Record Liquidations in the Market, and Magic Eden Launches Token - December 11, 2024

Also, Ripple stablecoin will come soon, and Microsoft rejects BTC.

TL;DR: Crypto Insights in Seconds

BTC: The token experiences record liquidations in just one day.

Memecoins: Suffer major losses and market cap drops.

USDT: Gains regulatory approval in Abu Dhabi.

RLUSD: Ripple stablecoin received approval from NYDFS.

Microsoft: Holders vote no to investing in BTC considering it unnecessary.

Chainlink: Partners for Coinbase’s Project Diamond to improve tokenized asset management.

Magic Eden: Launches ME token.

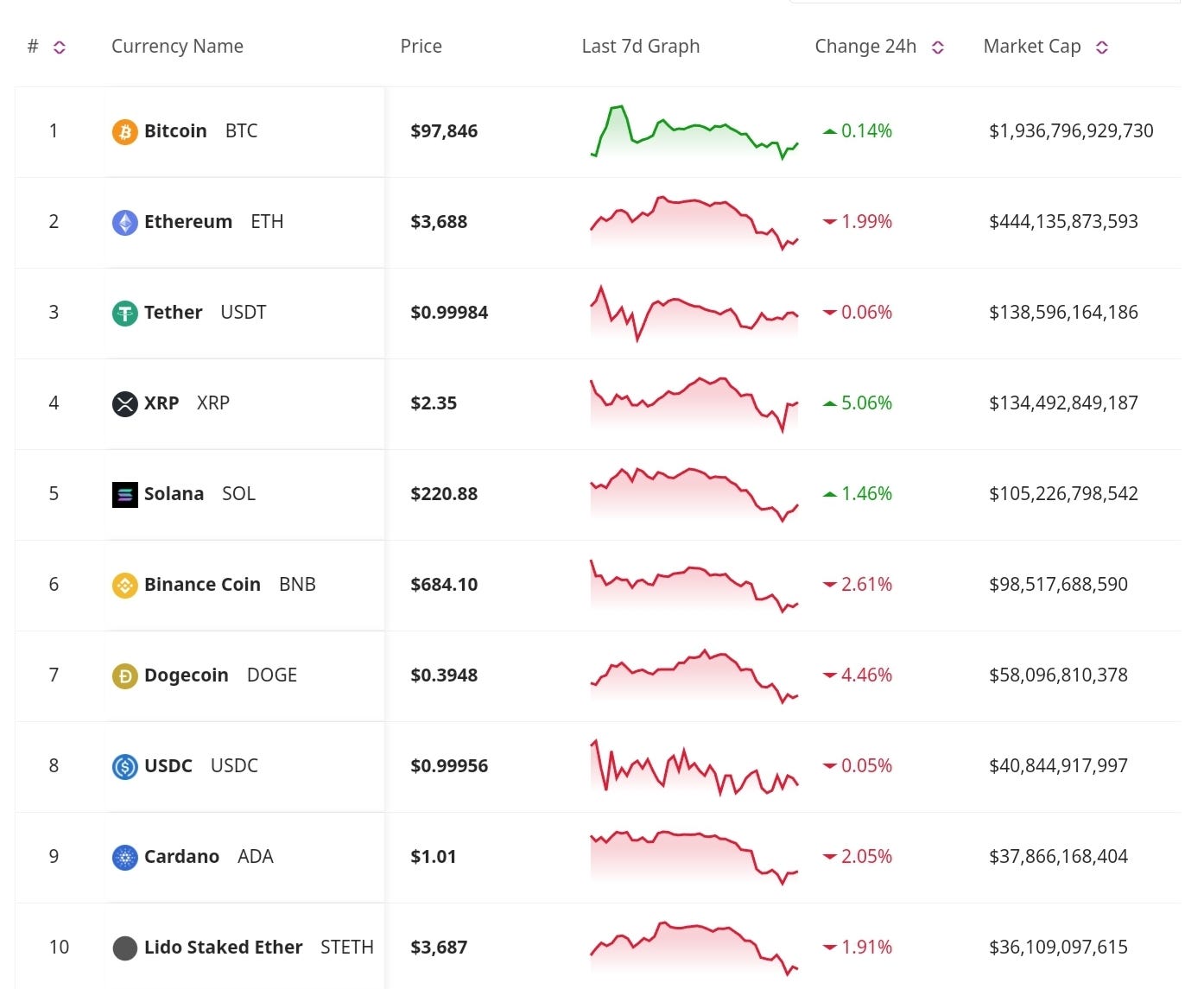

Price Update

Record Bitcoin Liquidations Trigger Market Reset and Opportunities

Bitcoin’s price crash to $94,000 on Dec. 9 caused the largest liquidation event since 2021, wiping out $1.6 billion across crypto markets. Aggressive selling by Coinbase traders and a cascading liquidation of leveraged positions fueled the decline. This volatility has reduced excessive leverage in the market, paving the way for healthier trading conditions. Despite the drop, institutional interest remains robust, with major players like MicroStrategy and Riot Platforms continuing large-scale BTC acquisitions.

Memecoins Suffer Major Losses, Market Cap Drops to Three-Week Low

Memecoins like Dogecoin, Shiba Inu, and Dogwifhat faced steep declines yesterday, erasing much of their gains from the Trump-inspired rally. The sector’s total market cap fell 21% to $119.6 billion, the lowest since late November, with daily trading volumes doubling amid heavy selling pressure.

Regulatory and Legal News

Tether’s USDT Gains Regulatory Approval in Abu Dhabi

The Abu Dhabi Global Market’s (ADGM) Financial Services Regulatory Authority has approved Tether’s USDT stablecoin as an Accepted Virtual Asset (AVA). This recognition allows licensed financial services to integrate USDT across blockchains like Ethereum, Solana, and Avalanche, aligning with the UAE’s ambition to lead in digital finance.

Ripple’s RLUSD Stablecoin Secures NYDFS Approval

Ripple Labs has received approval from the New York Department of Financial Services (NYDFS) for its RLUSD stablecoin. Ripple plans to back RLUSD with USD deposits, U.S. Treasury bonds, and cash equivalents, with a focus on institutional players. The company aims for a $2 trillion market cap by 2028 and has already established partnerships with exchanges like Uphold and Bitstamp.

Business News

Microsoft Shareholders Reject Proposal to Add Bitcoin to Balance Sheets

Microsoft shareholders voted against a proposal to allocate 1%-5% of profits to Bitcoin investments. Submitted by the National Center for Public Policy Research (NCPPR), the proposal wanted to diversify corporate assets and capitalize on Bitcoin’s growing institutional adoption. Despite arguments citing potential value growth and examples like MicroStrategy’s strategy, Microsoft’s board called the proposal “unnecessary” due to Bitcoin’s volatility.

Chainlink Integrates with Coinbase’s Project Diamond

Chainlink has partnered with Coinbase’s Project Diamond to improve tokenized asset management for institutions. This integration uses Chainlink's Cross-Chain Interoperability Protocol (CCIP) to link public and private blockchains with traditional financial systems, ensuring compliant solutions. Chainlink’s growing presence in the MENA region aligns with predictions of a $10 trillion tokenized asset market by 2030, reinforcing its pivotal role in onchain finance innovation.

Magic Eden Launches ME Token with Cross-Chain Utility

Magic Eden, a leading Solana-based NFT marketplace, has introduced its ecosystem token, ME. Users can claim ME tokens by connecting their cross-chain wallets to the ME Foundation website. ME tokens can be staked for participation in cross-chain challenges, airdrops, and future ecosystem activities.

The market draws back with massive liquidations in BTC, altcoins, and memecoins, while traders reposition themselves and wait for the next opportunity. On the other hand, approval for stablecoins show the impact these tools have and its growing adoption worldwide. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

amazing 🤩