Monetary Policy Turbulence and the Rise of Web3 Gaming on Telegram

Ethereum faces critical support as structural risks grow, dormant Dogecoin wallets show whale activity, and Notcoin reshapes Web3 gaming with Telegram integration.

TL;DR: Crypto Insights in Seconds

Bitcoin: holds around $95K while Fed rate cut speculation fuels caution. Short-term support sits at $91.5K–$92K.

Ethereum: risks sliding to $1,500 if support zones falter, highlighting market fragility.

Dogecoin: sees notable whale activity with a $17M dormant wallet transaction but lacks broader retail momentum.

Notcoin: drives adoption through Telegram-native, viral, play-to-earn blockchain gaming.

Security concerns: rise as abductors target crypto-affiliated individuals in Europe.

Tim Draper: predicts Bitcoin’s value could theoretically reach infinity under prolonged fiat debasement.

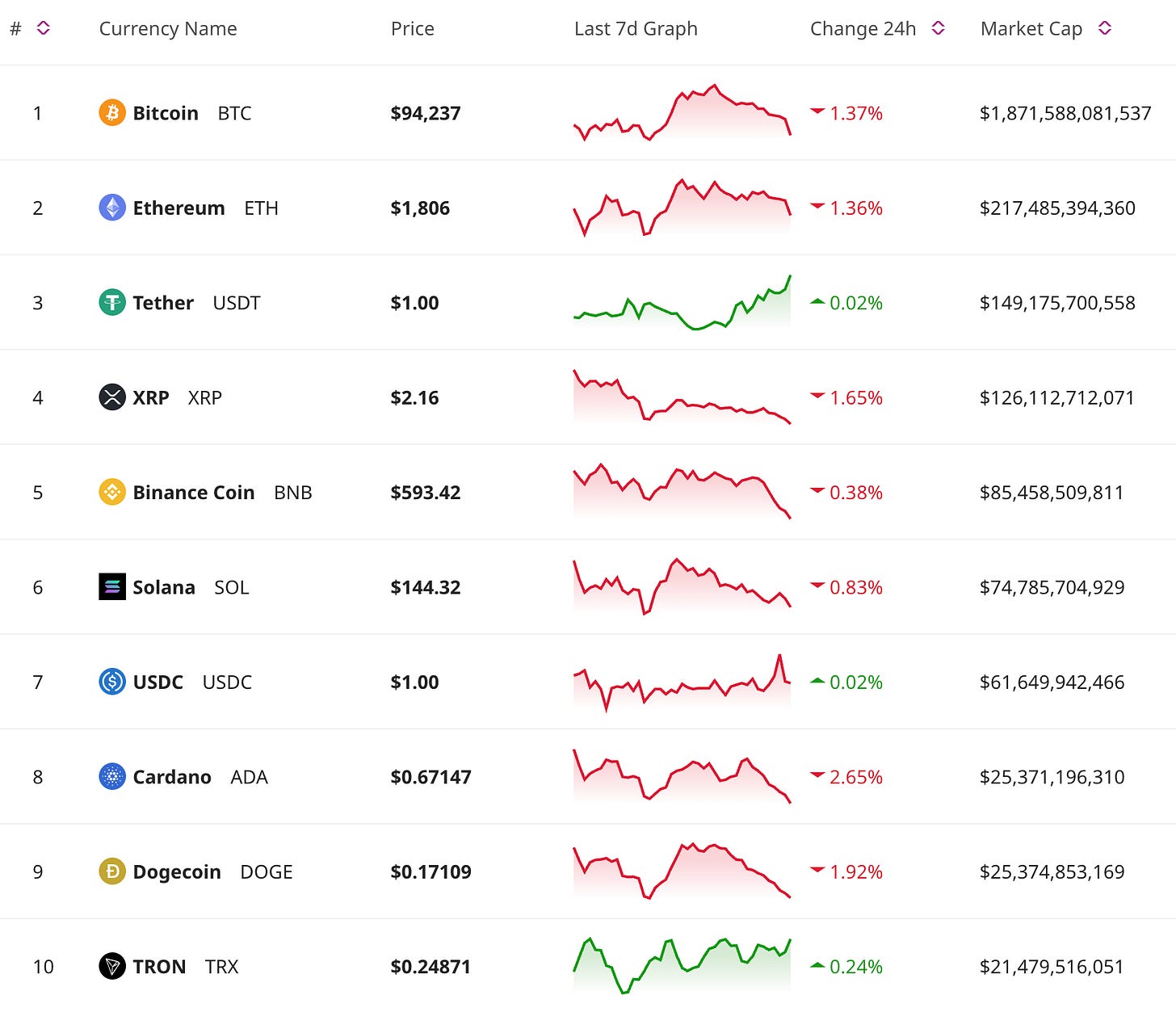

Price Update

Bitcoin Holds Steady Near $95K

Bitcoin tested $95,000 before retracing under macroeconomic uncertainty and hesitant institutional inflows. Investors are increasingly cautious as the Federal Reserve debates potential rate cuts amidst global instability. Analysts are closely watching the $91.5K–$92K zone, a critical support level. Meanwhile, traders remain skeptical about a push beyond $100K without clear bullish catalysts.

Ethereum at Risk of Breakdown

Ethereum consolidates within a fragile $1,770–$1,825 band as on-chain activity slows and leveraged traders show reluctance. A breach in this range could rapidly send ETH to $1,500, while a recovery to $2,100 would require heightened bullish momentum and favorable macro developments. Ethereum’s trajectory remains tethered to Bitcoin’s dominance and leverage levels across derivatives markets.

Cardano and Altcoin Trends

Cardano showcases renewed whale interest, with over 410 million ADA tokens acquired recently. This accumulation reflects potential optimism about staking developments and DeFi progress. On the altcoin fringe, PEPE’s recent speculative rally is cooling, suggesting sentiment in meme coins is shifting into consolidation mode.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Notcoin’s Telegram Takeover

Notcoin’s blockchain gaming platform on Telegram is driving adoption with its tap-to-earn model, token rewards, and plans for NFT interoperability. By leveraging Telegram’s vast user base, it removes onboarding barriers and makes blockchain more accessible.

With features like leaderboard staking and advanced token economies on the horizon, Notcoin could define mobile-first Web3 gaming. If successful, it may signal a shift toward simple, high-engagement platforms integrated into existing social networks.

Dogecoin Whale Activity

A dormant Dogecoin wallet recently moved 100 million DOGE ($17M), catching the attention of analysts. However, the transaction likely reflects internal reallocation rather than buy or sell activity. Despite this, Dogecoin's retail enthusiasm has cooled, with on-chain data showing reduced activity and fading speculation.

Tim Draper’s Bitcoin Vision

Tim Draper reaffirmed his bullish long-term stance, suggesting Bitcoin could reach unlimited valuation in fiat terms if monetary policies further deteriorate. His argument hinges on Bitcoin’s capped supply acting as a hedge against fiat inflation and systemic instability.

Don’t Miss Anything

Safeguarding Crypto Assets in Uncertain Times

The escalating risks in the crypto space are a stark reminder that security must go beyond digital measures. High-net-worth individuals, particularly those in crypto, are becoming targets for criminal activities. A troubling incident in Paris recently involved the abduction of a crypto entrepreneur’s father, with kidnappers demanding access to digital wallets. This is part of a larger trend forcing crypto users to think about physical security alongside digital safeguards.

Governments in Europe are beginning to take action, increasing scrutiny on privacy coins and tightening regulations around custodial wallets. These efforts aim to curb misuse, but they could also add complexities for legitimate holders by reducing anonymity and trust in decentralized systems.

For crypto holders, staying proactive is key. Hardware wallets are a must for reducing online vulnerabilities, while multi-signature wallets add another layer of protection by requiring multiple parties to approve transactions. Diversification is also critical—not just in portfolio management but in how and where assets are stored. High-value investors might consider keeping assets distributed across multiple wallets and reducing exposure to single points of failure.

Physical security can no longer be ignored. Using discretion when discussing crypto holdings, limiting public knowledge about personal wealth, and even installing basic home security measures are becoming best practices for those concerned about targeted threats. Staying ahead means blending digital expertise with street-smart defenses to protect both wealth and personal safety in these unstable times.

The crypto market exists at a crossroads where macroeconomic instability and innovative blockchain platforms intersect. Bitcoin tests critical resistance zones while Ethereum teeters, and Notcoin demonstrates blockchain’s potential to transcend speculative cycles through usability and user integration.

To stay ahead, focus on key price levels like Bitcoin’s $91.5K support, Ethereum’s $1,500 risk area, and the rapid rise of platforms simplifying blockchain interaction. Security concerns also serve as a stark reminder of the responsibilities tied to digital wealth.