Visa Embraces Ethereum, PayPal Expands Crypto, and Bitcoin Market Optimism Grows - September 26, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Visa: Launches platform enabling banks to issue fiat-backed tokens on Ethereum.

PayPal: US business accounts can now buy and transfer cryptocurrencies on the platform.

SEC: Delays ruling on BlackRock’s Ether ETF options, maintaining uncertainty.

Harris: Affirms that digital assets will play a key role in the U.S. economic future.

Gary Gensler: Criticized for SEC’s handling of crypto cases.

Hamster Kombat: Teases token buyback, NFTs, and web app launch.

Banana Gun: Exploit refunds begin after the security breach.

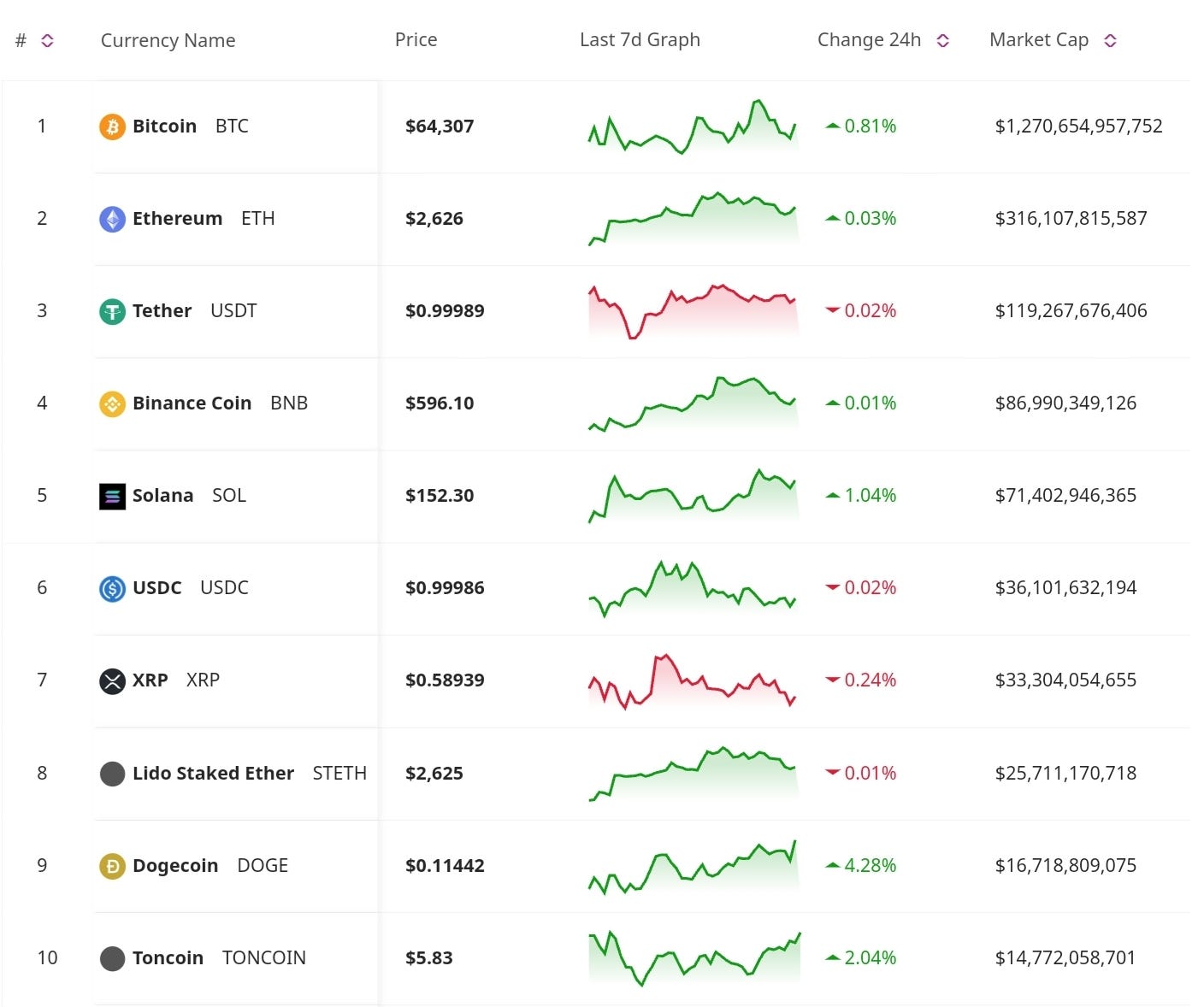

Price Update

Bitcoin Retreats After Reaching $64K

Bitcoin touched $64K but has pulled back since. However, analysts point to several bullish indicators, such as institutional interest and strong market fundamentals, that could support another upward move soon. The token has seen strong retail accumulation and exchange outflows. Investors are pulling their Bitcoin from exchanges, signaling that they expect future price increases.

Regulatory Updates

SEC Postpones Ruling on BlackRock’s Ether ETF Options

The SEC has delayed its decision on BlackRock’s Ether ETF options until November 10, creating further uncertainty in the crypto market. The regulator claimed it was appropriate to take more time to consider the rule change.

Gary Gensler Grilled in Congressional Hearing Over Crypto Regulation

SEC Chair Gary Gensler faced tough questions from Congress about the SEC's handling of crypto regulation and the Debt Box case. Lawmakers criticized Gensler for the perceived lack of regulatory clarity, especially in the evolving world of digital assets.

Kamala Harris Reiterates Support for Digital Assets in Economic Plan

Vice President Kamala Harris reaffirmed her support for digital assets as part of the U.S.'s economic future. Speaking at a recent event, she emphasized that the U.S. should take a leading role in blockchain and cryptocurrency innovation while ensuring consumer protection.

New Launches and Developments

Visa to Help Banks Issue Fiat-Backed Tokens on Ethereum

Visa has announced a major initiative to enable banks to issue fiat-backed tokens on Ethereum through its new tokenized asset platform. The first bank to use the platform will be Spanish BBVA, expecting to launch a live pilot on 2025.

PayPal to Allow US Business Accounts to Buy and Transfer Crypto

PayPal is further expanding its crypto services by allowing US business accounts to buy, sell, hold, and transfer cryptocurrencies.

Hamster Kombat Teases Token Buyback, NFTs, and Web App Launch

Hamster Kombat has announced plans for a token buyback, new NFTs, and the launch of a web app ahead of its airdrop. This has stirred excitement within the community, driving more engagement with the project.

Don’t Miss Anything

US Spot Bitcoin ETFs Lead Fourth Consecutive Week of Inflows

U.S. spot Bitcoin ETFs are continuing to see net inflows, marking the fourth consecutive week of positive inflows and reaching $136 million. BlackRock’s IBIT led the inflows with $98.8 million.

Banana Gun Exploit Refund Begins After Security Breach

Following a recent exploit, Banana Gun has started refunding users who were affected by the breach. The project is working to regain trust and rebuild its user base after the incident.

WazirX Hacker Nearly Finishes Laundering $230 Million in Stolen Funds

A hacker who stole $230 million from the WazirX exchange is reportedly close to finishing the process of laundering the funds, with just $6 million ether remaining.

This week’s developments signal strong momentum for institutional adoption and innovation. Visa’s integration with Ethereum and PayPal’s expanded crypto services highlight growing mainstream interest. Bitcoin’s market activity remains a key focus for investors. Regulatory uncertainty continues to weigh on the industry, with the SEC delaying decisions on key ETF proposals. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc