Ethereum’s “Purge” Plan, and JPMorgan Expands Tokenized Treasuries - October 28, 2024

Also, Tether faces scrutiny, and BTC drops below $68K.

TL;DR: Crypto Insights in Seconds

Ethereum: Vitalik Buterin outlines a roadmap for reducing network bloat.

Tether: U.S. authorities examine Tether’s business practices.

JPMorgan: Is pioneering tokenized U.S. Treasuries and stablecoin products.

Crypto Regulations: South Korea and Netherlands increase regulation policies.

Microsoft: Urges shareholders to reject Bitcoin investment proposal.

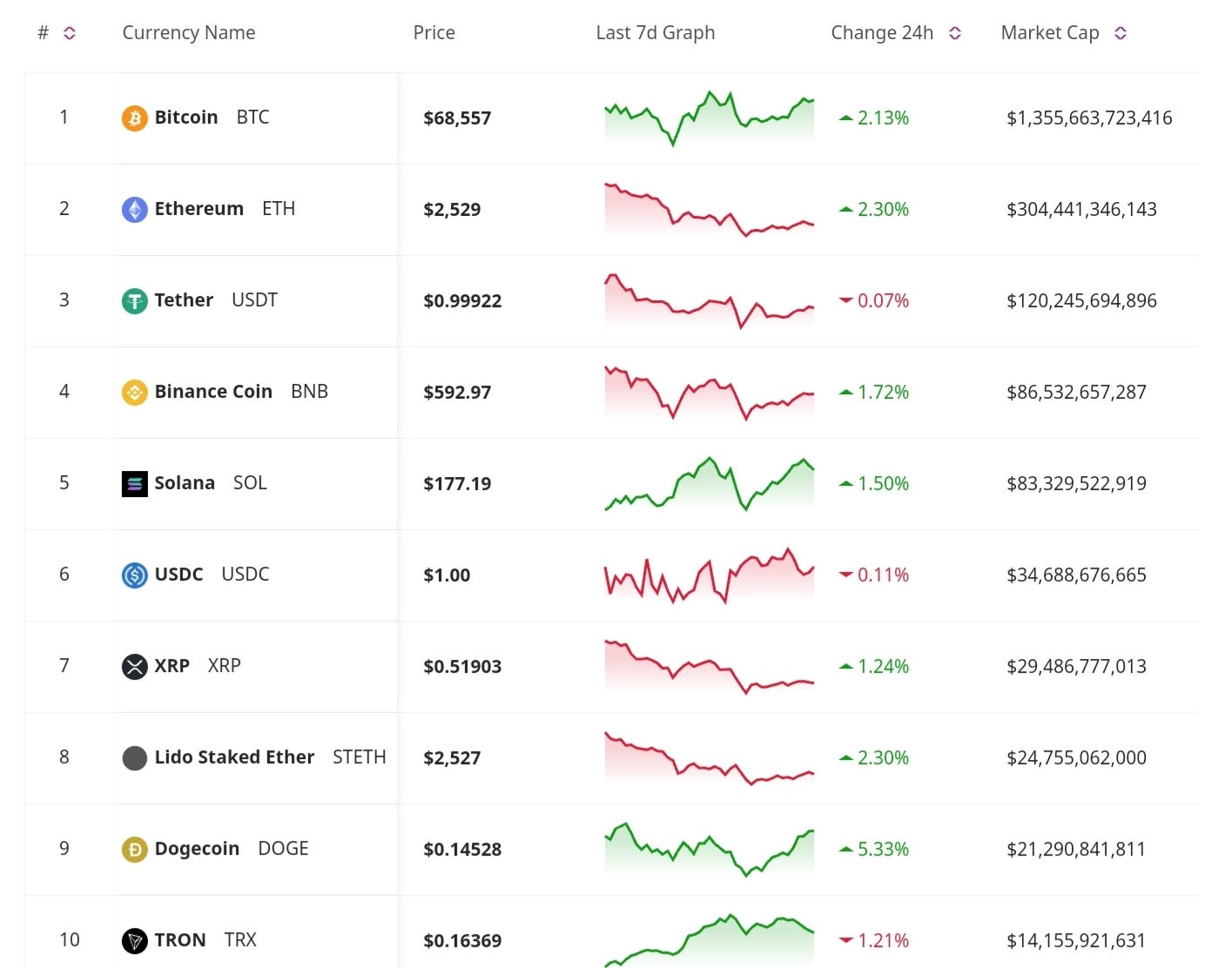

Price Update

Bitcoin Drops Below $68K, Still Leading Broader Market

Bitcoin dipped below the $68,000 mark during the weekend, breaking its recent upward momentum but still outperforming other major assets. Despite the pullback, it remains resilient, with analysts pointing out that strong investor demand and favorable market conditions continue to support its performance. The broader market faced declines as well, with Ether also down after its recent rally.

Regulatory Updates

Tether Under Investigation by U.S. Authorities, Faces Potential Sanctions

U.S. prosecutors and the Treasury Department are scrutinizing Tether’s business practices as concerns over its reserve transparency grow. This investigation could lead to sanctions, adding further regulatory pressure on the stablecoin giant. Tether, which operates the world’s largest stablecoin, has faced frequent calls for clearer reporting on its reserves, and this latest inquiry intensifies that demand.

Global Focus on Crypto Reporting: South Korea and Netherlands

South Korea has implemented a new reporting mandate for cross-border crypto transactions, joining a global trend towards increased oversight in digital asset markets. Similarly, the Netherlands is drafting legislation requiring crypto firms to report user data to the Dutch tax authority. These regulatory efforts reflect a push for greater transparency and compliance in the crypto space.

Business News

JPMorgan Expands Tokenized U.S. Treasuries and Stablecoins

JPMorgan is advancing its tokenized asset offerings, introducing tokenized U.S. Treasuries and stablecoins in a bid to appeal to institutional investors. This initiative aligns with the bank’s wider interest in blockchain technology as a tool to modernize financial markets. Tokenized assets like these offer faster settlement times and improve liquidity, highlighting JPMorgan’s commitment to integrating traditional finance with blockchain.

Microsoft Urges Shareholders to Reject Bitcoin Investment Proposal

Microsoft is advising its shareholders to vote against a proposal to assess Bitcoin as a diversification investment for the company. Microsoft’s stance shows caution among tech giants regarding Bitcoin as a corporate investment, contrasting with companies like Tesla and MicroStrategy, which have integrated Bitcoin into their treasury strategies.

Vitalik Buterin’s “Purge” Upgrade to Reduce Ethereum Bloat

Ethereum co-founder Vitalik Buterin has proposed a “Purge” upgrade aimed at minimizing network bloat and improving efficiency. The roadmap includes strategies to streamline Ethereum’s data storage needs, focusing on pruning unnecessary historical data to make the network more scalable. This upgrade is part of a larger effort to improve Ethereum’s performance as it scales to support more applications.

As Tether faces scrutiny from U.S. authorities, the demand for transparent practices in stablecoins is clearer than ever. Meanwhile, financial giants like JPMorgan are betting on tokenized assets as a bridge between traditional finance and blockchain, while global regulators push for more stringent reporting standards. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Great

Incredible 🚀💜