Important Regulatory Shifts, Bitcoin Bullish-Sentiment, and Key Market Trends - July 15, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

- IOTA partners with Eviden: To improve data integrity solutions using blockchain technology.

- SEC: Eases crypto reporting rules for banks and brokerages to simplify compliance.

- Crypto: Trading volume is projected to exceed $108 trillion in 2024, with Europe leading the market.

- Germany’s Government: Bitcoin transfer strategy impacts exchange holdings and market dynamics.

- MakerDAO: Plans a $1 billion investment in tokenized U.S. Treasuries to diversify collateral.

- Bitcoin ETFs: Log over $300 million in net inflows, reaching record levels.

- Celsius: Plans to liquidate tokens and NFTs after settling with KeyFi founder.

- BTC Wallet: Dormant Bitcoin address containing $60 million awakens after nearly 12 years.

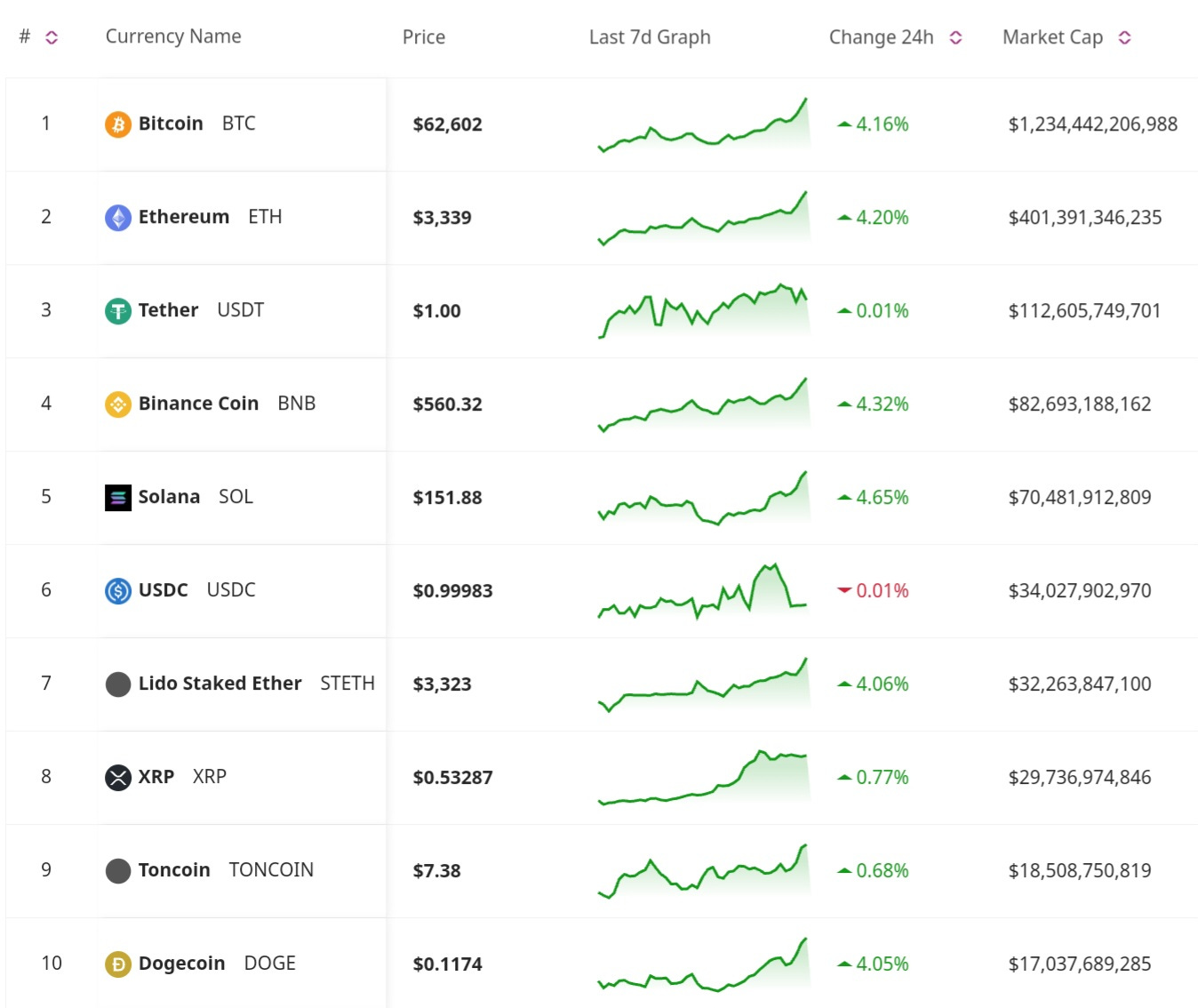

Price Update

Bitcoin Price Surges Above $58,400 Following German Government Sales

Bitcoin’s price has surpassed $58,400 after the German government sold a significant amount of BTC, reaching and struggling to maintain $60,000. Analysts believe the sale alleviated some market pressure, leading to a price increase. The market reacts positively to this move, seeing it as a sign of stability.

Germany Nears Completion of Bitcoin Sell-Off, Holding Less Than 5,000 BTC

Germany is close to finishing its Bitcoin sell-off, now holding less than 5,000 tokens. This strategic liquidation has been closely watched by the market, with each sale impacting Bitcoin’s price movements. The government’s methodical approach aims to minimize market disruption while optimizing returns from its crypto holdings.

Market Trends and Expectations

Final Approval for Spot Ether ETFs Expected Soon with Listings Projected Next Week

Final approval for Spot Ether ETFs is anticipated imminently, with listings expected as soon as next week. This development could significantly boost Ethereum's market liquidity and attract institutional investors, potentially driving up prices.

Crypto Trading Volume Expected to Top $108 Trillion in 2024 with Europe Leading the Market

Crypto trading volume is projected to exceed $108 trillion in 2024, with Europe dominating the market. This forecast highlights the growing mainstream adoption of cryptocurrencies and the significant role European markets are playing in this expansion.

MakerDAO Announces Plans to Invest $1 Billion in Tokenized U.S. Treasuries

MakerDAO has unveiled plans to invest $1 billion in tokenized U.S. Treasuries. This move is aimed at diversifying its collateral portfolio and generating stable returns for the protocol, enhancing its financial stability and resilience.

BlackRock Shows Interest in Participating in MakerDAO’s Grand Prix Initiative

BlackRock has expressed interest in participating in MakerDAO’s Grand Prix initiative. This involvement from a major asset management firm could significantly boost MakerDAO's credibility and adoption, attracting more institutional investors.

Dormant Bitcoin Address Containing $60 Million Awakens After Nearly 12 Years

A Bitcoin address containing $60 million worth of BTC has become active after nearly 12 years. The sudden activity of such an old wallet has sparked curiosity and speculation within the crypto community, with many wondering about the motives and future actions of the wallet owner.

Bitcoin ETFs Log Over $300 Million in Net Inflows, Reaching Record Levels

Bitcoin ETFs have seen over $300 million in net inflows over the past six days, reaching record levels. This influx of capital highlights growing investor confidence and interest in Bitcoin as a financial asset, facilitated by the ease of access provided by ETFs.

Celsius to Liquidate Tokens and NFTs After Settling with KeyFi Founder

Celsius has announced plans to liquidate hundreds of tokens and NFTs following a settlement with KeyFi founder Jason Stone. The liquidation is part of Celsius’s efforts to streamline its operations and resolve outstanding legal disputes, potentially impacting the broader NFT market.

Regulatory and Policy Developments

SEC Relaxes Crypto Reporting Rules for Banks and Brokerages to Encourage Adoption

The SEC has eased crypto reporting rules for banks and brokerages, aiming to simplify compliance and encourage more traditional financial institutions to engage with digital assets. This regulatory change is expected to foster greater crypto integration in the traditional financial system.

U.S. Senator Discusses Potential Crypto Policies Under a Second Trump Administration

A U.S. Senator has discussed potential crypto policies that could be implemented under a second Trump administration. The focus includes regulatory clarity and fostering innovation while ensuring consumer protection, which could significantly impact the crypto industry.

Russia Proposes Allowing Bitcoin Trading for Certain Investors as Regulatory Stance Softens

Russia is proposing to allow Bitcoin trading for certain investors, signaling a potential shift in the country’s regulatory stance towards cryptocurrencies. This move could open up new market opportunities and increase investor participation.

Binance Faces Tax Evasion Verdict in Nigeria on October 11, 2024

Binance is set to face a verdict on tax evasion charges in Nigeria on October 11, 2024. This case is part of broader regulatory challenges the exchange is facing globally, with potential implications for its operations and market standing.

Developments and Innovations

IOTA Partners with Eviden to Enhance Data Integrity Solutions Through Blockchain

IOTA has entered a partnership with Eviden to improve data integrity solutions by leveraging blockchain technology. This collaboration aims to provide more secure and reliable data management for various industries, enhancing trust and transparency.

Blockchain Payment Network Partior Raises $60 Million Backed by JPMorgan and Standard Chartered

Partior, a blockchain payment network supported by JPMorgan and Standard Chartered, has raised $60 million. The funding will be used to expand its services and further integrate blockchain technology into global payment systems, enhancing efficiency and security.

Today's market is characterized by significant regulatory and policy developments, particularly concerning the SEC’s easing of rules and Germany’s Bitcoin strategy. Bitcoin's price surge and the expected approval of Spot Ether ETFs highlight the market’s dynamic nature. Partnerships and investments, such as those involving IOTA, MakerDAO, and Partior, reflect ongoing growth and innovation in the crypto space. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc