NFT Edition: Artists Challenge SEC's NFT Rules

Artists vs. the SEC, and the legal battle to define NFT regulation

In a surprising turn of events, two prominent artists, Brian L. Frye and Jonathan Mann, have taken a bold step to challenge the U.S. Securities and Exchange Commission (SEC) over its regulation of NFTs.

This legal battle has sparked widespread debate over the role of government agencies in the art world, the definition of securities, and the future of NFTs as a legitimate medium for artists to make a living. On our last NFT Edition of the year, we take a step back to analyze the industry and consider how this could change it.

A Timeline of SEC-NFT Regulation

The SEC’s involvement with NFTs dates back to 2023, when it charged its first NFT-related case against Impact Theory. The media company was accused of selling NFTs as unregistered securities, setting a precedent that alarmed many in the crypto and art communities.

Later in 2023, Stoner Cats, an animated web series featuring Mila Kunis and Ashton Kutcher, became the second high-profile project to face SEC scrutiny. The series sold NFTs to fund its production, raising $8 million but drawing the attention of regulators for allegedly bypassing mandatory registration processes.

By August 2024, the SEC’s focus expanded to marketplaces, with OpenSea, the largest NFT trading platform, coming under fire. This move represented a widespread effort to regulate not just NFT creators but also the ecosystems supporting them.

Finally, in December 2024, the SEC’s actions hit a nerve with the artistic community. CyberKongz, a prominent NFT artist, was notified by the agency, prompting a collective call for artists to stand against what many see as government overreach.

The Lawsuit That Could Redefine NFT Regulation

Given these escalating tensions, Brian L. Frye and Jonathan Mann filed a lawsuit against the SEC in the summer of 2024. The artists argue that the agency’s broad definition of securities unfairly encompasses NFTs, strangling creativity and limiting artists’ ability to make a living.

The crux of their argument lies in two main points:

Overreach of the Securities Definition: The SEC’s current definition of securities is so expansive that it could include any type of art sold as an investment. NFTs, which allow artists to monetize their work in innovative ways, are particularly vulnerable under this interpretation.

Impact on Artistic Livelihoods: By requiring NFT sales to adhere to securities regulations, the SEC imposes costly and complex barriers that many artists cannot navigate. Jonathan Mann, for example, has been selling daily song NFTs as part of his career, a practice now threatened by the SEC’s stance.

Frye and Mann’s lawsuit attempts to force the SEC to clarify its position and limit its regulatory scope, ensuring that NFTs remain a viable medium for artists to thrive.

Setting the Stage: The Stoner Cats Case

One of the pivotal moments leading to this lawsuit was the SEC’s settlement with Stoner Cats 2 LLC. The animated series sold 10,000 NFTs to fund its production, but the SEC viewed these sales as unregistered securities. The settlement sparked outrage among artists and creators, including Frye and Mann, who saw it as a dangerous precedent.

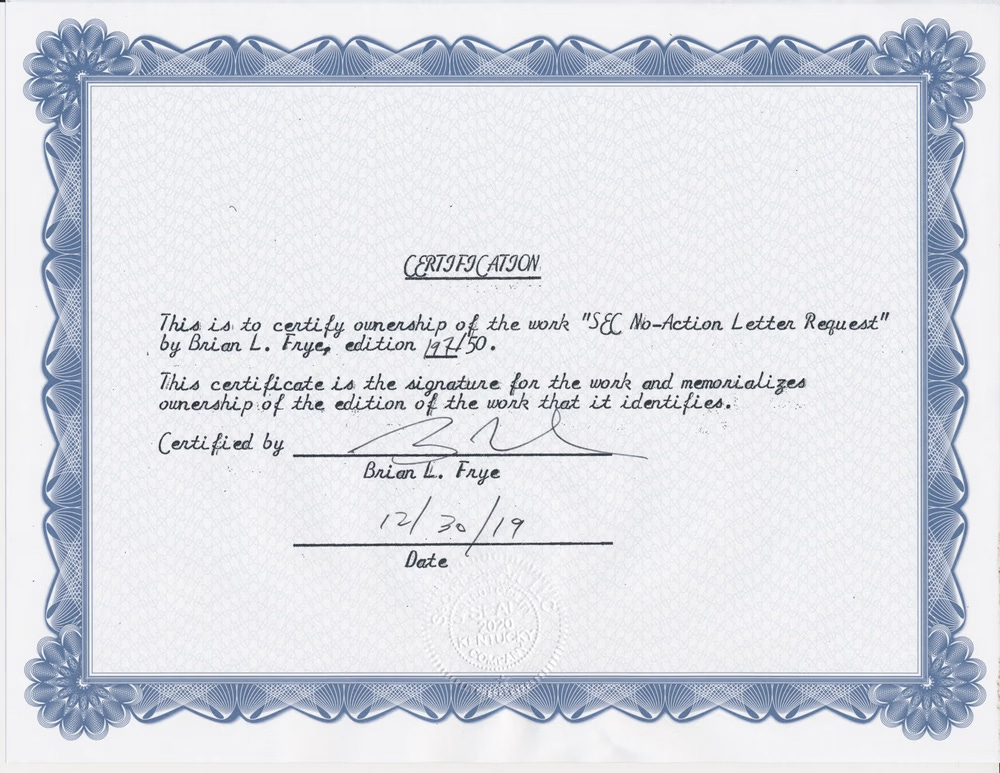

Frye had previously engaged with the SEC, creating an NFT titled "SEC No-Action Letter Request" to challenge the agency’s approach. However, the lack of a satisfactory response led him to take legal action, filing the lawsuit in Louisiana federal court alongside Mann.

Why This Case Matters

The lawsuit’s outcome could have far-reaching implications for the art world and beyond. If Frye and Mann succeed, it could limit the SEC’s ability to regulate NFTs, preserving artistic freedom and encouraging creators to experiment with new technologies without undue interference.

At the same time, a win for the SEC might expand its authority over the art market, potentially requiring artists to disclose risks associated with their work and comply with securities regulations. Such a change could discourage artists from exploring NFTs as a medium, reshaping the creative community.

This case also beings up again a bigger debate about the role of government in emerging technologies. NFTs represent a transformative opportunity for artists, offering new ways to connect with audiences and monetize their work. However, regulatory uncertainty threatens to squash this innovation before it can fully take root.

Next Steps for NFT?

As the legal battle unfolds, artists, collectors, and legal experts are watching closely. The Frye and Mann lawsuit is not just about NFTs, but the future of art, innovation, and the boundaries of government intervention.

For now, the art world remains in limbo, awaiting clarity on whether NFTs will continue to expand as a revolutionary medium or face stricter controls that could diminish their potential. One thing is certain: the outcome of this case could shape the trajectory of digital art for years to come.

impressive ❤️