Structural Market Divergence: Bitcoin's Dominance Amid Altcoin Turmoil

Also, Key developments like RealFin's governance overhaul, Solana's fee critique, and Riot Platforms' BTC liquidation highlight this week's deepening market divide.

TL;DR: Key Insights at a Glance

Bitcoin dominance climbs to 53.8%, reflecting capital rotation away from riskier altcoins.

Ethereum struggles, trading at $1,809 and facing mounting headwinds from regulatory delays and competition.

Solana's transaction fees spark debate, with most activity linked to speculative trading rather than organic growth.

TRON's USDT issuance hits $71B, yet TRX prices remain depressed below $0.27 due to tokenomics concerns.

DOGE and SHIB face sharp declines, underlining waning speculative fervor in memecoin markets.

Riot Platforms offloads BTC, reallocating $38.8M as mining economics evolve.

RealFin commits to transparency and trust-building through institutional-grade reforms after the Mantra Gate breach.

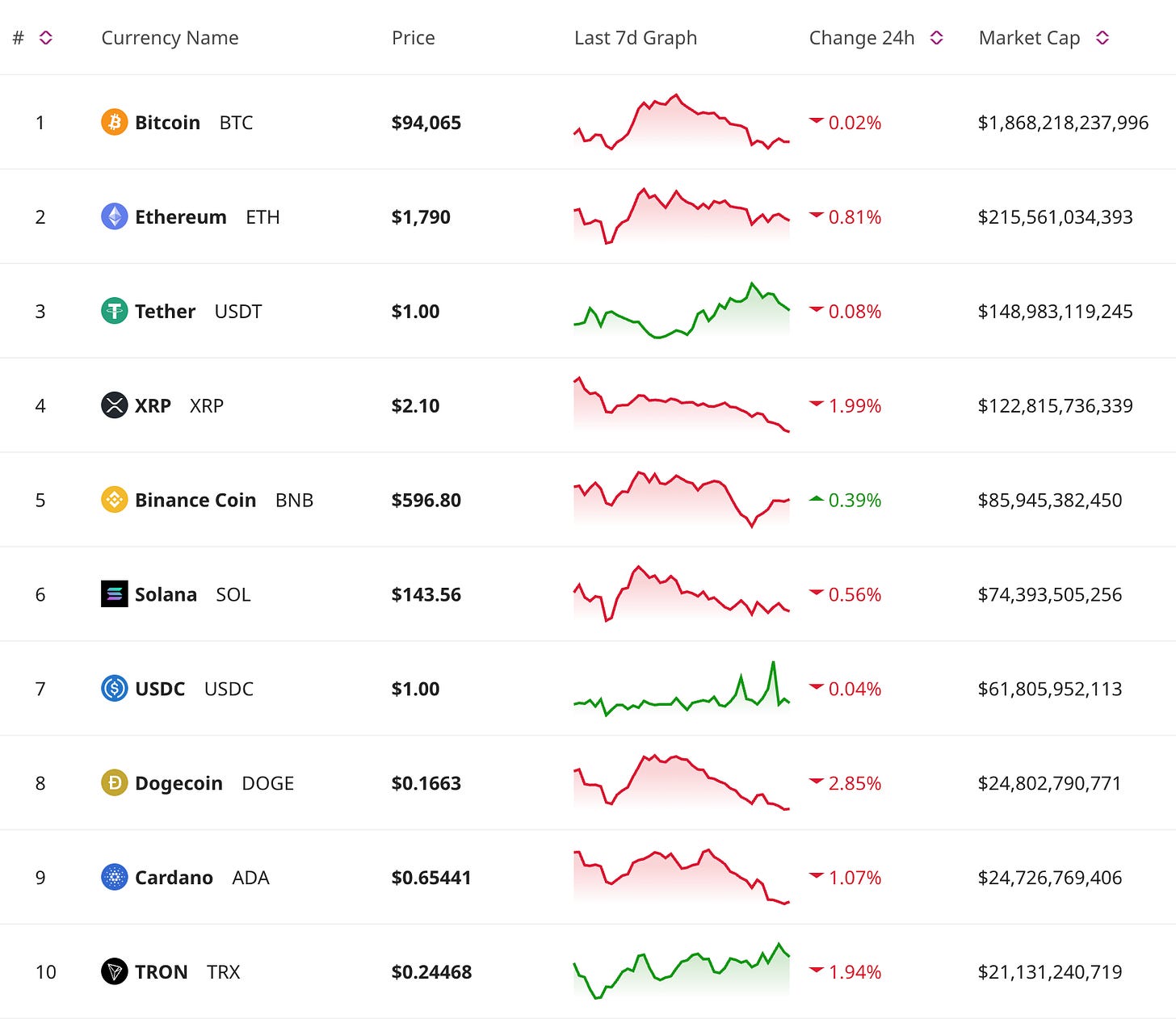

Price Update

Bitcoin's Resilience as a Digital Reserve Asset

Bitcoin continues to show strength, consolidating at a stable level despite uncertain market conditions and waning confidence in altcoins. Its growing dominance underscores a shift in capital towards a safer, more reliable asset during periods of market repricing. Long-term holder accumulation supports its role as a dependable macro hedge, reinforcing its position as the preferred anchor in an evolving digital asset market. Analysts expect this trend to persist, driven by Bitcoin’s stability and appeal amid speculative withdrawal.

Ethereum Faces Continued Reluctance

Despite consistent developer activity, Ethereum trades at $1,809, down 46% from year-to-date highs. The ecosystem is grappling with regulatory inertia on Ethereum-based ETFs, competition from alternative chains, and fragmentation within its Layer 2 ecosystem. While ETH remains a cornerstone of DeFi and NFTs, investors appear cautious, citing concerns over its scalability and diminishing monopolistic edge in smart contracts.

Altcoin Fatigue in Memecoin Markets

Speculative fervor is fading from the once-booming memecoin market, as DOGE trades at $0.1702 and SHIB dips below $0.000013. These declines reflect shrinking retail interest and institutional skepticism toward low-utility assets. The memecoin frenzy that powered previous bull cycles appears to be fading, with capital shifting toward high-conviction plays in Bitcoin and blue-chip assets.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

The Deepening Divide Between Bitcoin and Altcoins

Bitcoin's growing dominance reflects heightened risk aversion, as altcoins face uncertain roadmaps and fading innovation, particularly in Layer 1 ecosystems. Institutional investors continue to view Bitcoin as a reliable store of value due to its strong fundamentals. Analysts remain split on whether the altcoin downturn signals a temporary phase or a deeper structural shift, potentially paving the way for a Bitcoin rally or selective capital flow into robust altcoins.

TRON's USDT Growth vs. TRX Struggles

TRON’s record-setting issuance of $71 billion in USDT cements its dominance in stablecoin throughput, yet TRX lags at $0.27. Why? TRON’s architecture may optimize stablecoin velocity, but critics argue its tokenomics lack mechanisms to drive TRX valuation. This divergence underscores the growing importance of aligning network utility with token value.

Solana's Fee Metrics Under Fire

While Solana reports $25M+ in transaction fees, closer analysis reveals much of this activity stems from automated trading and memecoin speculation rather than lasting ecosystem growth. Declining daily active wallets and user engagement raise red flags about its scalability argument. For long-term success, Solana will need to attract projects that drive real-world use cases and encourage sticky user adoption.

Don’t Miss Anything

Riot Platforms Diversifies Mining Strategy

Riot Platforms surprised the market by liquidating $38.8M in Bitcoin, marking its first major sale since January 2024. Analysts speculate the move could be linked to ASIC upgrades, debt management, or strategic macro hedging. This reallocation highlights the increasingly sophisticated strategies among large mining operators, who must balance cash flow with long-term exposure.

DeFi Corp Dives into Validator Infrastructure

DeFi Development Corp has acquired a $3.5M Solana validator node, signaling a shift toward base-layer infrastructure investments. By securing validator stakes, the firm is betting on consistent revenue from staking rewards and a deeper role in network governance. This highlights a broader trend among institutions prioritizing long-term network participation over short-term DeFi yield opportunities.

RealFin Rebuilds Trust After Mantra Gate Scandal

Following a high-profile breach, RealFin is taking a proactive approach, introducing protocols like independent smart contract auditing and on-chain transparency for verifiable asset ownership. These measures aim to strengthen its role in real-world asset (RWA) tokenization, a sector primed for institutional adoption but plagued by reputational challenges. RealFin’s swift action sets a standard for governance-heavy projects navigating regulatory headwinds.

Bitcoin's increasing dominance, rising regulatory challenges for altcoins, and the growing importance of infrastructure developments signal critical structural changes in the digital asset ecosystem. These trends demand careful consideration and strategic foresight.

We encourage you to contribute your expertise. What market dynamics are you monitoring? Are there emerging opportunities worth exploring? Share your perspectives and join the conversation. Stay connected with us for precise analysis, strategic insights, and an informed perspective on the evolving future of digital finance.