raises $52.5 Million to Build Crypto City

The ambitious Praxis project, which wants to build a crypto-friendly city, has secured $52.5 million in funding. This project envisions a city designed around blockchain principles, where digital assets and decentralized governance play central roles.

Ripple and Bitstamp Explore Stablecoin Developments

Ripple, Bitstamp, and Bitso are reportedly collaborating on stablecoin-related projects. The growing interest in stablecoins among major crypto firms is a clear sign of the increasing demand for stable digital currencies, especially in cross-border payments and DeFi applications.

Bitcoin’s surge to $68K shows the growing optimism in the market, fueled by institutional inflows and expectations for U.S. ETF approvals. Grayscale’s new ETF filing, and ongoing regulatory battles, are another display of the current challenges the industry is facing. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc