ETH Hits $4K, and BTC on the Path to $110K - December 09, 2024

Also, BTC ETFs reached 1.1 BTC, and Cardano’s X account was hacked.

TL;DR: Crypto Insights in Seconds

BTC: Analysts suggest the path to $110K could be challenging.

ETH: The token touches the $4K mark.

ETFs: U.S Spot ETH and BTC ETFs see record inflows.

Stablecoins: The FSOC warns about stablecoins and urges for clearer framework.

Pump.fun: Bans UK users after regulatory warning.

Coinbase: Reveals FDIC stopped crypto banking activities in 2022.

Cardano: X account was hacked to scam users.

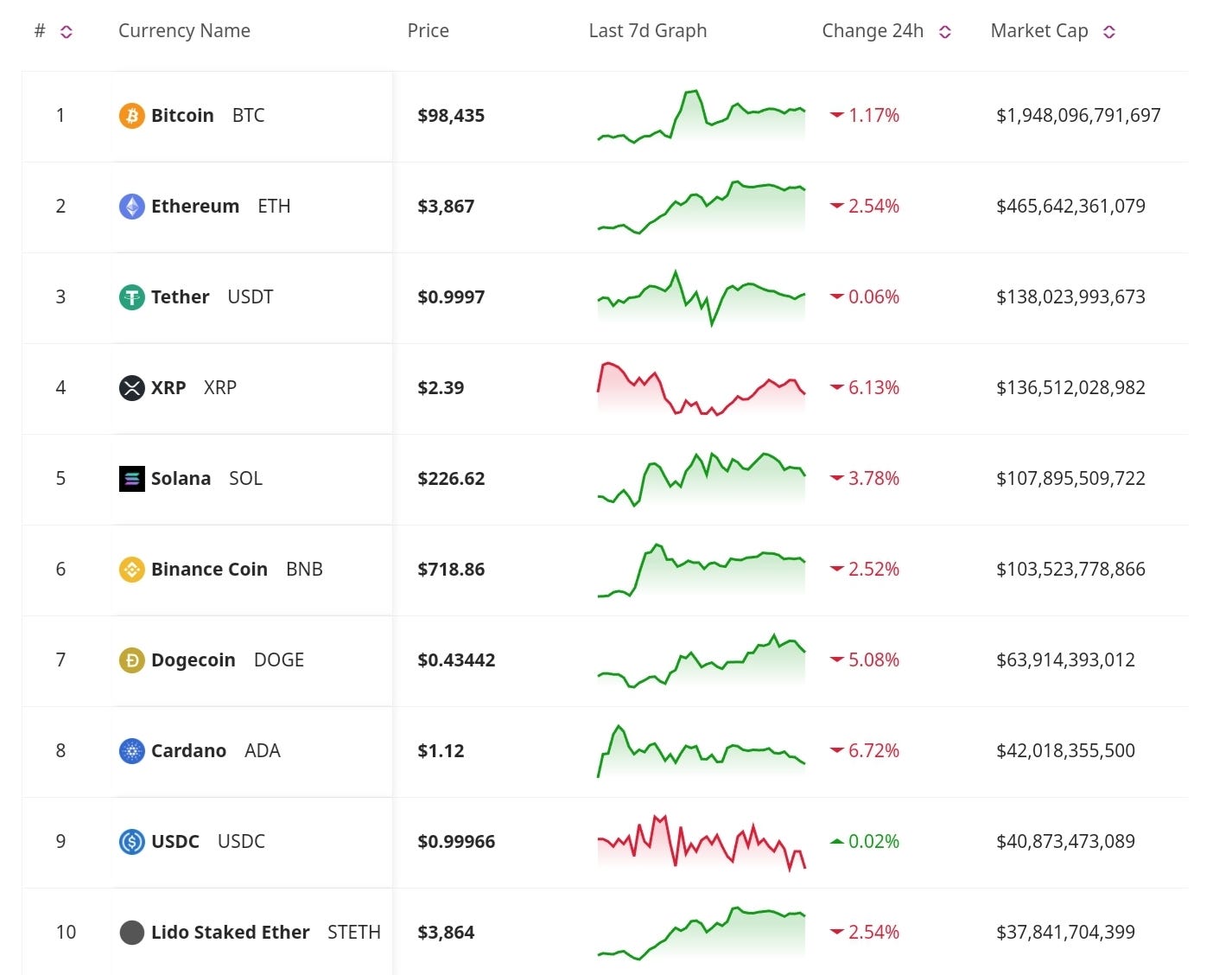

Price Update

Bitcoin and the Path to $110K

Bitcoin briefly dropped below $94K before rebounding and traders brace for resistance near $110K. Analysts note similarities with historical market consolidations, where Bitcoin often faced significant pullbacks before surging to new highs. The Bitcoin Choppiness Index, a technical indicator measuring market volatility, highlights the likelihood of prolonged consolidation near $110K.

Ether Hits the $4,000 Mark

Ethereum’s price broke through the $4,000 barrier, reflecting increased activity on the network and bullish sentiment among investors. Active addresses have surged, while the Coinbase premium suggests robust U.S. demand. Ethereum now mirrors the upward momentum that preceded Bitcoin’s rally earlier this year.

Crypto ETFs

Spot Ethereum ETFs See Record Inflows

U.S. Ether ETFs extended their two-week streak of inflows, showing growing institutional interest in Ethereum. With over $400 million flowing into these products recently, analysts suggest Ethereum’s price could see further upside.

U.S. Spot Bitcoin ETFs Surpass Satoshi Nakamoto's Estimated Bitcoin Holdings

Combined U.S. spot Bitcoin ETFs now hold 1.1 million BTC, surpassing the estimated holdings of Bitcoin's creator, Satoshi Nakamoto, which is estimated to be 1.1 million BTC. BlackRock’s IBIT leads with 521,164 BTC, followed by Grayscale’s GBTC and Fidelity's FBTC.

Regulatory and Legal News

Pump.fun Blocks UK Traders After Regulatory Warning

Pump.fun, a popular memecoin launchpad on Solana, has geoblocked UK users following a warning from the Financial Conduct Authority (FCA). The regulator flagged the platform for potentially offering unauthorized financial services. In response to the ban, traders created parody tokens mocking the situation, though none have gained traction so far.

Coinbase Reveals FDIC Stopped Crypto Banking Activities in 2022

Documents obtained by Coinbase through legal action show the FDIC instructed banks to pause crypto-related activities in 2022, citing unclear regulatory expectations. Coinbase's Paul Grewal argued this deliberate action blocked a legal industry from banking access. The redacted letters leave key details hidden, prompting Coinbase to push for transparency to uncover the reasoning behind the FDIC's stance.

FSOC Highlights Stablecoins’ Risks and Calls for Urgent Regulation

The U.S. Financial Services Oversight Council (FSOC) warns that stablecoins' weak risk management threatens financial stability. The council emphasized the market's concentration, with Tether holding over 66% of the $205 billion market, raising concerns about its dominance. It urged Congress to establish a comprehensive framework, warning of potential systemic impacts if left unregulated.

Don’t Miss Anything

Cardano Foundation's X Account Hacked to Spread Scams

The Cardano Foundation's X account was compromised on Sunday, leading to two major scams. Hackers first announced a fake token, $ADASOL, claiming it was a collaboration with Solana, which generated over $500,000 in trading before being debunked. Later, the account falsely claimed Cardano faced an SEC lawsuit. The Foundation confirmed the breach, urging users to ignore posts and promising updates on LinkedIn.

The crypto market remains a mix of bullish activity and regulatory hurdles. Ethereum’s momentum contrasts with Bitcoin’s struggles near $110K, while stablecoin scrutiny and global regulatory developments highlight the ecosystem’s challenges. With 2024 closing out, the crypto world awaits the next chapter. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Nice project

impressive