Tether CEO Discusses U.S. Regulation, and Aurum Launches $1B Tokenized Fund on XRP Ledger - October 23, 2024

Also, BTC hits $67K again, and Scroll debuts at a $212 million market cap.

TL;DR: Crypto Insights in Seconds

Aurum: Launches a $1 billion fund on the XRP Ledger.

Scroll: Debuts at a $212 million market cap, but experiences significant volatility.

Magic Eden: Expands to Berachain and ApeChain.

Buenos Aires: Improved privacy with ZK proofs in city app.

Tether: CEO predicts U.S. will catch up on crypto regulation.

Tokenization: FSB and BIS warn of risks from tokenization.

Options on BTC ETF: Analyst predict heightened volatility following approval of options trading.

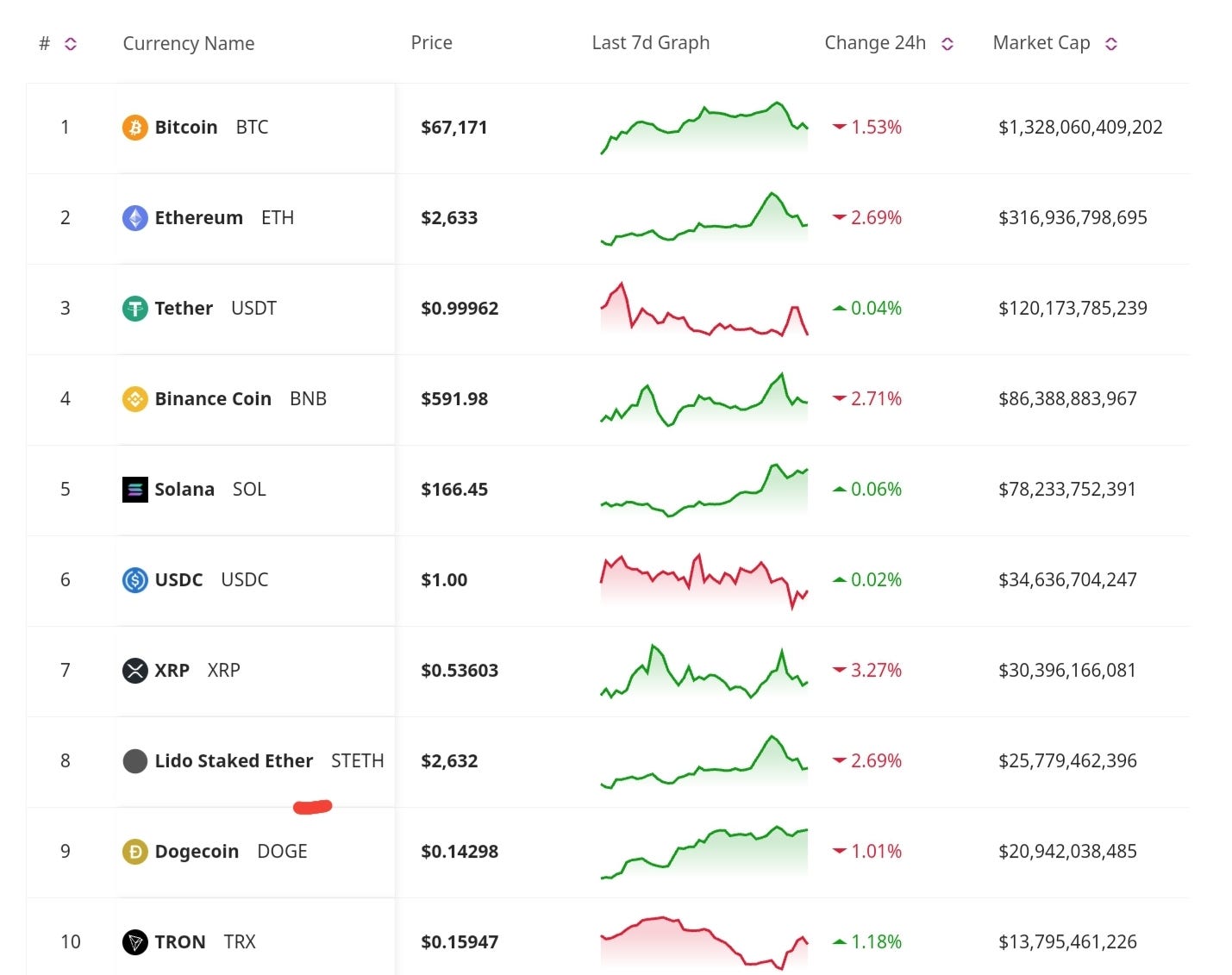

Price Update

Bitcoin Reclaims $67K Supported by Trading and ETF Inflows

Bitcoin has risen back to $67,000, supported by strong inflows into spot Bitcoin ETFs and leveraged trading positions. Analysts expect further volatility, particularly as options trading on these ETFs gains traction.

Market Trends

Options on Bitcoin ETFs Expected to Drive Volatility

Analysts are predicting increased volatility in the Bitcoin market following the approval of options trading on Bitcoin ETFs. As more investors use options to hedge or leverage their positions, market swings are expected to become more pronounced.

New Launches and Developments

Aurum Launches $1B Tokenized Fund for Data Centers on XRP Ledger

Aurum Equity Partners has launched a $1 billion tokenized equity and debt fund on the XRP Ledger, focusing on data center investments in the U.S., UAE, Saudi Arabia, India, and Europe. This is the first fund of its kind, using tokenization tech from Zoniqx. Ripple seeks to expand its role in real-world asset (RWA) tokenization, with its XRP Ledger providing secure and efficient transaction processing.

Scroll’s Governance Token Launches During High Volatility

Scroll’s SCR token, which powers the Ethereum Layer 2 scaling solution, debuted with a $212 million market cap. The trading session was marked by volatility, reflecting both strong interest in Layer 2 solutions and the inherent risks of new token launches.

Magic Eden Expands to Berachain and ApeChain

Magic Eden, a leading NFT marketplace, revealed its ambitious new vision: creating a platform where users can trade all assets across all blockchains within a single app. The team wants to make Magic Eden a fully on-chain platform similar to Binance or Coinbase, using $ME as the app’s growth engine. By the end of the year, Magic Eden plans to operate on at least 10 different chains, including this week's expansion to Berachain and ApeChain.

Buenos Aires Improves Privacy with ZK Proofs in City App

Buenos Aires has integrated zero-knowledge (ZK) proofs into its digital identity service, QuarkID, as part of its miBA app. This move seeks to improve privacy for 3.6 million residents by allowing them to authenticate documents without revealing unnecessary personal information. The use of ZK proofs reinforce user privacy while still ensuring government verification of documents. This new feature gives residents more control over their personal data when accessing municipal services.

Analysis and Commentaries

Tether CEO Predicts U.S. Will Catch Up on Crypto Regulation

Tether CEO Paolo Ardoino believes the U.S. will eventually catch up to other regions in crypto regulation, particularly as Tether continues to focus on transparency and communication. He emphasized that increased regulatory clarity is essential for broader industry growth, especially in the stablecoin sector.

FSB and BIS Warn of Risks from Tokenization

The Financial Stability Board (FSB) and the Bank for International Settlements (BIS) have warned that while tokenization presents significant opportunities, it also introduces new risks to the financial system. Their concerns center around potential destabilization due to the rapid growth of tokenized assets.

Bitcoin’s rise to $67K, driven by ETF inflows and strategic trades, signals strong investor interest, but rising volatility remains a concern. The launch of Aurum’s tokenized fund and Tether’s push for greater transparency underscore the continued integration of blockchain with traditional finance. However, regulators are urging caution as tokenization grows, warning of potential systemic risks. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Amazing project 💜

Great 👌