RWA Edition: Revolutionizing Credit Markets - How Maple Finance is Bridging TradFi and DeFi with Real-World Assets

Tokenized Real-World Lending Meets On-Chain Innovation - Maple Finance's RWA Evolution in DeFi

Redefining the Future of Blockchain Credit Markets

Imagine a financial world where real-world assets (RWAs), such as U.S. Treasuries, corporate debt, and invoice receivables, seamlessly integrate into decentralized finance (DeFi). Enter Maple Finance, a protocol at the forefront of this transformation. By bridging the $100 trillion TradFi credit market with the transparency and efficiency of blockchain, Maple is reshaping the foundations of global credit systems.

Through tokenized financial products and hybrid lending solutions, Maple unites institutional rigor with Web3 programmability, creating a scalable ecosystem that meets the demands of both DeFi participants and off-chain enterprises. Since 2024, the platform’s bold expansion into RWAs has unlocked new paradigms of capital efficiency, liquidity, and trust for decentralized credit.

Maple’s RWA Strategy Explained

At its core, Maple Finance serves as critical blockchain-native credit infrastructure. Traditionally, DeFi has been defined by overcollateralized loan systems that prioritize crypto-native assets. Maple has shifted this paradigm, focusing on undercollateralized lending paired with robust, institutional-grade underwriting frameworks. Its latest evolution integrates RWAs into two distinct yet complementary dimensions:

1. Institutional Asset Tokenization and Vault Management

Maple’s collaboration with Room40 Capital has enabled the tokenization of low-risk institutional assets, such as short-term U.S. Treasuries and corporate credit. These financial primitives are deployed within permissioned smart contract vaults, where accredited participants can tap into stable, off-chain yields.

The Benefits of Tokenized Assets

Enhanced Liquidity: By tokenizing traditionally illiquid instruments, Maple accelerates settlement processes, reduces intermediaries, and democratizes access for institutional and DeFi-native investors.

Real-Time Transparency: Participants benefit from blockchain’s inherent ability to provide granular, moment-to-moment visibility into asset performance and borrower activity.

Security and Compliance: Smart contracts enforce lending terms, reducing counterparty risk, while permissioned vaults ensure alignment with regulatory standards.

This approach moves beyond existing RWA efforts that have focused primarily on tokenized real estate and stablecoins. By bringing sovereign and corporate debt into DeFi, Maple expands the scope of what on-chain credit can accomplish.

Key Takeaways for Institutional DeFi

Maple’s strategies align blockchain-native innovations with time-tested financial products, driving increased trust and adoption by players at the intersection of TradFi and crypto.

2. Real-World SME Credit Lines

Building on its success with tokenization, Maple’s platform has extended its services to small and mid-sized enterprises (SMEs) seeking liquidity. These borrowers, often underrepresented in traditional banking systems, are onboarded through a combination of thorough due diligence and blockchain-executed loans.

What Makes SME Lending Unique on Maple?

On-Chain Liquidity: Borrowers receive stablecoins such as USDC, while lenders immediately benefit from tokenized repayment streams.

Revenue-Lined Agreements: By collateralizing loans with accounts receivable or revenue, Maple ensures real-world cash flows back its credit offerings.

Efficiency Gains: Hybrid architectures streamline funding timelines, cutting red tape and delivering capital at unmatched speed.

The Broader Implications

By targeting a historically underserved segment of the global economy, Maple unlocks capital for high-impact businesses while anchoring DeFi assets to tangible economic activity.

The Numbers Speak for Themselves

2025 has proven to be a pivotal year for Maple Finance. The platform’s performance metrics highlight its significant growth momentum, demonstrating its appeal to institutional, crypto-native, and enterprise participants alike.

Maple’s Key Achievements

Lifetime Originations Surpass $2.3B: Evidence of demand for scalable credit infrastructure in DeFi.

$13.7M+ in Interest Paid to Lenders: A testament to stable, risk-adjusted returns for participants.

$600M+ in Total Value Locked (TVL): Reflecting trust in Maple’s tokenized vaults.

Annualized Revenue Grows Tenfold: Expansion into RWAs drives sustainable business growth.

Market Yields Between 8–12% APY: Balancing yield-seeking behaviors with robust credit standards.

These figures firmly establish Maple as a critical player in DeFi, capable of scaling as the financial sector further embraces digitization.

Syrup: DeFi’s Gateway to Institutional Credit

While Maple has excelled in serving accredited investors and institutional borrowers, Syrup represents the protocol’s commitment to democratizing access to high-quality credit markets. This permissionless lending layer simplifies participation in RWA-backed lending pools without cutting corners on regulatory alignment or risk management.

Syrup’s End-to-End Benefits for DeFi Users

Streamlined Participation: Users can access pre-curated lending pools, removing the complexities of underwriting and asset selection.

Automated Lending Logic: Smart contracts handle loan execution, reporting, and real-time redemptions with precision and transparency.

Optimized for DAOs and Protocol Treasuries: Syrup bridges the gap between DeFi-native participants and regulated opportunities, helping DAOs diversify revenues sustainably.

By abstracting complexity into accessible frameworks, Syrup lowers the bar for decentralized capital to engage with institutional-grade strategies.

The Road Ahead for Maple Finance

Maple’s roadmap is as ambitious as it is forward-looking. By advancing its platform capabilities, the protocol aims to solidify its role as a dominant layer for blockchain-based credit systems.

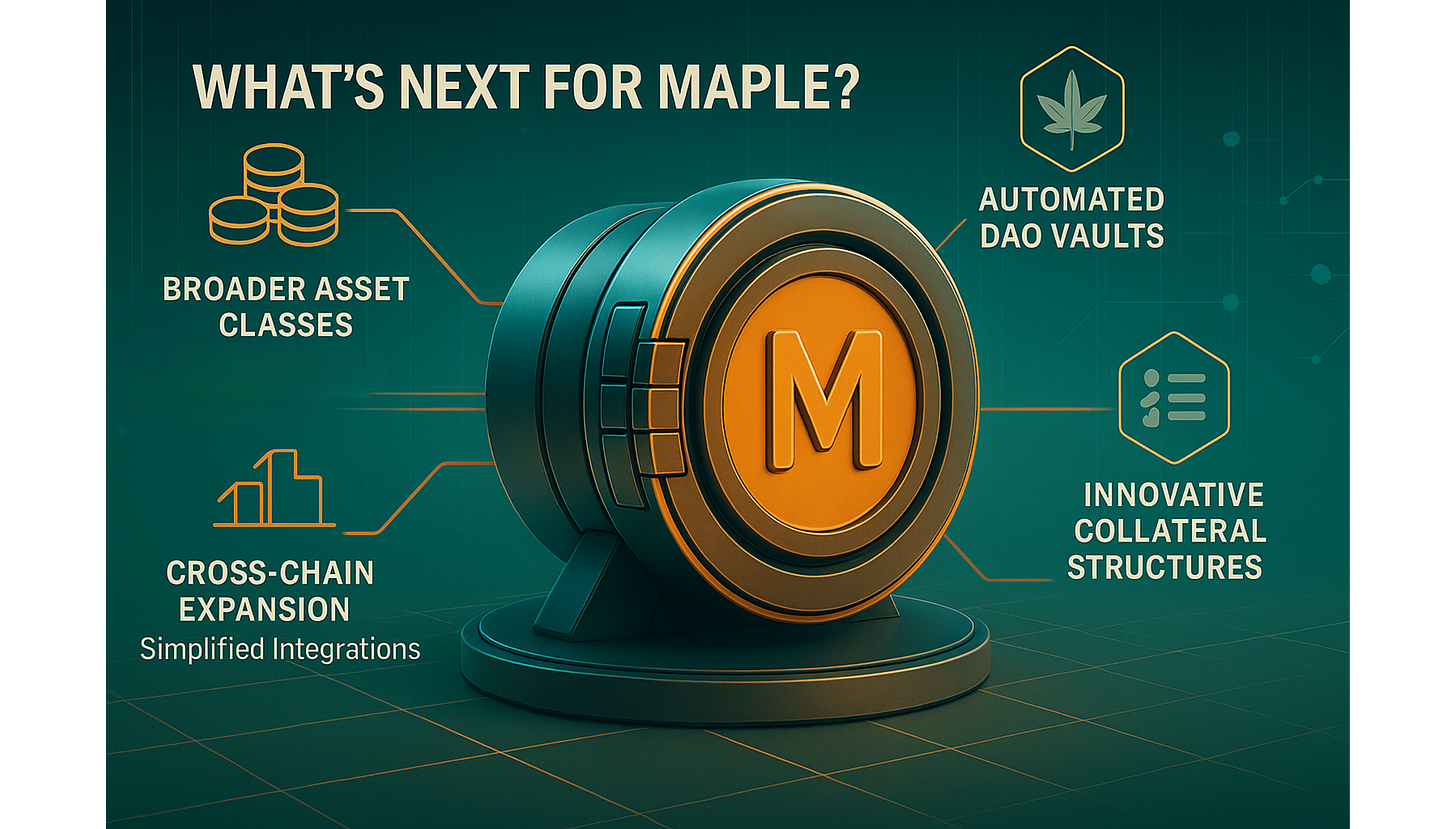

What’s Next for Maple?

Cross-Chain Expansion: Multi-chain deployments will enhance composability, making vaults accessible across major blockchains.

Broader Asset Classes: Plans to tokenize trade finance, factoring, and public infrastructure debt open diversified yield sources.

Automated DAO Vaults: Maple will pioneer automated treasury management strategies for decentralized organizations, optimizing DeFi assets.

Innovative Collateral Structures: Development of on-chain credit scoring systems and tokenized invoices (NFTs) will deepen borrower assessments.

Simplified Interfaces for TradFi Participants: Web3-to-Web2 solutions will onboard capital allocators efficiently, enabling seamless integration with blockchain rails.

By focusing on scaling infrastructure alongside new product verticals, Maple Finance is positioned to lead the evolution of DeFi credit markets well into the next decade.

The Takeaway

Maple Finance is redefining blockchain credit markets by integrating real-world assets with DeFi infrastructure. From tokenized Treasuries and corporate debt to SME-specific solutions, Maple delivers stable, regulated yields with institutional-grade underwriting. With its innovative Syrup protocol, ambitious roadmap, and robust performance metrics, Maple bridges TradFi and DeFi, creating a new era for on-chain financial systems.

Join the RWA revolution. Explore more opportunities at Block Consulting’s RWA Editorial.