ETH Shows Strength, and WalletConnect Launches Its First Airdrop - November 28, 2024

Also, Trump wants to shift from SEC to CFTC, and Tether will phase out EURT.

TL;DR: Crypto Insights in Seconds

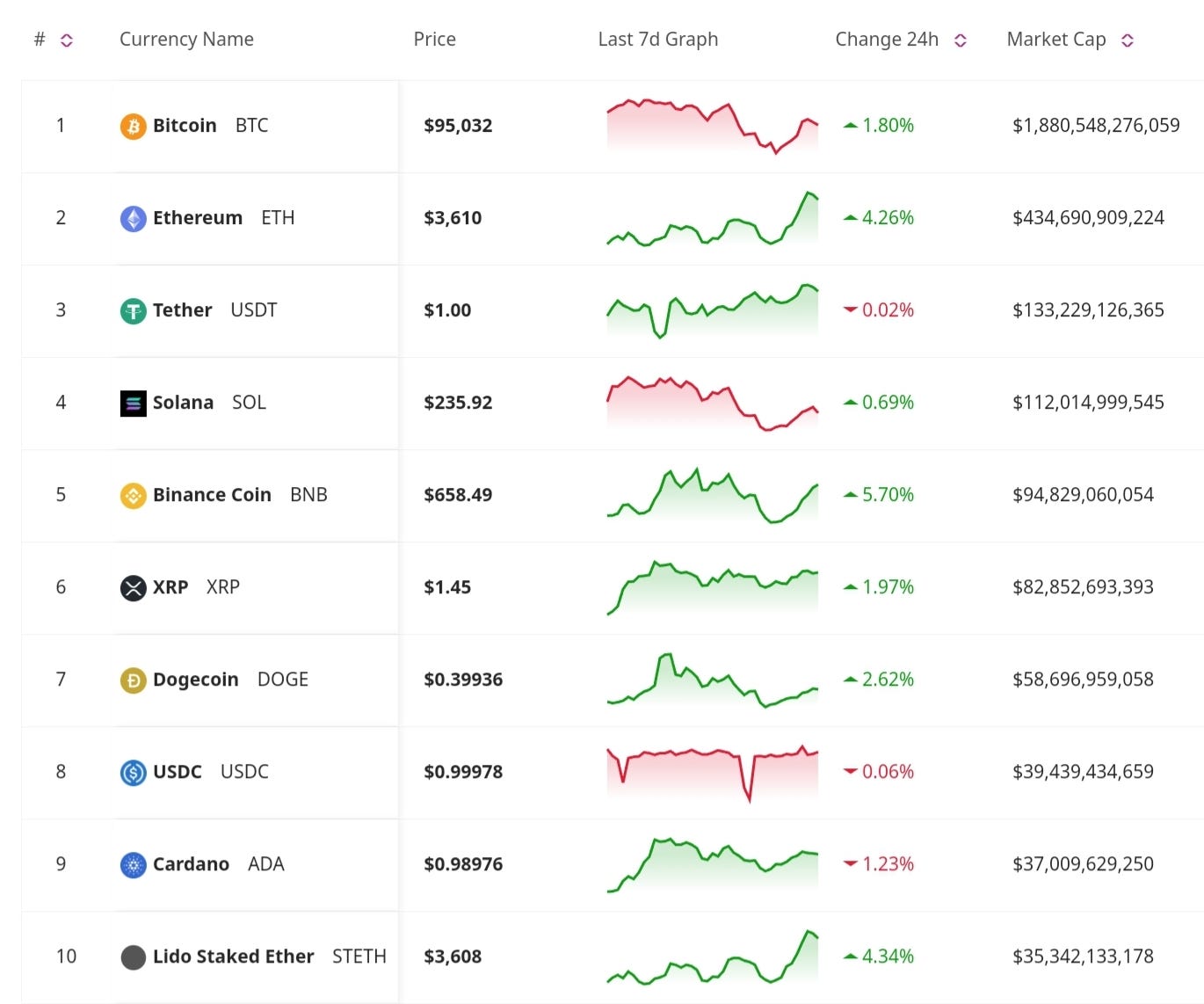

BTC: Jumps back to $94K.

ETH: Regains momentum and shows strength despite speculation.

Trump: Looking to transfer crypto oversight from SEC to CFTC.

Brazil: Proposes BTC reserve to hedge against inflation.

Tether: CEO wants to scale commodities liquidity pool to reach $5 billion by 2026.

EURT: Tether will phase out EURT by November 27, 2025.

WalletConnect: Launches its first airdrop of WCT.

Price Update

BTC Regains Momentum and Bull Market Outlook Stays Strong

Bitcoin has climbed back to nearly $94K, reaffirming its upward trajectory following a volatile Thanksgiving week. CryptoQuant revealed that long-term Bitcoin holders have sold over 728,000 BTC in the past 30 days. While this indicates profit-taking at current highs, Galaxy Research highlights that the bull market remains "far from over," supported by consistent institutional inflows and ETF momentum.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

Ethereum Metrics Defy Skepticism

Despite suspicion of Ethereum stagnation, surging on-chain metrics show ETH is still a force in DeFi and NFT activity. Notably, capital rotations from BTC into Ethereum, Cardano, and Solana suggest a renewed appetite for Layer-1 blockchain solutions.

Regulatory and Legal News

Trump’s Regulatory Realignment

The Trump administration is reportedly exploring ways to transfer crypto oversight from the SEC to the CFTC. This shift could potentially reshape the regulatory landscape, easing pressure on the crypto industry.

Brazil Proposes Bitcoin Reserve

A Brazilian lawmaker has proposed establishing a national Bitcoin reserve to hedge against global economic instability. This proposal not only shows Bitcoin’s recognition as a macroeconomic tool but also the growing adoption that’s happening at an institutional level in Latin American countries.

Don’t Miss Anything

Tether’s Liquidity and Transition

Tether CEO Paolo Ardoino shared ambitions for scaling the commodities liquidity pool to reach $5 billion by 2026. He also stated the initiative aligns with USDT's popularity in emerging markets, aiming to boost liquidity in the $10 trillion trade finance sector. The company also announced that it will phase out its Euro-backed stablecoin, EURT, by November 27, 2025, due to shifting regulatory landscapes in Europe and reduced demand. EURT issuance has already ceased, with the last request processed in 2022.

WalletConnect Airdrop Revolution

WalletConnect has kicked off its first WalletConnect Token (WCT) airdrop, distributing 50 million tokens to 160,000 eligible users, including builders and contributors. Participants must stake tokens, which remain non-transferable for now, to engage in governance. Staking durations range from one week to two years, with rewards starting Dec. 19.

The crypto space continues to evolve with dynamic market movements and policy proposals. Bitcoin’s resurgence, Ethereum’s resilience, and Tether’s strategic focus underline the ecosystem’s adaptability. Meanwhile, regulatory shifts and national Bitcoin reserve ideas reflect growing mainstream integration. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

to the moon