JUP Grows 40%, and BTC Drops to $98K - January 27, 2025

Also, U.S. BTC ETFs see major inflows, and Musk wants to optimize public spending with blockchain.

TL;DR: Crypto Insights in Seconds

BTC: The price drops, and there is temporary bearish pressure.

JUP: After important announcements, the token grows 40%.

ECB: Wants to speed up digital euro.

BTC ETFs: See major inflows despite price fluctuations.

DOGE: Elon Musk wants to use blockchain to track public spending.

ETFs: New proposals to create XRP and Litecoin ETFs.

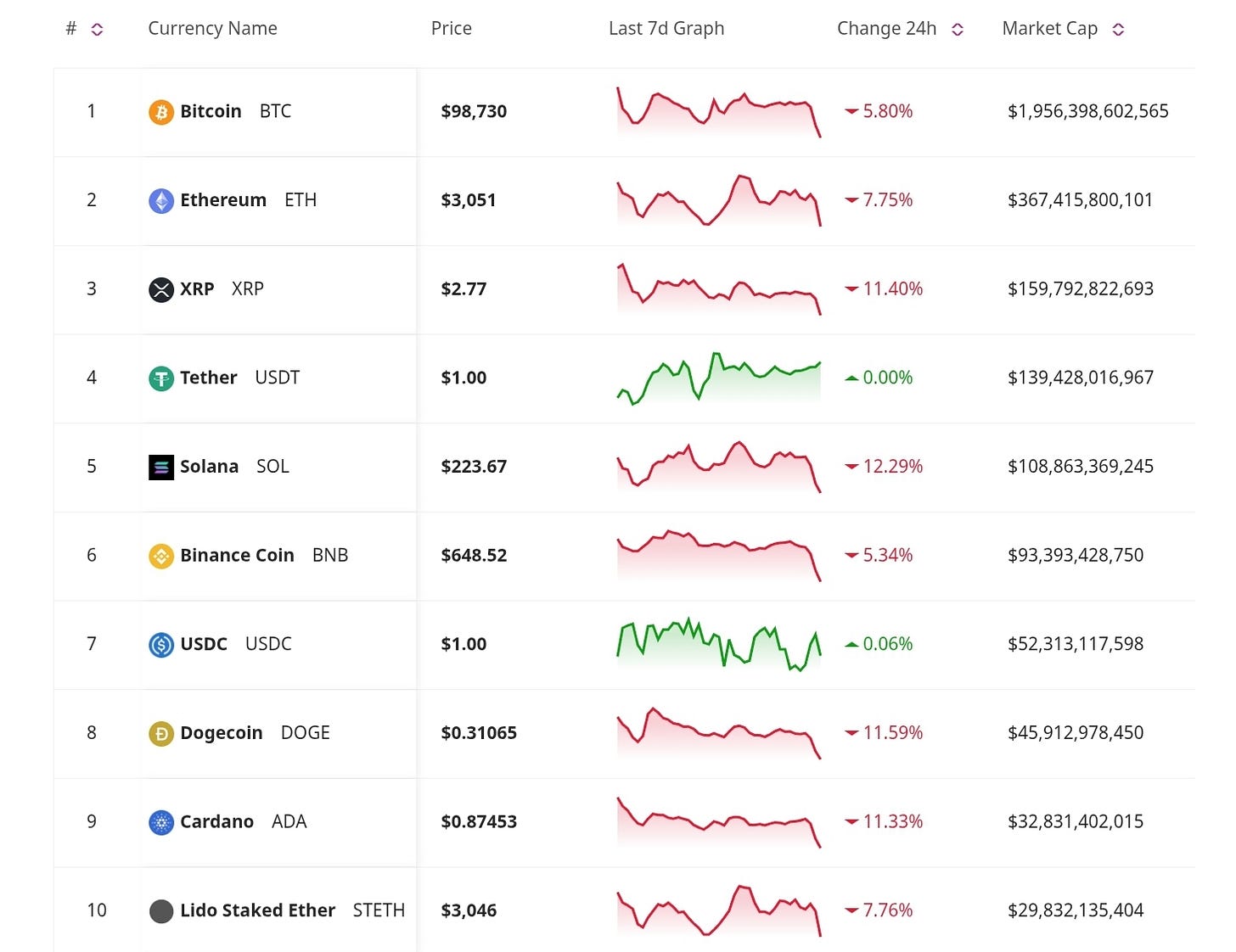

Price Update

Bitcoin Price Struggles Amid Binance Futures Bearish Signals

Bitcoin’s price faces bearish pressures as Binance perpetual futures hit record trading volumes. Analysts warn of potential downside risks if bearish trends persist. However, despite recent price fluctuations, Bitcoin's long-term holders show strong conviction, with increasing supply metrics suggesting confidence in the asset’s growth potential.

Jupiter Surges 40% Following a Buyback Announcement

The native token of the finance platform Jupiter spiked 40% following an announcement that 50% of platform fees will be allocated for token buybacks. After the announcement, the token went from its low $0.90 to about $1.27.

New Developments

ECB Advocates for Digital Euro Post-Trump Order

The European Central Bank has intensified efforts to roll out the digital euro, responding to President Trump’s crypto-focused executive order. Officials argue this move is critical to maintaining financial sovereignty and reducing reliance on non-EU digital assets.

US Bitcoin ETFs Witness Historic Value Surge

Bitcoin ETFs in the United States have reached record-high valuations, supported by a seven-day inflow streak that has logged $123 billion in total net asset value. Despite price fluctuations, this growth shows ongoing institutional interest and support, with these products surpassing expectations in their ability to attract capital.

Don’t Miss Anything

Elon Musk's DOGE Eyes Government Blockchain Adoption

Elon Musk’s “DOGE” initiative is reportedly exploring blockchain technology to enhance government efficiency, such as tracking expenses. This move could further cement blockchain’s role in public sector modernization while drawing increased attention to Dogecoin’s potential use cases.

Grayscale and CoinShares Propose New ETFs for XRP and Litecoin

In the wake of Trump’s executive order, regulatory filings from Grayscale and CoinShares indicate plans to launch ETFs tracking XRP and Litecoin. These products could expand institutional access to altcoins, driving liquidity and adoption.

As Bitcoin ETFs and institutional products gain traction, blockchain adoption in government and decentralized finance ecosystems continues to grow. Meanwhile, macroeconomic and regulatory shifts show us the evolving interplay between traditional finance and crypto innovation. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.