RWA Edition: Crypto ETFs Expansion and the Future of RWA

How ETFs could strengthen RWA and make it mainstream.

Cryptocurrency and blockchain have promised to change finance for years, and 2025 could be the year that promise starts becoming reality. A key driver of this shift is the rise of crypto ETFs (Exchange-Traded Funds), which could make Real-World Assets more accessible than ever.

These investment vehicles simplify access to tokenized assets and could reshape how investors interact with real estate, commodities, and even fine art. Today, we’ll break down what crypto ETFs are, how they can transform RWAs, and what this means for investors.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

What Are Crypto ETFs, and Why Do They Matter?

Crypto ETFs are funds traded on traditional stock exchanges that expose investors to cryptocurrencies. They eliminate the need to buy and store crypto directly, making the process simpler and more appealing to mainstream investors.

For example, instead of purchasing Bitcoin and managing private keys, you can invest in a Bitcoin ETF on the NYSE or Nasdaq. The same principle could apply to tokenized real-world assets like real estate, commodities, and art.

Why Crypto ETFs Are a Game Changer

Here’s why ETFs are a big deal for investors and the crypto market:

Easier Access: Crypto ETFs allow everyday and institutional investors to gain exposure to assets that can be considered complex or volatile.

Improved Liquidity: By wrapping tokens into ETFs, trading volumes increase, making these markets more active and efficient.

Regulatory Compliance: ETFs operate under traditional financial regulations, making them a safer option for investors hesitant about direct crypto exposure.

Crypto ETFs are helping close the gap between traditional finance and blockchain, bringing trust and accessibility to millions of new investors.

How Crypto ETFs Can Transform Real-World Assets

One of the most exciting developments is the combination of crypto ETFs with RWAs. Tokenization—the process of converting real-world assets into digital tokens—makes these assets easier to trade and more transparent. When combined with ETFs, the potential impact could be huge and revolutionary.

Tokenized Real Estate ETFs

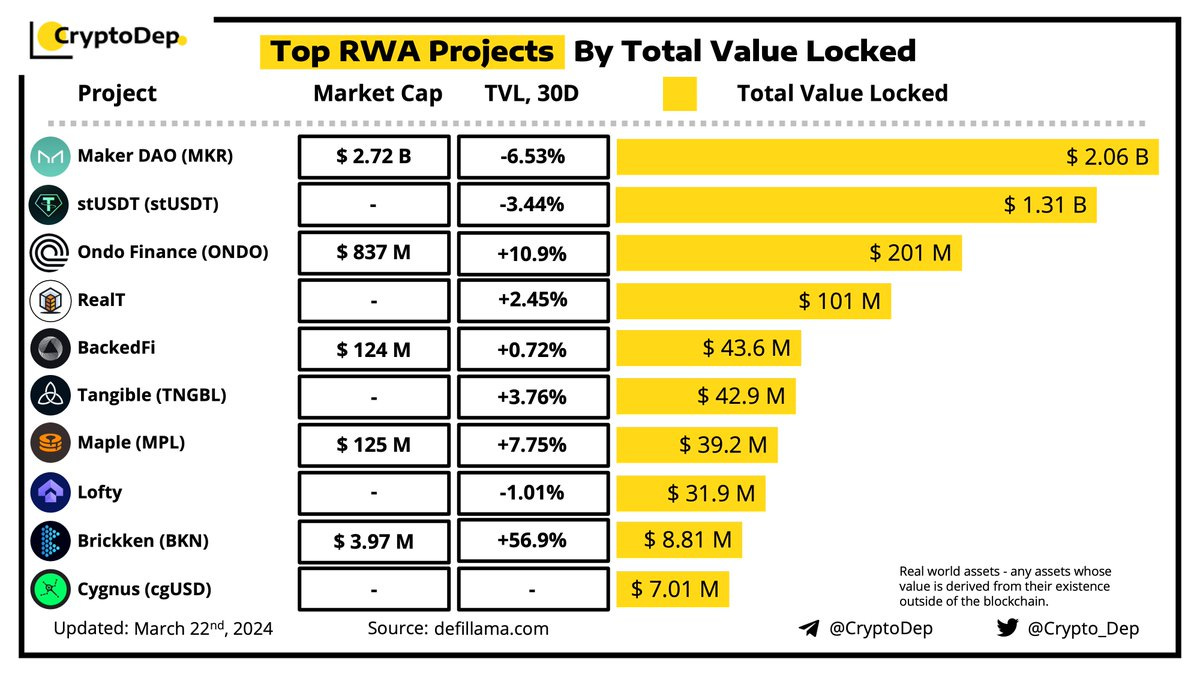

Real estate tokenization allows investors to own a fraction of high-value properties. Platforms like RealT and Landshare are already pioneering this concept. ETFs could bundle projects like these and make tokenized real estate mainstream, offering a window to institutional or conservative investors.

Commodity-Backed ETFs

Investing in gold, silver, and oil has always been a popular buffer against market volatility. Now, tokenized versions of these commodities, like PAX or XAUT, offer us a simple way to invest in them. An ETF based on commodities could diversify portfolios and simplify investment for many.

Art and Collectibles ETFs

Imagine owning a piece of a Picasso or a rare collectible without needing millions of dollars. Tokenized art is already a thing, and ETFs could open up alternative investments to a broader audience while adding liquidity to traditionally stagnant markets.

What This Means for Investors

The growth of crypto ETFs and tokenized RWAs is part of a larger financial shift. Consider these trends:

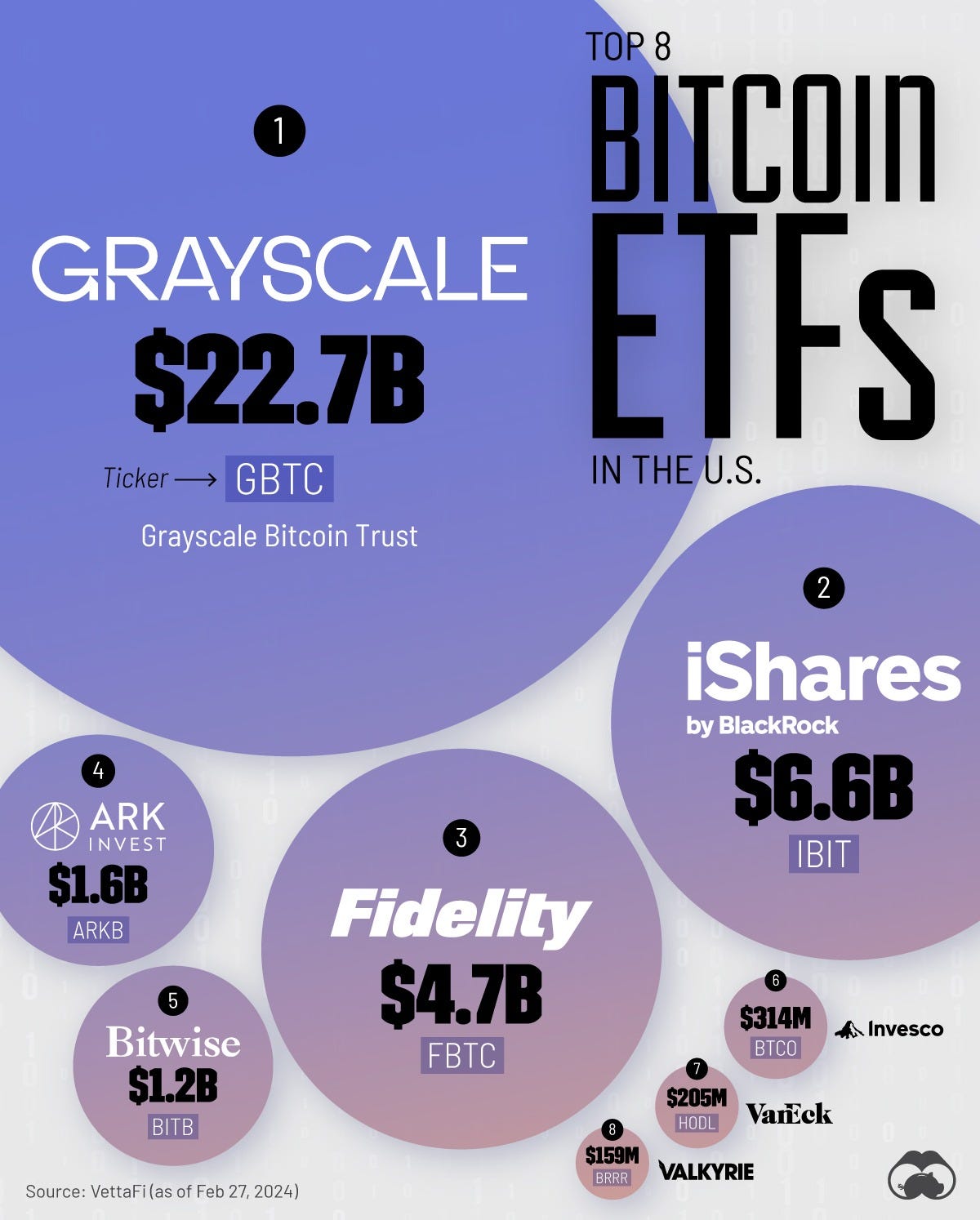

The global crypto ETF market grew 40% in 2024, surpassing $25 billion in assets under management (AUM).

The tokenization market is projected to hit $10 trillion by 2030, with real estate making up 40% of that growth.

This will be significant for all investors looking to diversify their portfolios. ETFs will open new markets to a wider audience, especially institutional investors, since this financial tool legitimizes blockchain assets and is regulated. We expect a new level of crypto adoption across traditional finance that could support major growth in the industry.

Even though the potential is huge, there are still some important challenges:

Regulation: Many countries are still figuring out how to handle crypto ETFs, leading to delays and uncertainty.

Liquidity Risks: Tokenized assets need active trading to maintain their value.

Valuation Issues: Pricing illiquid assets like real estate or fine art can be complex and subjective, posing risks for investors.

Infrastructure Needs: Custody solutions, platform interoperability, and security measures are still evolving.

Understanding these challenges is key to making informed investment decisions.

What the Future Holds Us

ETFs made stock investing accessible, growing from $200 billion to $9.6 trillion in two decades. Now, real-world asset tokenization is set to do the same for crypto, with institutions seeing massive potential beyond Bitcoin ETFs. Real estate, private equity, and corporate debt—once inaccessible to retail investors—could become tokenized, unlocking trillions in value.

Crypto ETFs and tokenized RWAs could be the biggest financial innovations of this decade. By combining blockchain with traditional markets, they will make investing more accessible, liquid, and transparent. So, what can investors do?

Research ETF Providers: Look for established names like Fidelity, Vanguard, BlackRock, and emerging blockchain-native ETF issuers.

Diversify Smartly: Tokenized ETFs can complement existing portfolios for greater exposure.

Stay Informed: Keep up with market trends and regulatory updates to make the most of emerging opportunities.

The moment is here, and those who get in early could be well-positioned to benefit from this financial evolution. ETFs are already changing the crypto market drastically, and with it, it is just a matter of time to do the same with the RWA industry.