Stability in the Market Amid Sell-Offs and Tech Advances — July 10, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds.

- Bitcoin Stability: Bitcoin remains steady above $57,000 despite major sell-offs by a German state.

- Mining Difficulty: There is a notable drop in Bitcoin mining difficulty, impacting miner profitability.

- Investment Surge: Digital asset investment rises by $441 million amidst sell-offs.

- TON and Polygon: Collaboration to enhance scalability and transaction efficiency.

- Tezos and Baanx: Partnership to launch a non-custodial crypto card.

- BlackRock Fund: Reaches $500 million milestone with $1.8 billion in tokenized treasuries.

- New Bitcoin ETF: Launched in Australia by DigitalX.

- Celebrity Endorsements: Messi and Ronaldinho boost Solana meme coin.

- Solana ETF Filing: CBOE confirms filing with the SEC.

- FTX Executives: Sentencing of former executives Gary Wang and Nishad Singh.

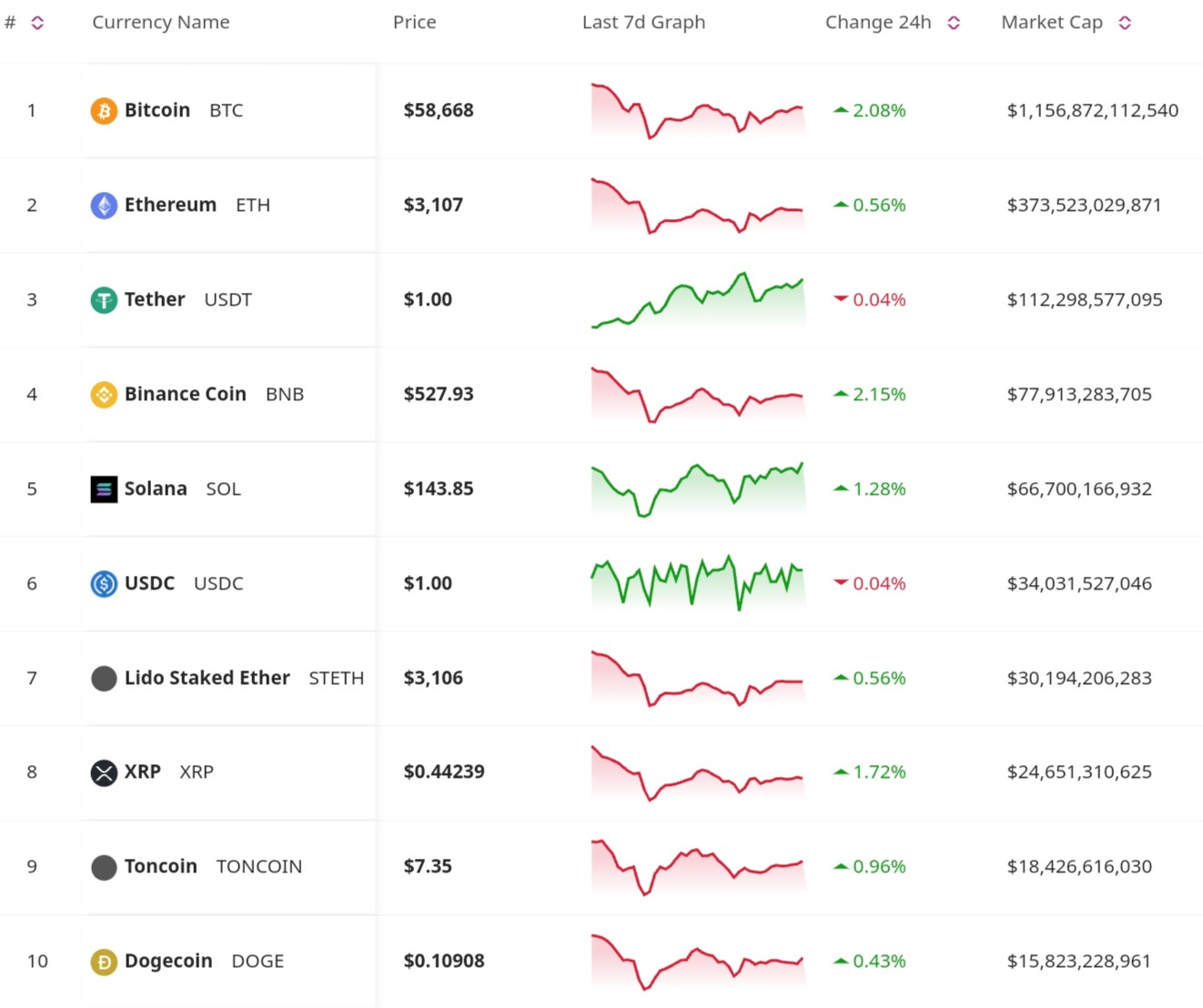

Price Update

Market Trends

Bitcoin Stability Amid German Sell-Offs

Bitcoin has held steady above $57,000 despite a German state's liquidation of 63,000 BTC. This sell-off, driven by regulatory mandates, contributed to market volatility but didn't shake Bitcoin's overall stability. Analysts view this resilience as a sign of strong market confidence.

Bitcoin Mining Difficulty Drop

CryptoQuant reports a significant drop in Bitcoin mining difficulty, reminiscent of the FTX collapse. This decrease may affect miner profitability and network security, raising concerns about long-term impacts on the Bitcoin ecosystem. Experts predict further market adjustments as miners adapt.

Digital Asset Investment Surge

Despite sell-offs by Mt. Gox trustees and the German state, digital asset investment surged by $441 million. This influx indicates ongoing investor confidence and market resilience. Institutional interest remains high, with digital assets seen as a hedge against traditional market volatility.

Regulatory Developments

BlackRock's BUIDL Fund and Tokenized Treasuries

BlackRock’s BUIDL fund has reached $500 million, with tokenized treasuries hitting $1.8 billion. This growth highlights increasing institutional interest in tokenized assets, which offer greater liquidity and accessibility than traditional financial products.

New Bitcoin ETF in Australia

Australia's ASX has listed a new Bitcoin ETF from DigitalX, expanding the regulated crypto investment options range. This ETF is expected to attract both retail and institutional investors, reflecting the rising demand for secure crypto investments.

Solana ETF Plan Confirmed by CBOE

The CBOE has filed with the SEC for a Solana ETF, aiming to provide regulated exposure to Solana. This move could drive mainstream adoption and investment in Solana.

Tech Advancements

Polygon's Chain Development Kit

Polygon has introduced a Chain Development Kit (CDK) to help developers create custom layer-2 networks. This toolkit promotes interoperability through a zero-knowledge proof-powered bridge, simplifying development and encouraging the adoption of layer-2 solutions.

TON Blockchain and Polygon Collaboration

The TON blockchain plans to launch a new layer-2 solution using Polygon's technology. This collaboration aims to improve scalability and transaction efficiency by leveraging Polygon's zero-knowledge technology, reducing costs, and speeding up transactions.

Tezos Foundation and Baanx Partnership

Tezos Foundation has teamed up with Baanx to launch a non-custodial crypto card. This card enhances security and control over assets, marking a significant step towards mainstream blockchain-based financial solutions.

Don’t Miss Out

Messi and Ronaldinho Boost Solana Meme Coin

Soccer stars Lionel Messi and Ronaldinho have endorsed a Solana meme coin, causing its value to spike. This endorsement has brought significant attention to the coin, showcasing the impact of celebrity influence in the crypto market.

Sentencing of Former FTX Executives

Former FTX executives Gary Wang and Nishad Singh are set for sentencing later this year. Their cooperation with prosecutors may reduce their sentences, but the case underscores the severe consequences of financial misconduct in the crypto industry.

The crypto market continues to demonstrate remarkable resilience and adaptability amidst regulatory changes and market pressures. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc