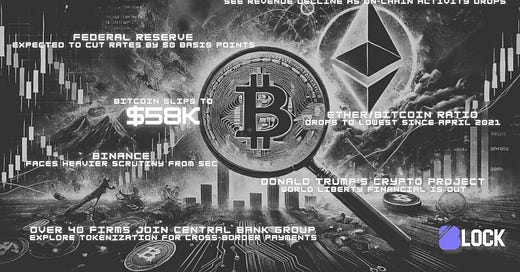

Trump Launches World Liberty Financial, Bitcoin Slips to $58K, and Fed Rate Cut Anticipated - September 17, 2024

A quick and digestible recap of the weekend’s crypto news.

TL;DR: Market Insight in Seconds

Trump: World Liberty Financial launched yesterday.

Binance: Faces increased SEC scrutiny over its token listing process.

Ethereum: Stakers see revenue fall as on-chain activity drops 60% since March.

Bitcoin: Leads global crypto investment product rebound, while Ethereum struggles.

Fed: Expected to cut rates by 50 basis points, potentially boosting Bitcoin.

Crypto: Ether/Bitcoin ratio drops to its lowest since April 2021.

UK Banks: See benefits of tokenization during experimental phase.

Price Update

Bitcoin Slips to $58K as Fed Faces Split Rate Cut Expectations

Bitcoin has slipped to $58,000 as the market reacts to the Federal Reserve’s split expectations regarding potential rate cuts. Some analysts anticipate a 50 basis point cut, which could provide a boost to Bitcoin, while others are predicting a more conservative approach. This uncertainty is leading to market caution, with investors waiting for clearer signals from the Fed.

Market Trends and Future Expectations

Bitcoin Leads Global Crypto Investment Product Rebound

Bitcoin is leading the global rebound in crypto investment products, despite the broader market's stagnation. According to CoinShares, Bitcoin has seen renewed institutional interest, with investors pouring money into Bitcoin products. Meanwhile, Ethereum has struggled to keep pace, with its stakers experiencing lower revenue as on-chain activity declines.

Ethereum Stakers See Revenue Decline as On-Chain Activity Drops 60%

Ethereum stakers are facing declining revenues, with on-chain activity plummeting 60% since March. The sharp drop in activity is impacting staking rewards, leading to reduced earnings for those participating in Ethereum’s proof-of-stake network. The reduced on-chain activity raises questions about Ethereum’s near-term outlook and whether it can regain its momentum.

Fed Expected to Cut Rates by 50 Basis Points

The Federal Reserve is now expected to cut interest rates by 50 basis points, a move that could provide a significant boost to Bitcoin. With inflation concerns still present and economic growth slowing, the rate cut could help stimulate investment in risk assets like crypto. Analysts believe that the lower interest rates would create a more favorable environment for Bitcoin.

Ether/Bitcoin Ratio Drops to Lowest Since April 2021

The Ether/Bitcoin ratio has dropped to its lowest point since April 2021, indicating that Ethereum is underperforming relative to Bitcoin. Several factors are contributing to Ethereum’s recent struggles, including reduced on-chain activity and lower staking rewards. Meanwhile, Bitcoin continues to dominate the market, benefiting from its status as a "safe haven" asset during the economic uncertainty.

Regulatory and Legal News

Binance Faces Heavier Scrutiny from SEC Over Token Listings

The SEC is placing increased scrutiny on Binance’s token listing and trading processes, according to a newly proposed amended complaint. The agency is focusing on whether Binance followed proper procedures when listing new tokens and whether these assets should be classified as securities.

Over 40 Firms Join Central Bank Group to Explore Tokenization for Cross-Border Payments

More than 40 global firms have joined a central bank-led group to explore tokenization for cross-border payments. The initiative wants to improve the efficiency and security of international transactions by taking advantage of blockchain technology and digital currencies. Tokenization has the potential to streamline the movement of assets across borders, reducing costs and enhancing transparency.

UK Bank Members See Tokenization Benefits During Experimental Phase

The U.K.'s trade association, UK Finance, along with 11 member banks, has completed the experimental phase of a tokenization and central bank digital currency (CBDC) platform. The trial demonstrated potential benefits, including programmable payments and tokenized commercial bank deposits. UK Finance is now looking to collaborate with regulators and public bodies to further develop and implement these technologies for future payment networks

Don’t Miss Anything

Trump’s World Liberty Financial is Out

Donald Trump’s highly anticipated crypto project, World Liberty Financial, officially launched yesterday. The initiative seeks to bring crypto and blockchain solutions to a broader audience, promoting financial inclusion and innovation. With Trump’s backing and the involvement of high-profile advisors, including the co-founder of Scroll, World Liberty Financial is expected to gain significant attention in the crypto space.

Flappy Bird Gets a Crypto Reboot on Telegram

The iconic mobile game Flappy Bird has received a crypto reboot on Telegram, rebranded as "Notcoin." It introduces a blockchain element to the classic game, allowing users to earn cryptocurrency while playing. The reboot is part of the ongoing trend of integrating crypto into gaming, especially in Telegram, but it has faced criticism for straying too far from the original game’s simple and addictive nature.

The crypto market continues to face a complex mix of bullish and bearish forces. Bitcoin remains in focus as it hovers around $58K, with the Federal Reserve’s rate decision expected to have a significant impact on its trajectory. Ethereum is struggling with lower staking revenues and reduced on-chain activity, while Bitcoin leads the market rebound in investment products. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc