Solana ETF Approved in Brazil, Bitcoin Returns to $61K, and Nigeria Plans Crypto Licensing - August 21, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Brazil ETF: The second Solana ETF was approved in Brazil.

Nigeria: Plans to introduce a crypto licensing process to regulate the sector.

Taurus: State Street selects Taurus for crypto custody and tokenization services.

Mango Markets DAO: Votes on settlement proposal with the SEC.

SEC: Rejects Cboe’s filings for Solana ETFs.

Hong Kong: Lawmaker calls for a legal framework to regulate DAOs.

Spot Bitcoin ETF: Sees lowest trading volume since February.

Base: Introduces ENS subnames and plans a fair launch via Dutch auction.

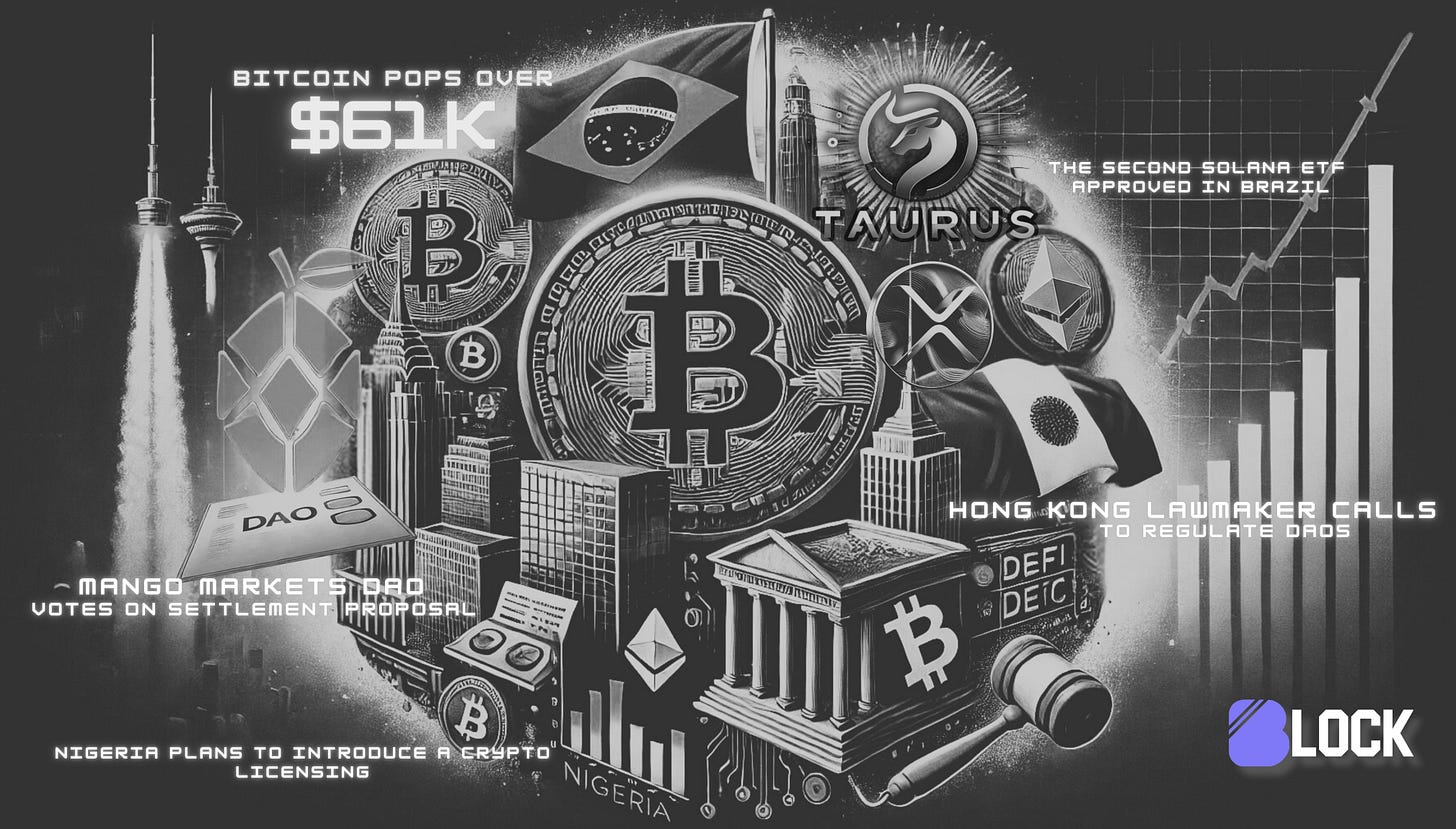

Price Update

Bitcoin Pops Over $61K, and XRP Leads Gains

Bitcoin has climbed back over $61,000, leading to a recovery in the broader crypto market. This upward movement comes as institutional investors continue to hold steady on Bitcoin, despite recent market volatility. Analysts suggest that Bitcoin’s resilience and institutional backing are key factors in its ability to outperform other assets. Currently, the coin went back to $59K. Another token indicating strength is XRP, showing gains among major cryptocurrencies, hovering around the $0.6 mark.

Market Trends

Spot Bitcoin ETF Sees Lowest Volume Since February

The trading volume of spot Bitcoin ETFs has dropped to its lowest level since February, raising concerns about investor interest in these products. The decline in volume suggests that market participants are taking a cautious approach during this ongoing volatility and economic uncertainty. Despite the drop in trading activity, institutional investors are reportedly holding steady on Bitcoin, indicating a long-term commitment to the asset.

Regulatory News

Second Solana ETF Approved in Brazil

Brazil has approved its second Solana ETF, marking a significant milestone in the country’s growing embrace of cryptocurrency investment products. This approval strengthens Solana’s position in the Brazilian market and shows the increasing demand for diverse crypto investment options. The ETF provides Brazilian investors with regulated access to Solana, a blockchain platform known for its high performance and scalability.

Nigeria Plans Crypto Licensing Process

Nigeria is planning to introduce a crypto licensing process, signaling a major step toward regulating the country’s growing crypto industry. The licensing framework is expected to bring clarity and oversight to the sector, which has seen rapid growth despite regulatory uncertainties. Nigeria’s move to regulate cryptocurrencies aligns with global trends of governments seeking to establish clear rules for digital assets.

SEC Rejects Cboe’s Solana ETF Filings

The U.S. Securities and Exchange Commission (SEC) has rejected Cboe’s filings for Solana ETFs, citing concerns about the security status of the underlying assets. This rejection is a setback for the efforts to introduce Solana-based financial products in the U.S. market. The SEC’s decision is another step in the regulatory challenges facing crypto ETFs, particularly those linked to newer blockchain platforms like Solana.

Mango Markets DAO Votes on SEC Settlement Proposal

Mango Markets DAO has voted on a settlement proposal with the SEC, following legal challenges related to the DAO’s activities. The vote shows the DAO’s efforts to resolve regulatory issues and move forward with its operations. The outcome of this vote could have significant implications for the broader DeFi space, where DAOs are increasingly used to govern decentralized platforms. The settlement with the SEC may set a precedent for how DAOs navigate regulatory landscapes, balancing innovation with compliance.

Hong Kong Lawmaker Calls for DAO Regulation

A lawmaker in Hong Kong has called for the establishment of a legal framework to regulate decentralized autonomous organizations (DAOs) following the Mantra DAO court case. The call for regulation highlights the growing importance of DAOs in the crypto ecosystem and the need for legal clarity to protect participants and ensure accountability. The proposed framework could serve as a model for other jurisdictions looking to regulate DAOs, which are becoming a popular governance structure in the DeFi space.

Don’t Miss Anything

State Street Selects Taurus for Crypto Custody and Tokenization

State Street, one of the world’s largest asset management firms, has partnered with Taurus to enhance its digital asset custody and tokenization services. By integrating Taurus’s technology, State Street wants to provide secure and efficient custody solutions for cryptocurrencies and tokenized assets. The partnership is a significant step forward in the institutional adoption of digital assets, offering clients a seamless way to manage and secure their crypto holdings.

Base Introduces ENS Subnames, Plans Fair Launch

Base, a blockchain project, has introduced ENS subnames for its users and announced plans for a fair launch via a Dutch auction. The introduction of ENS subnames allows users to create personalized blockchain identities, enhancing their experience on the platform. The planned Dutch auction for the fair launch is Base’s way to show commitment to transparency and equitable distribution of its tokens.

The cryptocurrency market is witnessing a mix of regulatory developments, business expansions, and market movements that are shaping the landscape. With Brazil approving another Solana ETF and Nigeria moving towards crypto regulation, the global embrace of digital assets continues to grow. Bitcoin’s resurgence above $61K and the ongoing institutional interest underscore the asset’s resilience, while challenges such as the SEC’s rejection of Solana ETF filings highlight the complexities of navigating the regulatory environment. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc