Fed Decision, Tether’s Record Profit, and Trump’s Bitcoin Sneakers - August 1, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

FDUSD: Struggles but holds a significant presence on Binance.

Bitcoin: Slight gains as the Fed holds rates steady.

Tether: Reports a record $5.2 billion profit in the year's first half.

Nansen CEO: Memecoin hits $6 million market cap in a day.

Donald Trump: Sells Bitcoin-themed sneakers post-keynote speech.

Fidelity International: Launches Bitcoin ETP on the London Stock Exchange.

Network Platform: Coinbase and Google veterans raise $5 million for a blockchain "LinkedIn."

Bitcoin Mining: Hashrate nears all-time high levels.

Grayscale Bitcoin Mini Trust: Starts trading after SEC approval.

Worldcoin: Launches World ID in Austria with eyeball-scanning orbs.

U.S. spot Ethereum ETFs: $33.6 million in net inflows, ending the negative streak.

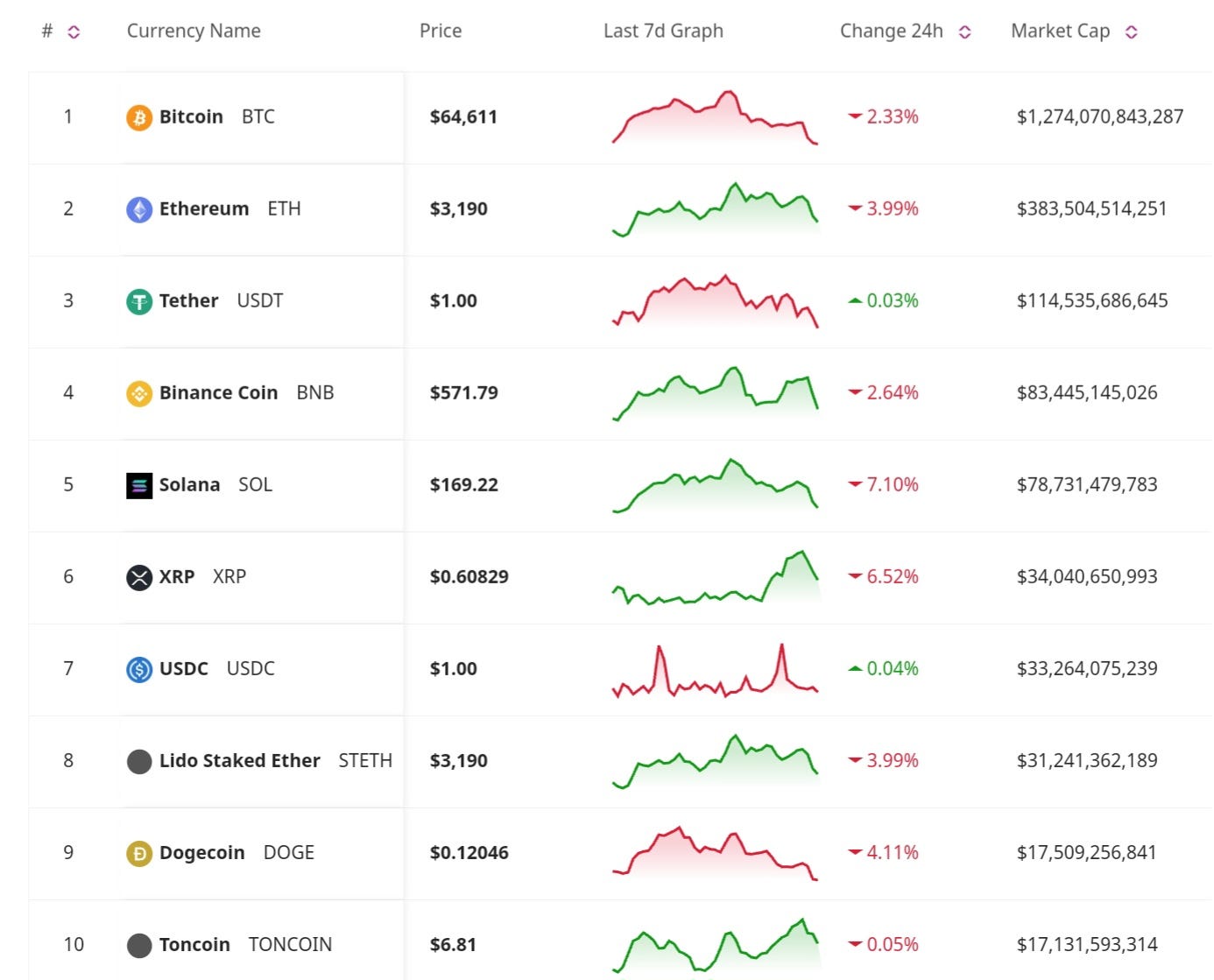

Price Update

Bitcoin Posts Gains After Fed Holds Rates Steady

Bitcoin saw a slight gain after the Federal Reserve decided to hold interest rates steady, citing further progress toward its 2% inflation target. This decision boosted Bitcoin, keeping its head above $64.000, as steady rates tend to support higher-risk assets like cryptocurrencies. The market reacted positively to the Fed's cautious approach, with investors anticipating a stable economic environment.

Market Trends

Bitcoin Mining Hashrate Nears All-Time High

CryptoQuant has linked the nearing all-time high levels of Bitcoin mining hashrate to potential price stability. The increased hashrate indicates robust network security and miner confidence. A higher hashrate is often associated with stronger price support, as it reflects the health of the Bitcoin network.

Tether Reports Record $5.2 Billion Profit

Tether has generated a record profit of $5.2 billion in the year's first half, underscoring its dominance in the stablecoin market. This impressive performance displays the growing demand for stablecoins as a reliable medium of exchange in the crypto ecosystem. The company’s financial health reinforces its position as a key player in the crypto market.

U.S. Spot Ethereum ETFs See Net Inflows

U.S. spot Ethereum ETFs have recorded $33.6 million in net inflows, ending a streak of negative flows. The positive net inflows are due to the growing appeal of Ethereum ETFs as a convenient investment vehicle. Investors are looking for opportunities to gain exposure to Ethereum during its ongoing developments and upgrades.

Grayscale Bitcoin Mini Trust Begins Trading

The Grayscale Bitcoin Mini Trust has begun trading following SEC approval. This new product offers investors a more accessible entry point to Bitcoin investment with a lower share price. Grayscale’s continued innovation in crypto financial products highlights its commitment to expanding market access.

Global Developments

Fidelity International Launches Bitcoin ETP

Fidelity International has launched a Bitcoin Exchange-Traded Product (ETP) on the London Stock Exchange. This move marks a significant step in bringing Bitcoin to traditional financial markets in Europe. The ETP provides institutional and retail investors with a regulated and convenient way to gain exposure to Bitcoin.

Worldcoin Launches World ID in Austria

Worldcoin has launched its World ID project in Austria, featuring eyeball-scanning orbs for identity verification. The World ID project is an advancement in biometric authentication and blockchain technology. By ensuring that identities are unique and secure, Worldcoin aims to prevent fraud and enhance privacy.

Don’t Miss Anything

FDUSD Maintains Presence on Binance Despite Struggles

FDUSD went from a remarkable $4.2 billion in supply to $1.9 billion, which seems coincidental with Binance removing the zero-fee trading offers for the coin. The stablecoin has struggled to gain significant traction but remains an important part of the exchange’s offerings, accounting for 35% of spot trading in June. Despite its current struggles, FDUSD's role in the market underscores the ongoing demand for stablecoins.

Nansen CEO Launches Memecoin

The CEO of Nansen has launched a new memecoin called IQ that quickly reached a $6 million market cap within a day. The success of this memecoin is explained by the influence of prominent figures in the crypto community. Investors are drawn to the potential for quick gains, especially if it is backed up and promoted by influential profiles in the crypto space.

Blockchain “LinkedIn” Raises $5 Million

Veterans from Coinbase and Google have raised $5 million to develop a blockchain-based professional networking platform, often dubbed the “LinkedIn of Blockchain.” This platform wants to connect professionals in the crypto and blockchain industries, promoting collaboration and innovation. The funding round reflects strong investor interest in building specialized networking tools for the growing crypto community. The platform is expected to facilitate new business opportunities and partnerships within the industry.

Trump Sells Bitcoin-Themed Sneakers

Following his keynote speech at the Bitcoin 2024 conference, Donald Trump has started selling Bitcoin-themed sneakers. This unusual move combines political branding with cryptocurrency marketing. The sneakers have attracted attention both within and outside the crypto community. The sale of these sneakers demonstrates the diverse ways crypto culture influences mainstream trends.

The cryptocurrency market continues to be dynamic and multifaceted, with significant developments in regulatory actions, new projects, and market movements. Bitcoin's slight gain post-Fed decision and the nearing all-time high in mining hashrate reflect its resilience. Innovative projects like Worldcoin’s biometric ID and blockchain networking platforms highlight ongoing technological advancements. As the market evolves, being informed and adaptable remains key for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc