Fed Cuts Rates, Trump’s Crypto Project Faces Criticism, and Revolut Enters Stablecoin Market - September 19, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

BTC: Fed cuts rates by 50 bps and Bitcoin briefly hits $61K.

Trump: Crypto project faces scrutiny from the crypto community.

Revolut: UK fintech company announces plans to issue a stablecoin.

BlackRock: Bitcoin paper highlights the cryptocurrency’s value as a hedge against global risks.

Google Cloud: Releases a blockchain RPC service compatible with Ethereum.

US Spot Bitcoin ETFs: Discussion heats up after the latest FOMC meeting.

Monerium: Launches euro-backed stablecoin via the Noble blockchain.

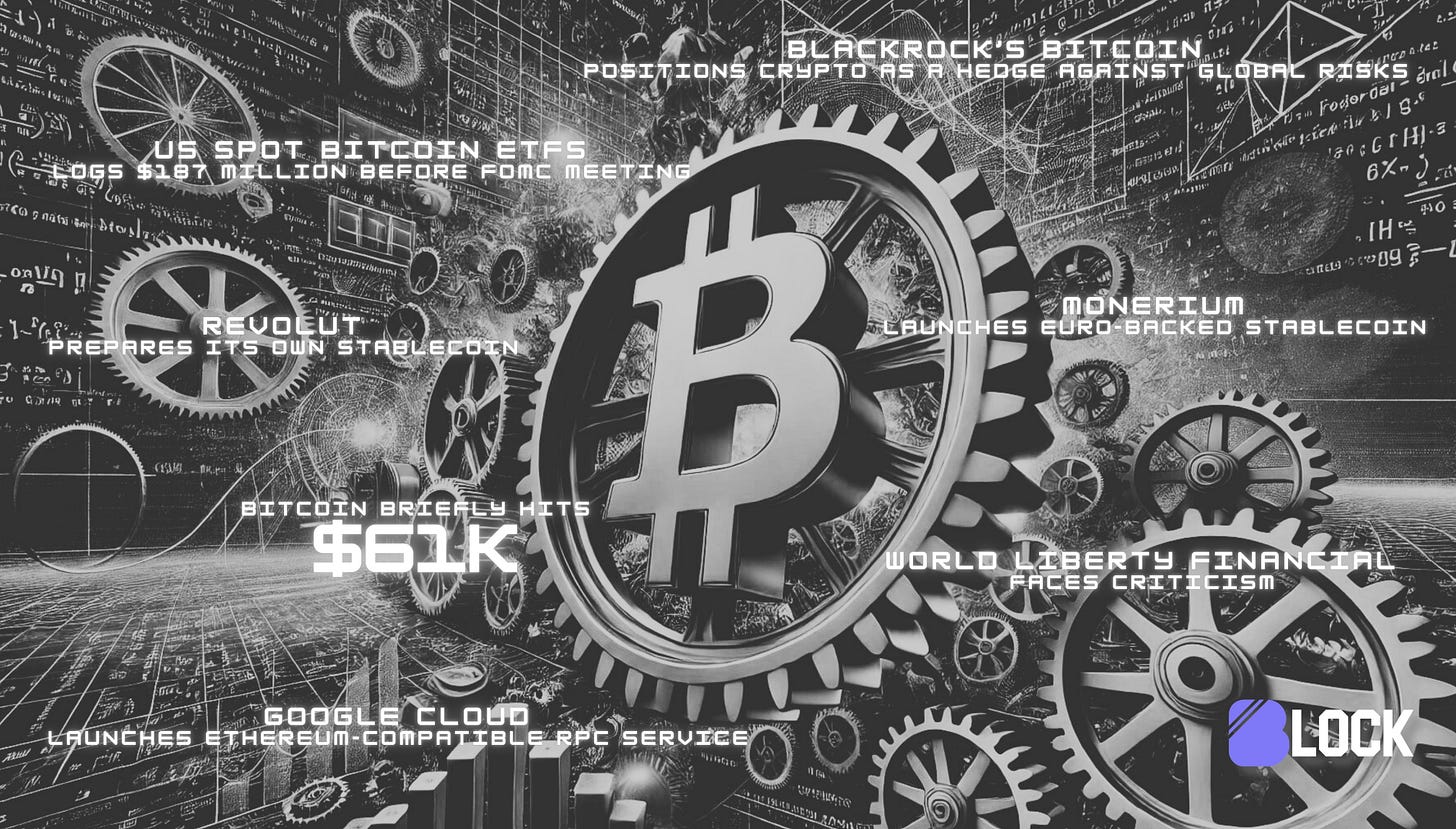

Price Update

Fed Cuts Interest Rates by 50 Basis Points, Bitcoin Briefly Hits $61K

The Federal Reserve’s decision to cut interest rates by 50 basis points for the first time in four years led to a brief Bitcoin rally, pushing the price to $61,000. Markets were anticipating looser monetary policy, and this significant cut was seen as an attempt to counter-cooling inflation and rising unemployment. Crypto market analysts expect more volatility, with Bitcoin positioned for price swings of 2%-3%.

Market Trends and Future Expectations

US Spot Bitcoin ETFs Logs $187 Million Before FOMC Meeting

The U.S. spot Bitcoin ETFs saw a significant surge, logging $187 million in net inflows yesterday. This comes just ahead of the Federal Open Market Committee (FOMC) meeting, which is expected to impact broader market conditions, especially regarding interest rates.

BlackRock’s Bitcoin Paper Positions Crypto as a Hedge Against Global Risks

BlackRock has published a report on Bitcoin, emphasizing its potential as a shield against economic and geopolitical uncertainties. The paper highlights how the cryptocurrency could protect portfolios during periods of high inflation and market instability, reinforcing BlackRock's growing involvement in the crypto market.

New Launches and Developments

Google Cloud Launches Ethereum-Compatible RPC Service

Google Cloud has introduced an Ethereum-compatible Remote Procedure Call (RPC) service, making it easier for developers to build and scale dApps on the Ethereum blockchain. This service wants to simplify infrastructure management and improve performance for Ethereum projects by using Google’s cloud computing power.

Monerium Launches Euro-Backed Stablecoin on Cosmos via Noble

Monerium, a blockchain-focused fintech company, has introduced a euro-backed stablecoin on the Cosmos blockchain, launched through Noble. The stablecoin is expected to facilitate cross-border payments and increase accessibility for users seeking euro-denominated digital assets

Revolut Prepares to Launch Its Own Stablecoin

UK fintech firm Revolut is planning to release its own stablecoin, further expanding its presence in the crypto space. While details remain limited, the move could position Revolut as a serious player in the stablecoin market, competing with giants like Tether and Circle.

Don’t Miss Anything

ETHena Labs Temporarily Shutters Frontend Due to Security Breach

DeFi platform ETHena Labs was forced to take down its frontend site temporarily after a domain registrar account was compromised. The team is working on resolving the security breach to ensure user data and funds are protected.

Donald Trump-Backed World Liberty Financial Faces Criticism

Trump’s World Liberty Financial (WLF) has been met with skepticism from both crypto advocates and critics. The project, which is launching a governance token (WLFI), claims to offer innovative DeFi solutions. However, concerns about transparency and leadership, given Trump’s prior stance on crypto, have dampened enthusiasm for the initiative.

The crypto landscape is as dynamic as ever, with Bitcoin experiencing a rally following the Fed's major rate cut. Meanwhile, institutional giants like BlackRock continue to advocate for Bitcoin's role as a hedge, and fintech companies like Revolut are eyeing stablecoins. With the market still reacting to the Fed's decision, all eyes will be on Bitcoin's next move. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc