Ethereum Gas Fees Drop, Bitcoin Mining Struggles, and BlackRock's ETFs Surpass Grayscale - August 19, 2024

A quick and digestible recap of the weekend’s crypto news.

TL;DR: Market Insight in Seconds

ETH: A record drop in Ethereum gas fees signals a historically bullish outlook for ETH.

BTC Mining: Profitability hits all-time lows in August, according to a JPMorgan analyst.

BlackRock: Crypto ETFs surpass Grayscale’s in assets.

Spot Bitcoin ETFs: See continued inflows, indicating positive institutional sentiment.

WLD: Malaysians can now digitally prove their humanity using Worldcoin’s Orbs.

Nasdaq ISE LLC: Withdraws proposals to list and trade options on spot Ethereum and Bitcoin products.

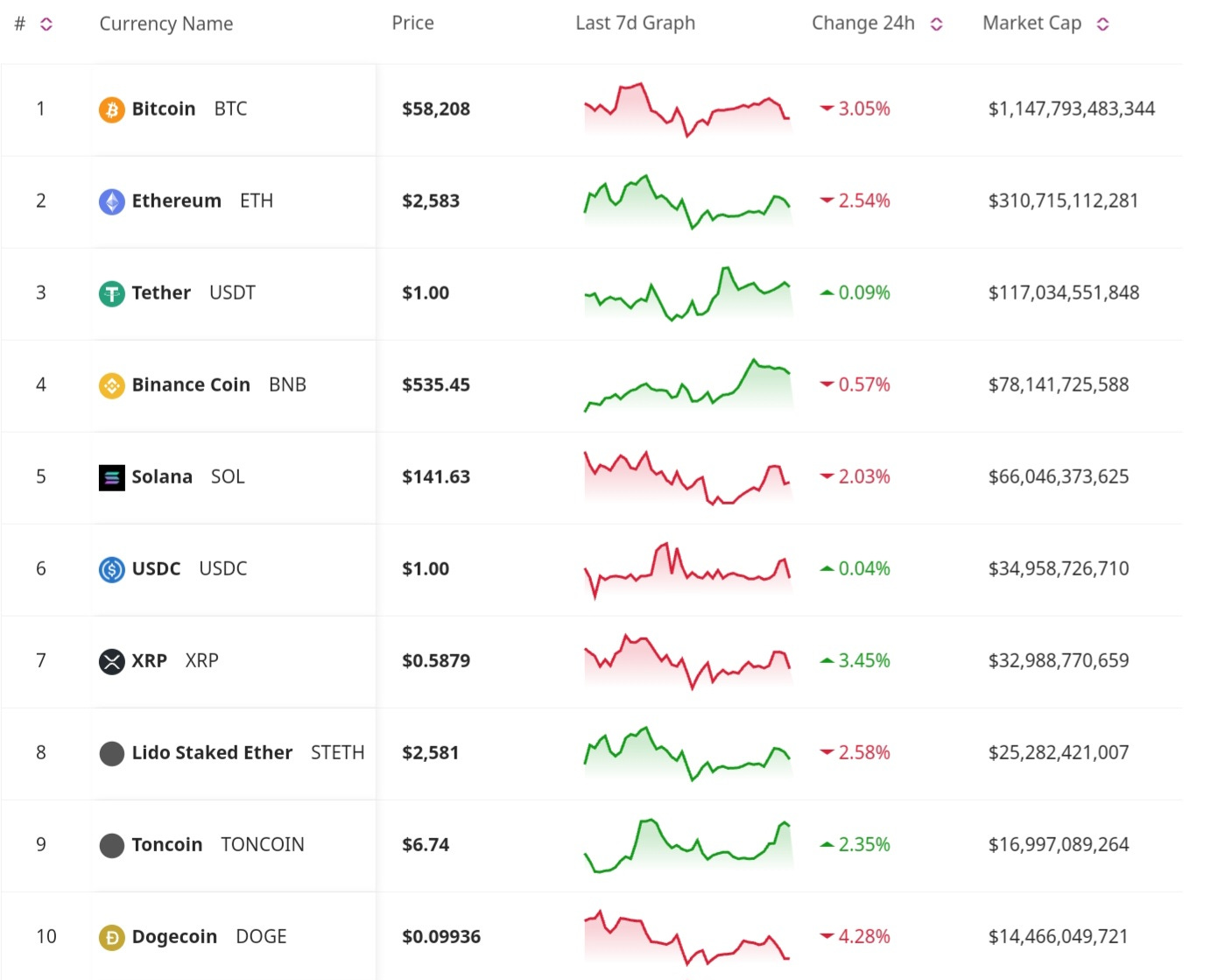

Price Update

BTC and ETH in Standby with Possible Bullish Push

Bitcoin and Ethereum remain the focal points of the market, both experiencing price fluctuations influenced by broader market conditions and recent economic data. After the CPI inflation data, the market froze. BTC holds steady at around $58K, with some signals showing a bullish push. ETH has risen back to the $2,5K mark and seems to be staying around it.

Market Trends

Spot Bitcoin ETFs See Continued Inflows

Spot Bitcoin ETFs are experiencing continued inflows, signaling positive sentiment among institutional investors. The steady inflows into these ETFs suggest that institutions are increasingly viewing Bitcoin as a viable investment option right now, particularly as a hedge against economic uncertainty. The growing acceptance of Bitcoin ETFs also reflects ongoing trends of integrating cryptocurrencies into traditional financial markets.

Record Drop in Ethereum Gas Fees Marks Bullish Signal

Ethereum has seen a record drop in gas fees, which analysts are interpreting as a historically bullish signal for ETH. The decrease in gas fees suggests lower congestion on the Ethereum network, making transactions cheaper and more efficient. This development is seen as a positive indicator for Ethereum’s long-term adoption, as lower fees could attract more users and developers to the platform.

Bitcoin Mining Profitability Falls to All-Time Lows

Bitcoin mining profitability reached an all-time low in August, according to a JPMorgan analyst. The decline in profitability is attributed to a combination of factors, including rising energy costs, increased mining difficulty, and stagnant Bitcoin prices. This challenging environment is putting pressure on miners, particularly those with higher operational costs. The drop in profitability could lead to a shakeout in the mining industry, with smaller or less efficient miners potentially exiting the market.

Business and Financial News

BlackRock’s ETFs Surpass Grayscale’s in Assets

BlackRock’s crypto ETFs have surpassed Grayscale’s in total assets, marking the rise of a new leader in the crypto fund space. The shift in dominance from Grayscale to BlackRock highlights the competitive nature of the crypto fund market, where innovation, strategic positioning, and investor trust play crucial roles. BlackRock’s ascent in the crypto space is a significant development, signaling increased mainstream adoption and interest in digital assets among traditional financial institutions.

Nasdaq ISE LLC Withdraws Proposals for Ethereum and Bitcoin Options

Nasdaq ISE LLC has withdrawn its proposals to list and trade options on spot Ethereum and Bitcoin products. This withdrawal comes during a challenging regulatory environment and ongoing scrutiny of crypto-related financial products. The decision to pull back these proposals indicates the difficulties exchanges face in navigating the complex landscape of crypto regulation.

Worldcoin Expands to Malaysia with Digital Identity Verification

Worldcoin has announced that Malaysians can now use its Orbs to digitally prove their humanity, expanding the project’s reach. This development is part of Worldcoin’s broader mission to create a global digital identity system that is both secure and inclusive. The introduction of Orbs in Malaysia allows users to participate in the Worldcoin ecosystem, which includes earning and using Worldcoin tokens.

The cryptocurrency market continues to evolve. Ethereum’s record drop in gas fees presents a new opportunity for the ecosystem. Challenges such as declining Bitcoin mining profitability and regulatory hurdles for new financial products underscore the complexity of the crypto landscape. As institutional interest in Bitcoin ETFs remains strong and projects like Worldcoin expand globally, the market is poised for further growth and innovation. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc