GameFi Edition: The Rise and Fall of GameFi–Is There Hope for the Industry?

93% of GameFi projects are dead, so what’s next?

In the dynamic world of blockchain and crypto, few sectors have experienced as turbulent a journey as GameFi. Born from the fusion of gaming and decentralized finance, GameFi was positioned as the next great technological breakthrough during the 2022 crypto bull run. Billions poured into the space as investors and gamers alike were captivated by the promise of play-to-earn (P2E) models and tokenized economies.

Yet, as the numbers from a recent ChainPlay and Storible study reveal, GameFi has struggled to deliver on its early promises. Behind the initial hype lies a sobering narrative of failure, volatility, and unrealized potential. On our last GameFi Edition of the year, we are reflecting on the lost opportunities and the next steps for the industry.

The Reality: Why GameFi Projects Struggle to Survive?

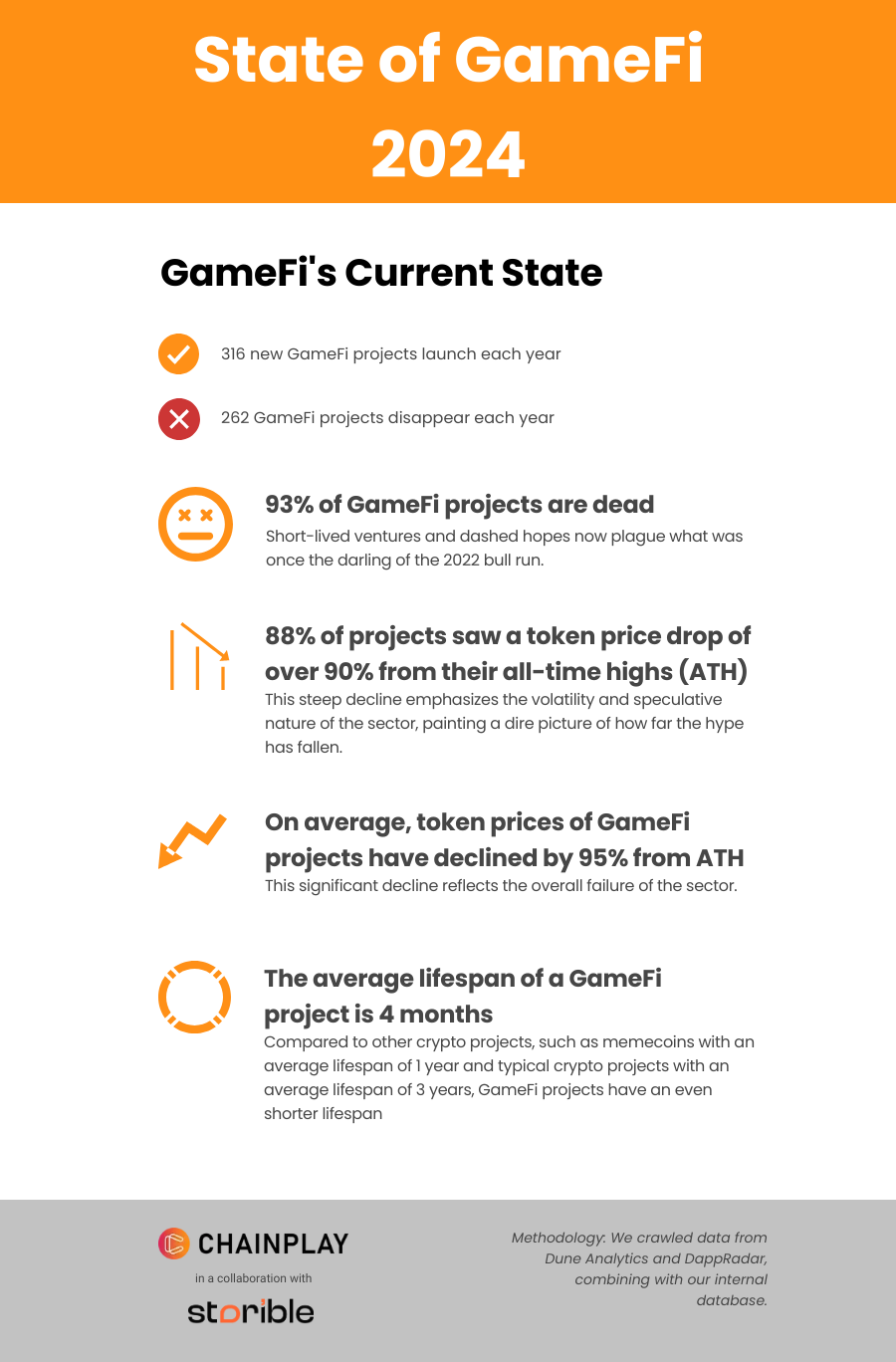

Of the 3,279 GameFi projects analyzed, an astonishing 93% have been declared dead. Whether measured by plummeting token prices or declining daily active users, the statistics paint a bleak picture: on average, GameFi tokens have lost 95% of their value from their all-time highs, and most projects survive just four months before fading into obscurity. It is clear these numbers don’t align with the original ambitious vision.

Why such a high rate of attrition? At its core, the GameFi industry faces a fundamental divide between expectation and execution.

Many projects entered the market during the speculative excitement of 2022, prioritizing flashy tokenomics over genuine gameplay. The result? A marketplace littered with projects that failed to captivate players or offer long-term value.

Gamers, drawn by the prospect of earning real-world returns, often found themselves disillusioned by repetitive, uninspired gameplay. Meanwhile, investors were left holding tokens whose value evaporated almost overnight.

Winners and Losers in GameFi Profitability

While retail investors and venture capitalists alike have faced significant losses, their experiences differ dramatically. Retail investors, particularly those participating in initial decentralized offerings, managed average profits of just 15%. However, the high concentration of locked tokens and the rapid devaluation of assets often turned these modest gains into illiquid losses.

VCs, on the other hand, have seen more polarized outcomes. While 42% of VCs recorded profits—some achieving astronomical returns—a majority (58%) suffered losses ranging from modest dips to near-total wipeouts. Notable winners like Alameda Research and Binance Labs demonstrated the potential for strategic gains, while others, like Golden Shovel Capital, are the perfect example of the risks of betting on unsustainable projects.

This disparity show us a critical issue: success in GameFi usually depends on timing, insider knowledge, and a deep understanding of both gaming and blockchain ecosystems. For the average investor or gamer, these advantages are largely out of reach, leaving them vulnerable to the sector’s inherent volatility.

Where Do We Go From Here?

Despite its challenges, GameFi is not without hope. The industry’s failures provide valuable lessons for its future evolution. The first and most pressing need is a shift in focus, away from speculative tokenomics and toward delivering genuinely engaging gaming experiences. We now realize the novelty of earning crypto through gameplay can only sustain interest for so long; without engaging, valuable ecosystems, projects are destined to fade.

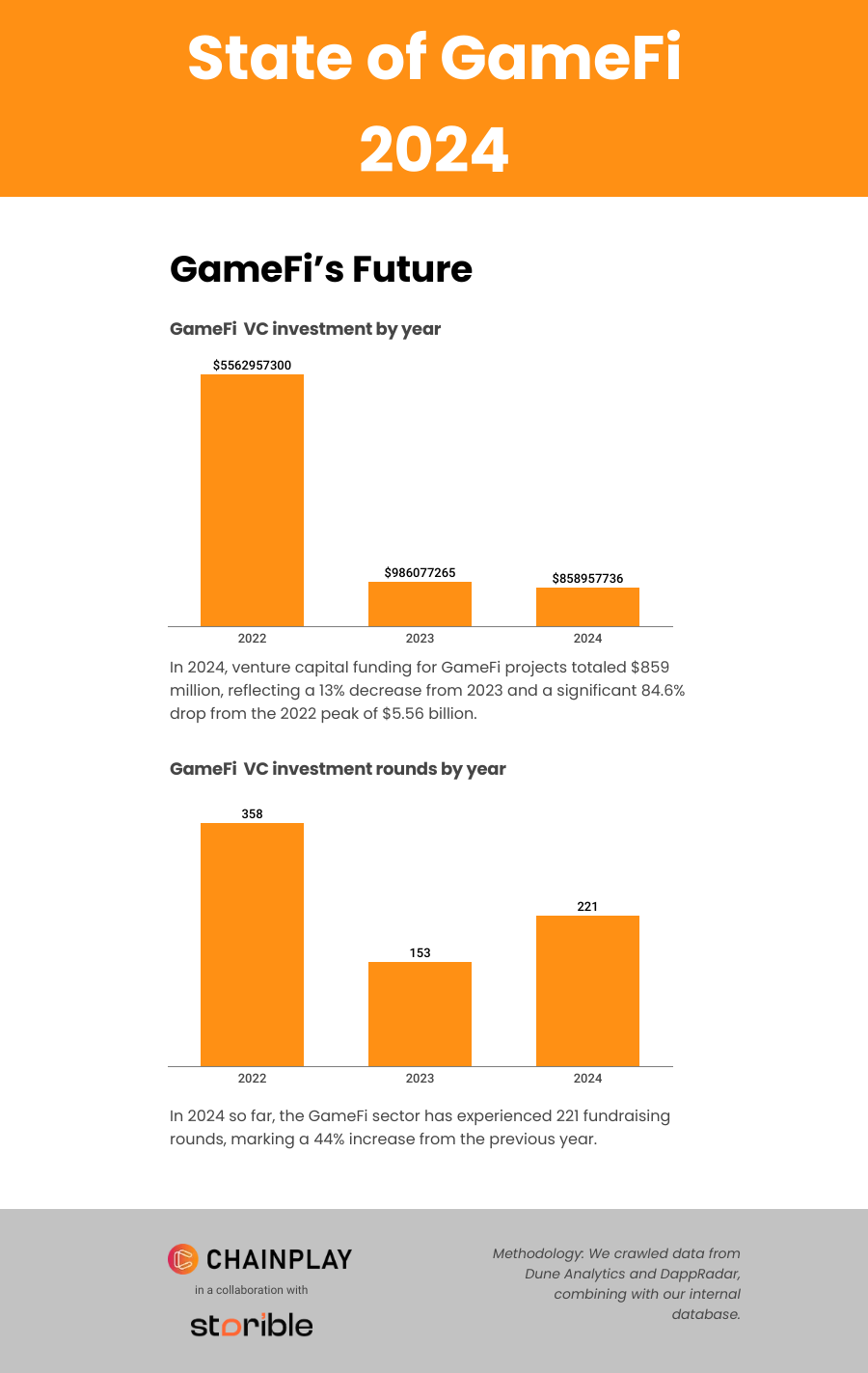

The fundraising scene offers a glimpse of cautious optimism. While total venture capital investment in GameFi has plummeted—from $5.56 billion in 2022 to $859 million in 2024—the number of fundraising rounds has increased year-over-year, suggesting a more selective, quality-focused approach. Meaning, investors are no longer chasing the next big trend but are instead seeking projects with sustainable models and clear roadmaps.

For GameFi to succeed, developers must embrace a longer-term vision. This includes creating games that prioritize fun and immersion; using blockchain technology to complement rather than define the gaming experience; and nurturing communities that extend beyond short-term speculation. Projects that succeed in these areas have the potential to rebuild trust and attract both players and investors.

A Crossroads for GameFi

The story of GameFi is far from over. While the sector’s rapid rise and fall serve as a cautionary tale, they also represent the resilience and adaptability of the blockchain gaming community. If the lessons of the past two years are honored, GameFi could emerge from this turbulent period stronger and more mature, ready to deliver on its original promise of revolutionizing the gaming world.

The question now is not whether GameFi can succeed, but how. Will it continue to chase fleeting trends, or will it evolve into a sustainable, player-centric industry? As we enter 2025, the answer may well determine the future of gaming itself.

great community