U.S. Election Day Activity, and Memecoins Surge - November 6, 2024

Also, BTC jumps above $70K, and ETH/BTC ratio hits a multi-year low.

TL;DR: Crypto Insights in Seconds

ETH/BTC: Ethereum’s market cap ratio compared to Bitcoin declines.

Memecoins: Thousands of election-themed tokens flood the market.

BTC Mining: Difficulty surpasses 100 trillion for the first time.

U.S. Election: Traditional finance plans to keep investing in crypto regardless of election results.

Memecoins: Capitalize on U.S. election frenzy.

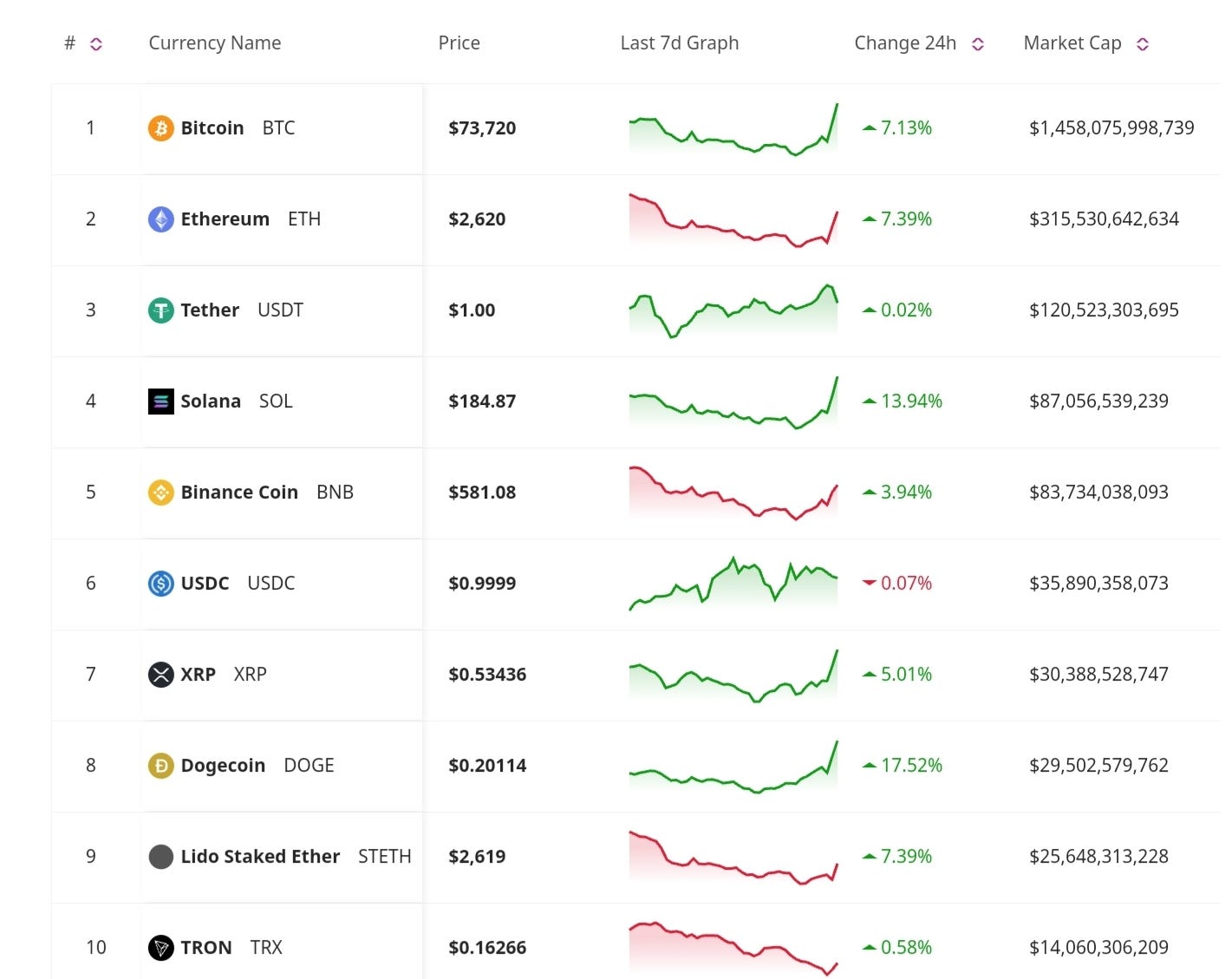

Price Update

Bitcoin Dominates Altcoins, Surpasses $70K on Election Day

Bitcoin has climbed above $70,000, maintaining momentum as the U.S. election day stirs interest in speculative assets. BTC’s performance has outpaced most altcoins, with analysts noting that Bitcoin’s historical appeal as a “safe haven” asset is drawing investors during the political uncertainty. Some market watchers suggest this rally could face a “seesaw effect” with fluctuations between $6,000 and $8,000, depending on election results and subsequent policy directions.

Market Trends

ETH/BTC Market Cap Ratio Drops to Lowest Level Since 2021

The ETH/BTC market cap ratio has fallen to 24.5%, the lowest it has been in over three years. This trend shows Bitcoin’s increasing market dominance, likely prompted by renewed interest in Bitcoin-focused ETFs and the macroeconomic environment. Ethereum’s weaker performance relative to Bitcoin has prompted speculation over whether the trend will reverse, especially as Ethereum continues to develop its staking and Layer 2 ecosystems.

Bitcoin Mining Difficulty Surpasses 100 Trillion for the First Time

Bitcoin’s mining difficulty has reached a record high of over 100 trillion, putting added pressure on smaller mining operations. This increase in difficulty, which reflects the computational power needed to mine new Bitcoin blocks, makes it more challenging and costly for miners to remain profitable. Analysts note that rising mining costs could influence Bitcoin’s price, potentially creating additional price stability in the long term.

U.S. Crypto Updates

Traditional Finance Unmoved by Election-Related Crypto Uncertainty

As the crypto world braces for possible shifts in regulation post-election, traditional financial (TradFi) institutions seem unfazed and likely to continue exploring crypto and blockchain technology. Analysts expect that major financial institutions will continue their crypto initiatives regardless of U.S. election outcomes, signaling a continued commitment to blockchain innovation from established financial players.

Memecoins Capitalize on U.S. Election Frenzy

Thousands of new election-themed tokens have been created as memecoin developers tap into the U.S. election excitement. While most of these tokens are expected to be short-lived, the influx highlights how quickly crypto markets respond to global events. Some investors, however, remain cautious, given the speculative nature of these assets and their tendency for rapid price swings.

Bitcoin’s strong performance above $70K shows its dominance in the crypto market, with its safe-haven appeal gaining traction amid the election-driven uncertainty. The contrasting performance of Ethereum, as seen in the ETH/BTC market cap ratio’s multi-year low, highlights BTC’s current market leadership. The memecoin frenzy surrounding the U.S. election reflects crypto’s tendency to quickly adapt to global narratives. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.