Tokenized Carbon Credits & Green DeFi: Unlocking the $70B Crypto Opportunity

How Blockchain Is Redefining Carbon Markets & Driving Real Change

The Real-World Asset (RWA) revolution has taken the crypto world by storm, and it’s no longer just about tokenizing real estate, stocks, or bonds. A new trillion-dollar market is emerging—and it’s green. Enter tokenized carbon credits, where blockchain meets climate action.

If you’re into crypto, DeFi, or RWA investments, this is one trend you can’t afford to sleep on.

Quick Take: The collaboration between CarbonHood and Blubird is bringing $70 billion worth of carbon credits on-chain. This makes carbon credits transparent, verifiable, and globally tradable—paving the way for Green DeFi opportunities, ESG compliance, and programmable carbon offsets.

Here’s why this is a game-changer for crypto and sustainability—and how you can get involved.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

The Problem with Current Carbon Credit Markets

The carbon credit industry plays a key role in fighting climate change, but right now, it’s a mess.

Lack of Transparency: Buyers can’t always verify whether a carbon credit was genuinely retired or reused.

Fraud & Double Spending: Some credits are sold multiple times, thanks to inadequate tracking systems.

Costly & Slow: Relying on middlemen and outdated paper systems makes transactions sluggish and expensive.

Restricted Access: Retail investors and small businesses are often locked out of participating.

Simply put, the system is ripe for disruption. That’s where tokenization steps in.

How Blockchain Fixes It

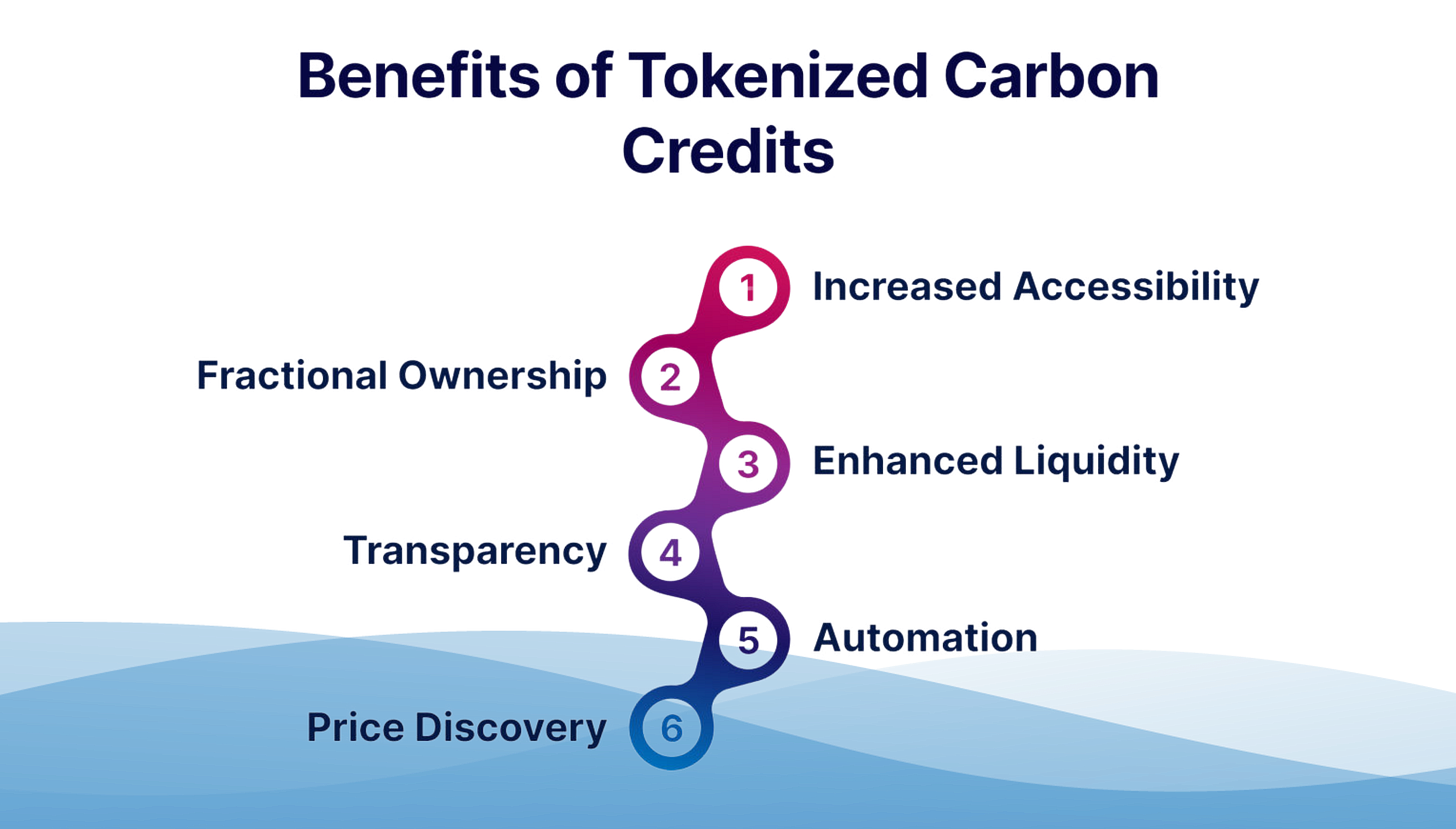

When carbon credits are tokenized on a blockchain, they become:

Traceable & Tamper-Proof: Every credit has a unique record on-chain, ensuring transparency.

Instantly Verifiable: Smart contracts eliminate the risk of double spending.

Efficient & Low-Cost: Middlemen are replaced by automated, decentralized systems.

Accessible to All: Investors worldwide gain access through fractionalized, tradable tokens.

Imagine buying or trading carbon credits as easily as crypto on a decentralized exchange (DEX). That’s the kind of innovation blockchain brings to the table.

CarbonHood & Blubird’s $70B Blockchain Move

The Vision for Tokenized Carbon Markets

CarbonHood and Blubird are at the forefront of revolutionizing carbon credit markets. Their initiative introduces $70 billion worth of tokenized carbon credits that integrate seamlessly into the DeFi space, creating new possibilities for investment and sustainability.

How It Works

Tokenization

Each carbon credit is converted into a unique, blockchain-based token backed by real-world carbon offset projects.

On-Chain Verification

Technologies like IoT sensors, satellite data, and oracles ensure accurate monitoring of emissions reductions.

Decentralized Trading

These credits can be traded on DEXs and specialized marketplaces designed for tokenized RWAs.

Carbon in DeFi

Tokenized credits can power ecosystems supporting staking, yield generation, and even carbon-backed stablecoins.

This isn’t just sustainability on paper—it’s using blockchain to create real-world environmental impact.

Why Crypto Investors Should Care

Still wondering why this matters for you? Here’s why tokenized carbon credits might be the next big thing in crypto and RWAs.

Exploding Demand

With global corporations scrambling to meet ESG (Environmental, Social, Governance) mandates, the demand for carbon credits is skyrocketing.

DeFi-Led Opportunities

Tokenized credits open the door to carbon-backed lending pools, yield strategies, and programmable carbon offsets.

First Mover Advantage

Firms like BlackRock and State Street are already exploring this space. For retail crypto investors, getting in early is key.

The carbon credit market is projected to be worth $250 billion by 2030. The tokens you invest in today could be the backbone of a trillion-dollar market tomorrow.

A Glimpse Into the Future of Green DeFi

The fusion of blockchain, ESG, and DeFi ecosystems presents endless possibilities. Here are just a few to watch out for in the coming years:

DeFi Collateral: Tokenized carbon credits could back stablecoins, loans, and other DeFi products.

Automated Offsets: Smart contracts could automatically buy and retire carbon credits based on IoT emissions data.

ESG Investments for All: Fractionalized tokens will democratize access to sustainable investments, allowing individuals to take part, not just big corporations.

Yield-Generating Liquidity Pools: Think of a liquidity pool tied directly to sustainability-focused projects, offering both financial and environmental returns.

The future isn't just digital—it’s green. As DeFi grows, tokenized carbon credits will play a critical role in merging profit and purpose.

The potential of tokenized carbon credits extends far beyond sustainability—it’s a doorway into a new era of investing and environmental impact. With blockchain powering transparency and efficiency, Green DeFi could be the game changer the world has been waiting for.