Ethereum ETFs Surge, Telegram Under Fire, and VP Harris Embraces Digital Assets - September 24, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Ethereum ETFs: $1.3 billion in trading volume but minimal impact on ETH’s price.

Telegram: Agrees to provide more information to governments.

VP Harris: Promises to foster crypto innovation while protecting consumers.

Global Crypto: Investment products inflows reach $321 million.

ETH: Outperformance Bitcoin after Fed cut rate.

Australia: New laws for crypto firms.

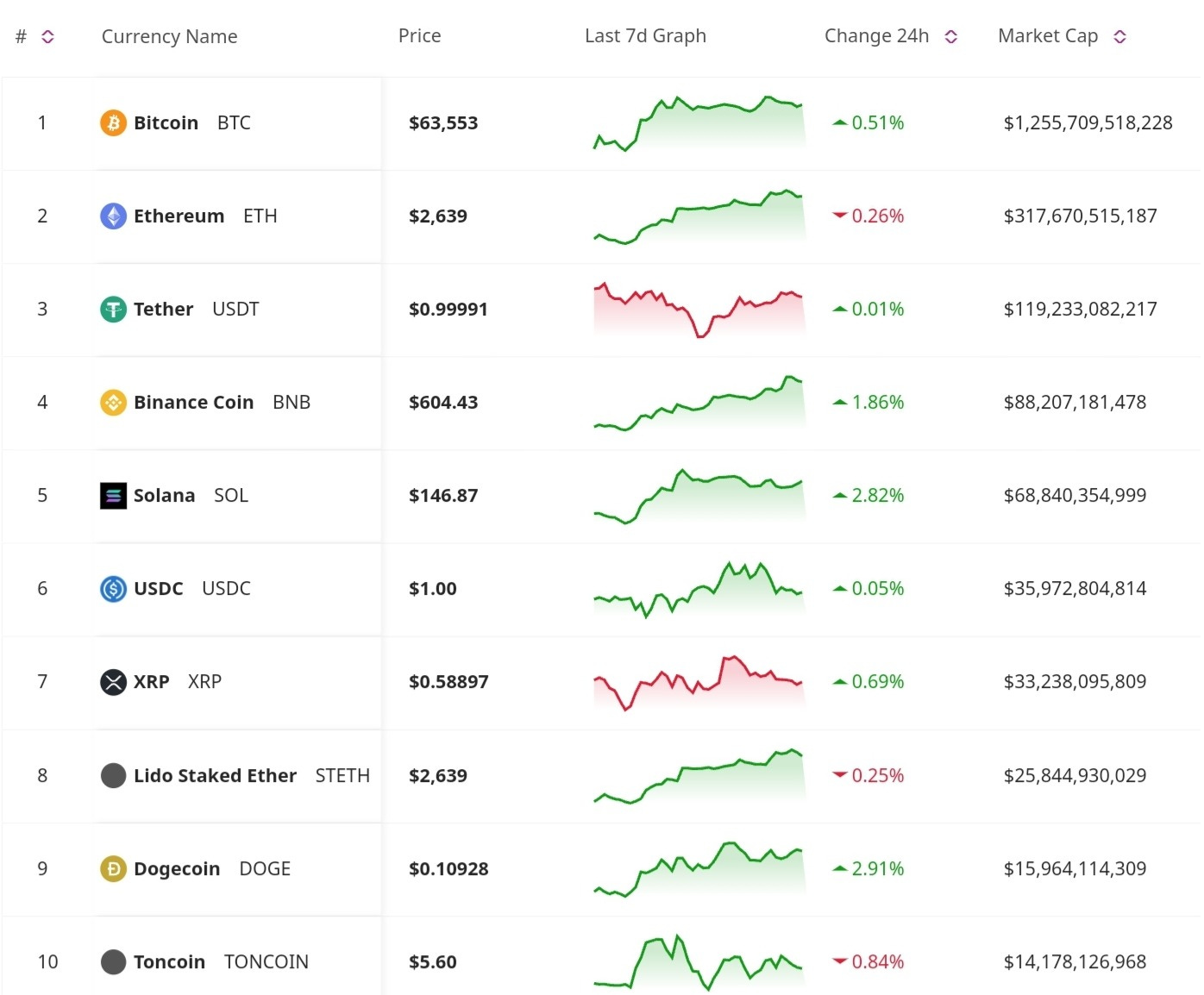

Price Update

BTC Reaches $64K and the Market Responds Positively

Bitcoin’s price surged to a one-month high, reaching $64,000 before settling at $63K, fueled by the Federal Reserve’s recent 50 basis point interest rate cut. Lower rates are expected to benefit speculative assets like Bitcoin.

The crypto market remains cautious, with regulatory uncertainty and upcoming U.S. elections. Broader markets were mixed, with Ether rising 2.7%, while SOL, XRP, ADA, and MATIC saw smaller fluctuations. Anticipation grows for more economic cues from upcoming Fed speeches and data releases.

Market Trends and Future Expectations

Ethereum ETFs See $1.3 Billion in Volume

Ethereum ETFs have gained significant traction, amassing $1.3 billion in trading volume. Despite this, the price of ETH has remained relatively stable. Analysts suggest that while ETFs drive institutional interest in Ethereum, this hasn't yet translated into significant price movement.

Ethereum Outperforms Bitcoin Following Fed Rate Cut

Ethereum has outpaced Bitcoin in market performance since the Federal Reserve’s recent rate cut. Investors see the rate cut as a bullish sign for riskier assets like altcoins, with Ethereum in particular benefiting from increased market confidence.

Global Crypto Investment Products See $321 Million in Weekly Inflows

Institutional interest in crypto remains strong, with global investment products recording $321 million in net inflows over the past week. This marks a continued appetite for digital assets, even as markets adjust to macroeconomic shifts.

Crypto Stocks Show Correlation with Fed Rate Cut

Crypto stocks have shown a notable correlation with the Federal Reserve’s rate cut, with several stocks rising in response. As the market adjusts to new monetary policies, crypto-related stocks are increasingly viewed as tied to macroeconomic trends.

Win Crypto and Real World Assets in Seconds!

Discover a whole new way to bid and win digital assets with Token Deal. Auctions are built on transparency and fairness, giving you a real chance to win every time. Ready for the excitement? Join and get 50% Off.

Regulatory Updates

Australia Tightens Rules for Crypto Firms Under Corporations Law

Australia is stepping up its regulatory framework for crypto firms by including them under the nation's Corporations Law. This new legal approach seeks to better regulate the growing crypto sector while improving consumer protections.

VP Kamala Harris Pledges Crypto Innovation While Protecting Consumers

At a recent Wall Street fundraiser, Vice President Kamala Harris stated her support for promoting cryptocurrency businesses while ensuring consumer protection. Harris emphasized that digital assets, including cryptocurrencies, will play a role in her administration’s investment in America’s future, a sentiment she echoed in several speeches this week.

Don’t Miss Anything

Telegram to Provide More User Data to Governments After CEO's Arrest

Telegram has agreed to provide more user data to government authorities following the arrest of its CEO. This development has raised concerns about privacy within the crypto and tech communities, as Telegram has been a platform known for its commitment to user privacy and security.

Ethereum is taking the spotlight with strong ETF performance and market outperformance, while the broader crypto market enjoys healthy inflows. Meanwhile, Vice President Harris is positioning herself as a proponent of responsible crypto innovation, indicating that digital assets will remain a key topic in U.S. policy. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc