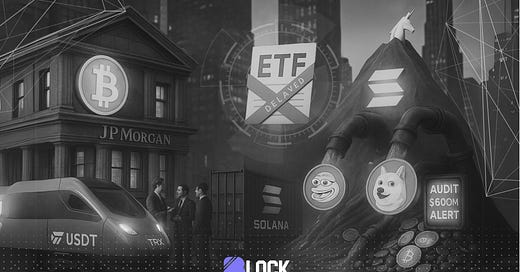

Tron Surpasses Ethereum in Stablecoin Volume as Institutional Bitcoin Adoption Gains Momentum

Also in this issue, SEC delays Solana ETF decision, Ethereum unveils stateless nodes, Cardano faces treasury scrutiny, and memecoins see renewed whale interest.

TL;DR: Key Insights at a Glance

Tron surpasses Ethereum in USDT volume, processing $23B daily as it cements its leadership in stablecoin settlements.

JP Morgan opens Bitcoin access to institutional clients in a major shift toward digital asset integration.

SEC delays ruling on Solana ETFs, stalling altcoin regulatory progress.

Bitcoin ETFs see record inflows over five weeks, defying economic volatility.

Whales favor speculative memecoins PEPE and WIF, indicating a brewing altcoin rally.

Cardano audit uncovers irregularities in $600M of ADA funds, raising governance concerns.

Uniswap approaches key resistance, with bullish on-chain metrics pointing to a potential breakout.

Price Update

Ethereum Gains 5.11%, But Whale Sentiment Turns Cautious

Closing at $2,521 with a 5.11% daily rise. While this price uptick reflects renewed market interest, significant outflows from large whale wallets suggest caution. Simultaneously, Ethereum is advancing its scalability goals with Vitalik Buterin championing stateless nodes to lower entry barriers and reduce state bloat. However, short-term price momentum remains divided as technical gains clash with careful repositioning from major holders.

Uniswap Inches Toward $7 Breakout

Uniswap (UNI) is gathering bullish steam, supported by rising volume and liquidity depth. Activity from seven key datasets highlights strong correlations between address accumulation and price upwards pressure. $7 remains a pivotal resistance level, where a breakout could ignite further gains as market macro trends align for UNI recovery. Analysts point to sustained increases in market interest as a sign of potential longer-term bullish momentum.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Record-Breaking Bitcoin ETF Momentum

Over the past five weeks, U.S.-listed Bitcoin ETFs have logged their highest-ever inflows, signaling increasing institutional appetite for regulated BTC exposure. This trend reflects a broader narrative of digital asset integration into traditional portfolios, even amid global macroeconomic uncertainties. The preference for ETF vehicles over direct market exposure showcases shifting investor priorities toward secure and accessible Bitcoin entry points.

JP Morgan Joins the Bitcoin Train

JP Morgan has launched Bitcoin services for institutional clients, despite CEO Jamie Dimon’s longstanding skepticism. This move underlines growing demand for crypto access in the traditional finance sector while highlighting competitive pressures among banks. Legacy institutions are beginning to reconcile ideological resistance with client-driven pragmatism, positioning themselves for the expanding crypto economy.

Whales Turn to PEPE and WIF Memecoins

Blockchain analysis reveals increasing whale allocations to memecoins PEPE and WIF. This accumulation phase bears similarities to previous speculative cycles, where whale positioning heralded market-wide altcoin rallies. With retail sentiment for memecoins steadily reviving, these new moves could signal the first wave of renewed speculative energy in the altcoin sector.

Don’t Miss Anything

SEC Delays Solana ETFs, Creating Market Uncertainty

The Securities and Exchange Commission has postponed decisions on Solana ETF proposals filed by VanEck and 21Shares. This delay underscores the hesitancy surrounding non-Bitcoin ETF approvals and reflects lingering concerns about altcoin market oversight. Investors are closely watching these decisions, as prolonged ambiguity could stymie broader altcoin adoption in institutional portfolios.

Cardano’s Treasury Management Under Scrutiny

A recent third-party audit has revealed discrepancies involving $600M worth of ADA funds in the Cardano treasury. Governance concerns over potential misallocations have sparked wider questions about transparency and internal financial controls. If unresolved, such issues could weigh heavily on investor confidence and project credibility in the decentralized finance landscape.

Tron Takes the Lead in Stablecoin Transactions

Officially surpassing Ethereum in processing daily stablecoin transactions, Tron is hitting $23B in USDT throughput. Its cost-efficiency and scalability make Tron a preferred option for high-volume markets, particularly in Asia and South America. While Ethereum continues to address its scalability challenges, Tron has positioned itself as the network of choice for rapid and low-cost stablecoin settlements worldwide.

The crypto space evolves quickly, and being ahead of the curve is essential. If you enjoyed this edition, don’t hesitate to share your insights or start a conversation—we’d love to hear your take on the latest trends.

Stay connected and never miss an update. Make sure to subscribe for fresh, in-depth analysis delivered straight to your inbox. Until next time, keep exploring, innovating, and navigating the world of digital assets with confidence.