New NFT from Trump, BTC Steady Rise, and BlackRock’s Spot ETH ETFs - July 18, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insights in Seconds

- Bitcoin: briefly peaks above $66,000 while Ether edges up.

- Donald Trump: teases release of a fourth NFT collection.

- On-chain Tickets: First major U.S. venue adopts on-chain ticketing via Aptos.

- Taiwan: Tightens AML regulations for virtual asset providers.

- BlackRock: Sets 0.25% fee in preparation for launching spot Ethereum ETFs.

- State Street: Plans to create its own stablecoin.

- German Government's: Bitcoin selloff nets $2.9 billion.

- Grayscale: Launches a new fund focused on decentralized AI.

- U.S. spot Bitcoin ETFs see $422 million in net inflows.

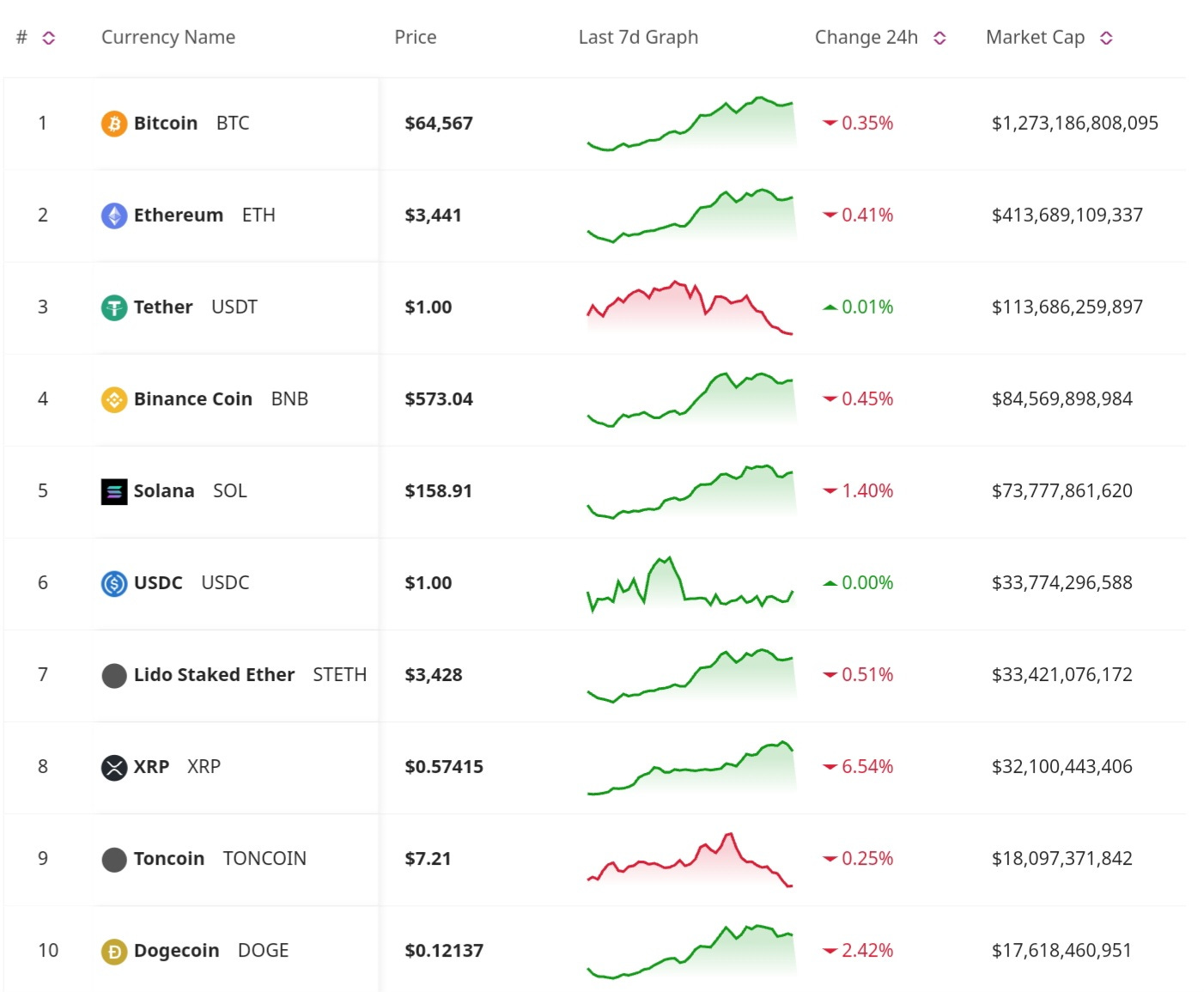

Price Update

Bitcoin Briefly Peaks Above $66,000 While Ether Edges Up

Bitcoin's price briefly peaked above $66,000, signaling strong market momentum. Ether also saw gains, moving up alongside Bitcoin. These price movements suggest a bullish trend in the cryptocurrency market, driven by positive investor sentiment and favorable market conditions. Analysts are optimistic about the continued upward trajectory of both Bitcoin and Ethereum.

Releases and Developments

Donald Trump Teases Release of Fourth NFT Collection

Former U.S. President Donald Trump is set to release his fourth NFT collection, continuing his journey into the digital collectibles space. The previous collections have seen mixed success, attracting both supporters and critics. This new release is expected to feature unique digital assets, potentially appealing to both political supporters and NFT enthusiasts.

Grayscale Launches New Fund for Decentralized Artificial Intelligence

Grayscale has launched a new fund focused on decentralized artificial intelligence. The fund aims to invest in projects and technologies at the intersection of blockchain and AI. This initiative represents Grayscale's commitment to explore innovative investment opportunities in emerging technologies. The fund is expected to attract investors interested in the potential of AI and blockchain convergence.

First Major U.S. Venue Goes Fully On-Chain with Aptos-Powered Live Event Ticketing

An iconic New York music venue has become the first major U.S. venue to adopt on-chain live event ticketing, employing technology powered by Aptos. This move strives to improve security, reduce fraud, and streamline the ticketing process. The adoption of blockchain technology in ticketing represents a significant step towards integrating decentralized solutions in mainstream entertainment.

BlackRock Sets 0.25% Fee in Preparation for Launching Spot Ethereum ETFs

BlackRock has set a 0.25% fee as it gears up to launch its spot Ethereum ETFs. The fee structure is part of the latest round of amended forms submitted by the asset management giant. The introduction of these ETFs is expected to attract significant institutional investment, boosting the adoption and liquidity of Ethereum.

German Government’s Bitcoin Selloff Nets $2.9 Billion Amid Film Piracy Case

The German government has successfully sold off a significant portion of its Bitcoin holdings, netting $2.9 billion. The sale is linked to proceeds from a high-profile film piracy case. This substantial liquidation of Bitcoin by a government entity highlights the growing involvement of state actors in the cryptocurrency market. The funds raised are expected to be allocated to various government projects and initiatives.

U.S. Spot Bitcoin ETFs Post $422 Million in Net Inflows, Largest Since Early June

U.S. spot Bitcoin ETFs have recorded $422 million in net inflows, marking the largest inflow since early June. This surge in investment reflects growing confidence in Bitcoin and the appeal of ETFs as a convenient investment vehicle.

Don’t Miss Anything

State Street Looks to Create Its Own Stablecoin

Financial services company State Street is planning to create its own stablecoin, according to reports. The initiative will use blockchain technology to improve the efficiency of financial transactions and settlements. State Street's entry into the stablecoin market highlights the increasing interest among traditional financial institutions in adopting digital currencies.

Taiwan Tightens AML Regulations for Virtual Asset Providers

Taiwan has announced stricter anti-money laundering (AML) regulations for virtual asset service providers. The new rules are designed to increase transparency and compliance, addressing concerns about illicit activities in the crypto space. Providers will need to adhere to more rigorous reporting and verification requirements, aligning with global regulatory standards.

Today's market highlights the intersection of technology, regulation, and innovation in the cryptocurrency space. Donald Trump's upcoming NFT collection and the on-chain ticketing adoption by a major U.S. venue underscore the expanding use cases for blockchain. Regulatory developments in Taiwan and market moves by BlackRock and State Street reflect the growing mainstream acceptance and integration of digital assets. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc