Whales Watching, XRP Surprises, and DOGE Eyes Wall Street

Also in focus OpenSea vs. the SEC, and Bybit’s rebound after a major hack.

TL;DR: Quick Crypto Insights

BTC price: Struggles post-CPI as relief rally fizzles. Whale moves at $80K under the spotlight.

ETH: Uninspired decoupling from BTC. Hedge fund shorts cap momentum.

XRP ETF: Teucrium’s debut leveraged product shocks markets with massive trading volume.

DOGE ETF: 21Shares files for a DOGE ETF, keeping the memecoin’s institutional narrative alive.

NFT market: CryptoPunk #3100 sells for $6M, a 62% YoY drop, signaling weak sentiment for blue-chip NFTs.

Bybit: Fully recovers 7% market share after surviving the largest crypto hack in history.

OpenSea: Pushes back hard against SEC allegations of selling unregistered securities.

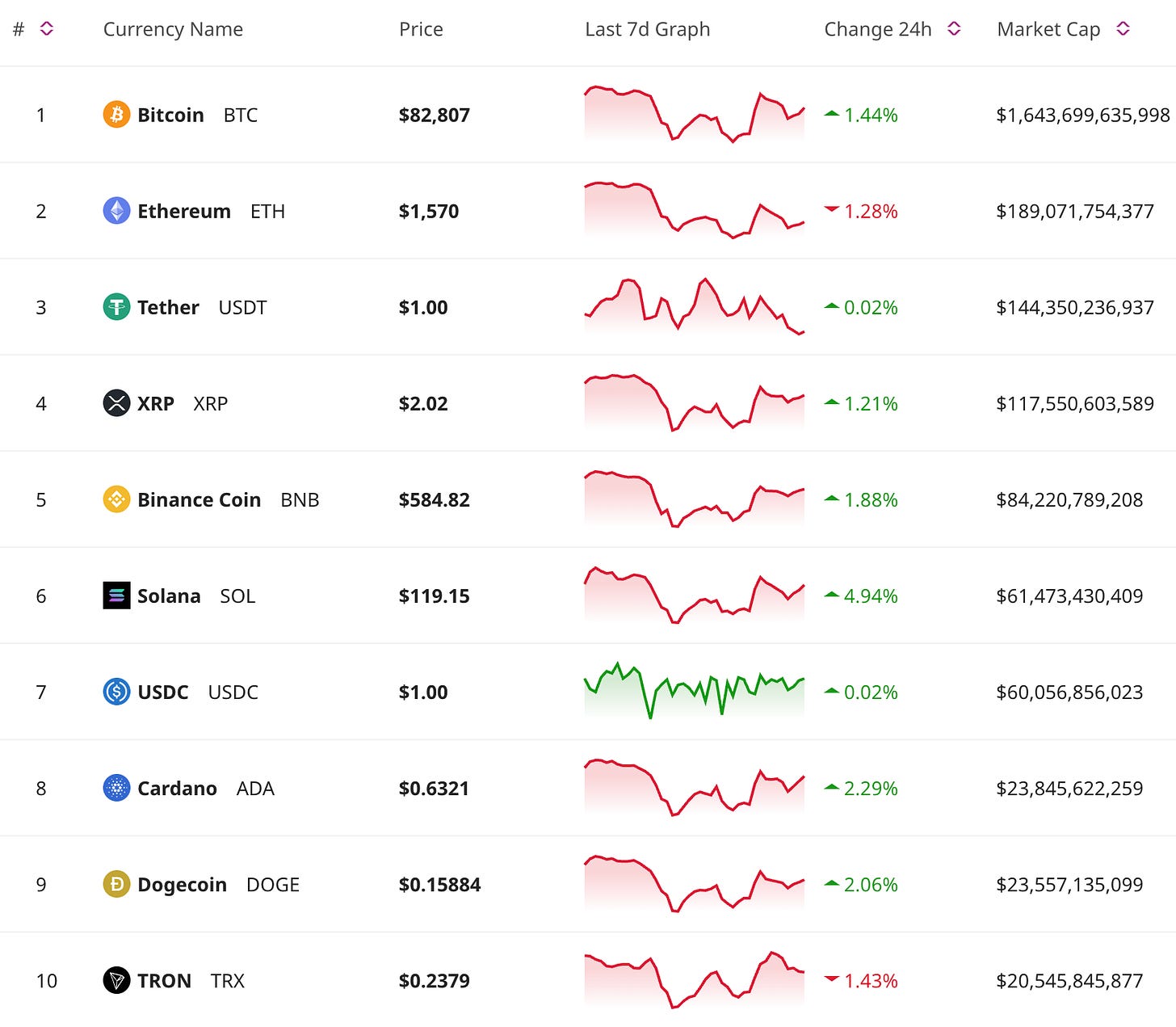

Price Update

Bitcoin Price Faces Whale Resistance at $80K

Bitcoin (BTC) briefly spiked past $82,000 after a softer-than-expected CPI reading combined with a pause on tariffs sparked optimism. However, the rally was short-lived, highlighting the market’s fragile sentiment. Without sustained volume, BTC couldn’t hold gains.

All eyes are now on whale accumulation around $80K. Glassnode reports significant wallet activity, suggesting potential buying pressure. Will whales defend this level, or will BTC fall into deeper consolidation?

Altcoins Flash Mixed Signals

While Bitcoin wavers, altcoins are showing pockets of opportunity—but with thin volume. Santiment data highlights key undervalued mid-cap tokens nearing historical support. Chainlink (LINK), for instance, is flirting with the $7.50 mark, which previously triggered bouncebacks.

For now, with no clear macro catalyst, dollar-cost averaging (DCA) and patience remain the go-to strategies for savvy traders.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

XRP ETF Debut Stuns with High Volume

Defying expectations, Teucrium launched the first-ever U.S.-regulated leveraged XRP ETF (XXRP). Over 215,000 shares traded on Day 1, underscoring persistent institutional appetite for altcoin-linked products—even as the broader market hesitates.

This significant milestone cements XRP’s position as a key player in institutional adoption narratives. However, volatility remains high, with leveraged ETFs amplifying both gains and losses.

DOGE ETF Filing Signals Bold Institutional Interest

21Shares has made waves by filing for a DOGE ETF, showing confidence in the memecoin’s liquidity and appeal. If approved, this could bridge retail enthusiasm with institutional investment, ushering in a new era of meme token integration into mainstream finance.

The move capitalizes on DOGE’s enduring cultural relevance and sets a precedent for other unconventional crypto assets. Speculation is already brewing about which memetokens might follow DOGE’s lead.

Bybit’s Phoenix Moment After Largest Hack to Date

Bybit has regained its 7% market share after bouncing back from the most significant hack in crypto history. The company credited swift communication, beefed-up withdrawal transparency, and rapid security upgrades for its recovery.

Bybit’s story is a masterclass in damage control. Other platforms would do well to replicate its strategy, particularly in an era where trust and resilience matter as much as technical innovation.

Don’t Miss Anything

OpenSea Challenges SEC’s NFT Classification

The SEC hit OpenSea with a Wells Notice alleging the NFT giant facilitated unregistered securities transactions. OpenSea clapped back, asserting NFTs are unique digital collectibles, not investment contracts.

This case could become a regulatory bellwether for the NFT market, with huge implications for marketplaces and digital ownership laws. Crypto insiders are watching closely as this battle unfolds.

If the SEC succeeds, platforms like OpenSea may face stricter compliance standards, potentially stifling innovation. On the flip side, a victory for OpenSea could solidify the legal argument for NFTs as non-securities.

CryptoPunk Sells for $6M – A 62% Loss

CryptoPunk #3100 sold for $6M, down massively from its previous sale at $16M. While sobering for NFT enthusiasts, this sale highlights the sharp correction from the 2021–2022 bull run. Blue-chip NFT holders may need to adjust expectations as the market searches for sustainable value beyond hype.

Altcoin Watchlist Shows Key Opportunities

Santiment data flags several mid-cap altcoins approaching critical support levels, offering potential entry points for long-term traders. A notable example is Cosmos (ATOM), which has held strong near $9 despite macro pressures. Additionally, ETH-linked ETF speculation provides a fundamental backdrop for potential Ethereum ecosystem plays.

The crypto market remains cautious but dynamic, with structural shifts reshaping the playing field. Whale activity is steering BTC sentiment, institutions are doubling down on ETFs (even for memecoins), and the NFT market’s legal parameters are about to get tested.

Stay sharp, stay nimble, and don’t miss the potential opportunities brewing under the surface.