TON Blockchain Outage, OpenSea Faces SEC Action, and Bitcoin Slips Under $60K - August 29, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Durov: Telegram CEO Pavel Durov released from French custody; set to appear in court.

TON: Blockchain suffers two outages, raising concerns over stability.

OpenSea: Receives a Wells Notice from the SEC, signaling potential enforcement action over NFTs.

Hong Kong: Opens its tokenization sandbox to major institutions.

Ether spot ETF: Flows underperform compared to Bitcoin.

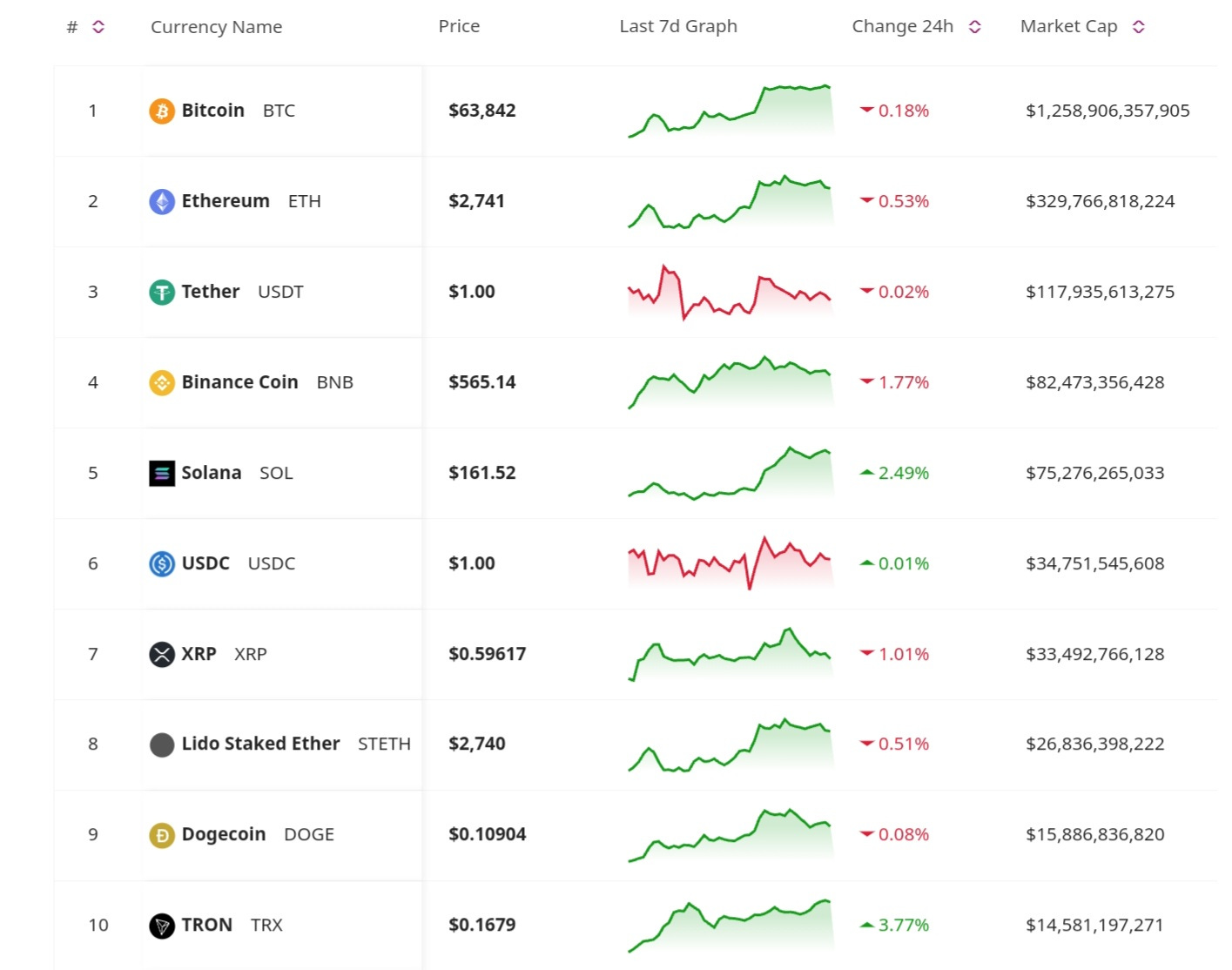

Price Update

Bitcoin Falls Below $60K Amid Broad Market Pressure

Bitcoin has slipped below $60,000, continuing a downward trend as the crypto market faces broad pressure. Analysts suggest that the risk-off sentiment in the market is driven by macroeconomic factors, including economic uncertainty and concerns over interest rate hikes. Another reason was Nvidia’s earning report, which impacted not only stocks but also cryptocurrencies. Bitcoin’s inability to sustain its rebound is another tell of the fragility of the current market environment, where investors are quick to react to any signs of macroeconomic or corporate weakness. After the slipped, the coin jumped back, reaching $63K fueled by investors taking advantage of new positioning.

Regulatory and Legal News

Telegram CEO Pavel Durov Released from Custody, Set to Appear in Court

Telegram CEO Pavel Durov has been released from French custody and is scheduled to appear in court following his weekend arrest. The arrest, which was initially linked to unauthorized cryptology services, has caused significant ripples in the crypto community, particularly affecting The Open Network (TON) and its associated token. The upcoming court appearance is likely to attract widespread attention, given Durov’s influence in the tech and crypto sectors.

OpenSea Receives Wells Notice from SEC Over NFT Sales

OpenSea, a leading NFT marketplace, has received a Wells Notice from the U.S. Securities and Exchange Commission (SEC), indicating that the regulator may pursue enforcement action against the platform. The notice alleges that NFTs sold on OpenSea could be classified as securities, raising important questions about the regulatory status of NFTs and other digital assets. This development is a significant challenge for OpenSea, as it navigates the complexities of regulatory compliance in an emerging market.

New Launches and Developments

Hong Kong Markets Authority Launches Tokenization Sandbox

The Hong Kong Markets Authority has launched a tokenization sandbox, opening the door for major institutions to experiment with digital asset tokenization. The sandbox seeks to foster innovation in the financial sector by allowing companies to test and develop new blockchain-based solutions in a controlled environment. Several major institutions have already expressed interest in participating, signaling strong support for Hong Kong’s efforts to position itself as a hub for digital finance. The sandbox is expected to accelerate the adoption of tokenization, particularly in areas such as securities, real estate, and other traditional assets.

Don’s Miss Anything

TON Blockchain Suffers Two Outages

The TON blockchain, closely linked to Telegram, suffered two outages in a short period, causing further concerns over its stability. The second six-hour outage has raised questions about the network’s reliability and its ability to handle increased usage and technical challenges. TON’s developers are working to address the issues, but the repeated disruptions have shaken confidence in the network.

Ether Spot ETF Flows Underperform Compared to Bitcoin

Ether spot ETFs have underperformed compared to Bitcoin, according to recent data from JPMorgan. Despite the launch of several Ether-focused ETFs, investor interest seems to be lagging behind that of Bitcoin. The lower inflows suggest that while there is growing interest in Ether as a leading blockchain platform, Bitcoin continues to dominate as the preferred choice for institutional investors. This trend also shows the differing perceptions of Bitcoin and Ether in the investment community, with Bitcoin seen as a store of value and hedge against inflation, while Ether is viewed more as a platform for innovation and growth.

The cryptocurrency market continues to navigate a challenging environment. Bitcoin’s slide below $60K and the TON blockchain’s outages are prime reminders of the market’s fragility and the importance of resilience. Meanwhile, developments like the SEC’s action against OpenSea and Hong Kong’s tokenization sandbox highlight the evolving regulatory landscape and the push for innovation in digital finance. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc