Trump’s Crypto Executive Orders, and BTC Holding Above $100K - January 24, 2025

Also, Buterin warns about political tokens, and BlackRock CEO urges for tokenization.

TL;DR: Crypto Insights in Seconds

BTC: Drops to $102K after Trump’s executive order announcement. Some analysts warn about potential bearish signs.

Trump: Signs crypto executive order that supports crypto innovation and fair regulation.

SEC: Has dissolved SAB 121, a guidance that many cataloged as a burden.

Vitalik Buterin: Warned the community about tokens tied to politicians.

BlackRock: CEO urges for tokenization of bonds and stocks.

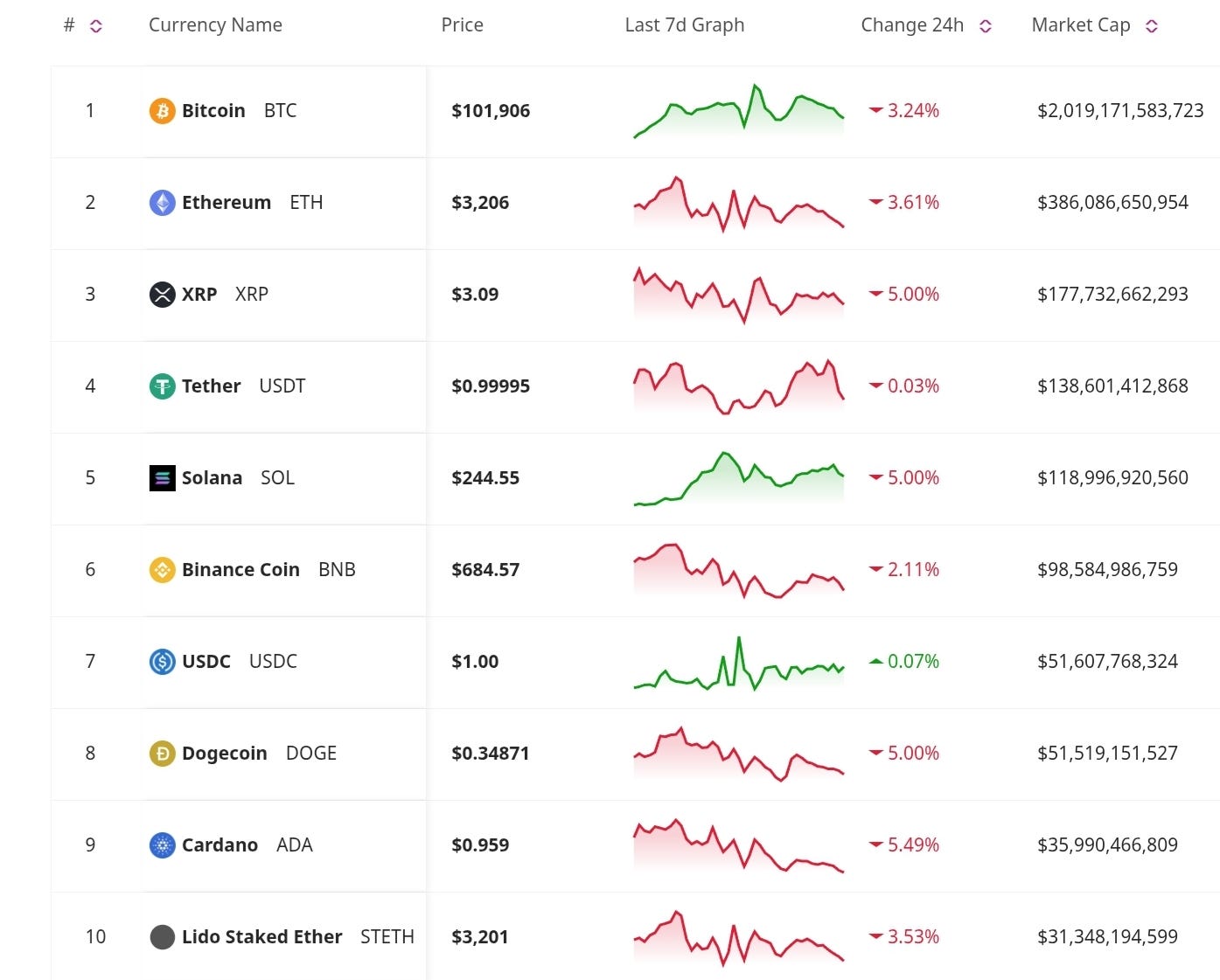

Price Update

Bitcoin Dips Following Trump’s Crypto Executive Order

President Trump signed an executive order to establish a National Digital Asset Stockpile and form a working group dedicated to crypto policy and regulation. While the move indicates government recognition of digital assets, Bitcoin fell sharply below $102K, with concerns over potential market intervention causing unease among investors.

Bitcoin’s Diamond Pattern Raises Concerns

A technical analysis of Bitcoin’s price chart shows a diamond pattern, a rare formation that could signal a downturn. Analysts predict a potential fall to $96K if bearish sentiment gains momentum. However, the current price trajectory resembles the midpoint of the 2015–2018 cycle, indicating ongoing growth. Despite short-term corrections, the trend points toward sustained bullish momentum.

New Developments

Trump's Executive Order Marks a Major Shift in U.S. Crypto Policy

President Trump issued an executive order to reshape U.S. cryptocurrency regulations, creating a working group to develop a framework for digital assets and banning the creation of CBDCs to protect existing cryptocurrencies. The order also seeks to safeguard banking services for crypto companies and establish a national cryptocurrency stockpile. During a speech at the World Economic Forum in Davos, President Trump declared the United States will be the "world’s crypto capital," reaffirming his administration's commitment to supporting innovation.

SEC Rescinds Crypto Accounting Guidance Post-Gensler

The SEC has repealed SAB 121, crypto accounting guidance that required companies to classify customer crypto holdings as liabilities. This decision follows the resignation of former SEC Chair Gary Gensler and industry criticism of the guidance as overly burdensome. Acting Chair Mark Uyeda and Commissioner Hester Peirce, who previously called SAB 121 a “pernicious weed,” are steering a new approach, with a task force promising clearer crypto regulations.

Don’t Miss Anything

Vitalik Buterin Warns of Political Tokens’ Risks

Ethereum co-founder Vitalik Buterin has cautioned against political tokens, calling them “vehicles for unlimited political bribery.” He warned the crypto community to be wary of tokens tied to political agendas, as they risk undermining blockchain’s decentralized ethos.

BlackRock CEO Urges Rapid Tokenization Approval

BlackRock CEO Larry Fink has called on the SEC to expedite tokenization approvals for bonds and stocks, advocating for a more efficient financial system via blockchain. Fink emphasized tokenization's potential to optimize market transparency and streamline processes, which could have profound implications for crypto adoption.

The market is experiencing a significant shift, as the U.S. market is creating a new framework for crypto that could encourage further growth. Despite recent pullbacks, analysts and traders remain optimistic about the future. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates.