ETF Options Go Live and Ethena Sees $1 Billion in Inflows - November 20, 2024

Also, there is a potential name for SEC leadership, and Bitcoin keeps testing $93K.

TL;DR: Crypto Insights in Seconds

Bitcoin: BTC climbs to $93,500, boosted by ETF options trading debut.

SEC: Trump considers crypto-friendly Teresa Goody Guillen for SEC chair.

El Salvador: Offers tokenized US Treasuries.

BlackRock: BUIDL token takes off on Securitize platform.

Russia: A proposed 15% crypto tax could change the game for miners and traders.

Ethena: Sees $1 billion in inflows.

A16z: Supports Forta firewalls for smart contracts.

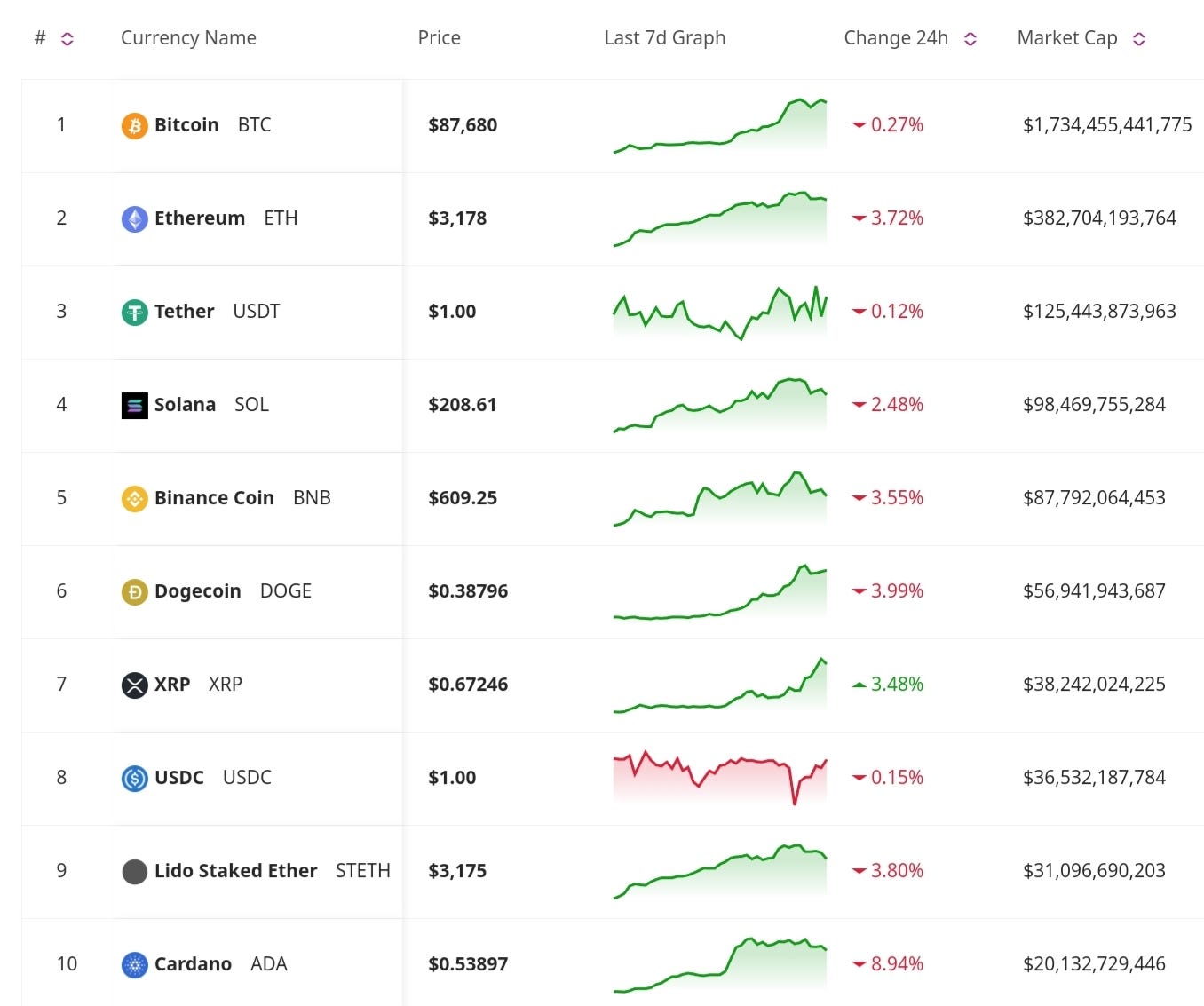

Price Update

Bitcoin Hits $93,500 with ETF Options Boost

Bitcoin reached a historic $93,500 as options trading tied to spot Bitcoin ETFs debuted with record-breaking volumes. BlackRock’s Bitcoin ETF alone saw unparalleled options activity on its first trading day, signaling robust market demand. Analysts highlight how this milestone strengthens Bitcoin’s status as a fundamental financial instrument.

Ethena Sees $1 Billion in Inflows with Crypto Rally

Ethena’s USDe token has regained popularity during the post-election crypto market surge, attracting $1 billion in capital and reaching a $3.44 billion market cap. The synthetic dollar token, backed by BTC and ETH with a hedging strategy, now offers a 29% annualized yield. Recent integrations, including Aave adding staked USDe as collateral, are expected to drive billions in demand.

Crypto ETFs

Spot Bitcoin ETF Options Go Live

The launch of options trading tied to spot Bitcoin ETFs marks a new phase of market sophistication. Investors now have access to hedging and speculative tools, deepening liquidity across the crypto space. Analysts see this as a game-changer, unlocking new avenues for institutional participation and amplifying Bitcoin’s role in financial markets.

International Crypto News

El Salvador Offers Tokenized US Treasuries

El Salvador is launching its first tokenized US treasuries offering, a move that underscores the nation’s blockchain ambitions. This initiative allows investors to access US Treasury yields through a tokenized framework, blending traditional finance with blockchain innovation.

Russia’s Proposed 15% Crypto Tax

Russia is exploring a 15% tax on income derived from crypto trading and mining. While the proposal seeks to regulate the sector, it could also impact miners and traders navigating an already complex global landscape.

U.S. Crypto News

Trump Weighs Crypto-Friendly Pick for SEC Chair

Speculation is building around who will become the next SEC chair under President-elect Trump, with names like former SEC Commissioners Dan Gallagher and Paul Atkins, as well as Robert Stebbins and Brad Bondi, reportedly in consideration. Crypto lawyer Teresa Goody Guillen has emerged as a frontrunner to chair the SEC. Her selection could mark a shift toward a more favorable regulatory environment for digital assets.

Don’t Miss Anything

A16z Backs Forta Firewall for Smart Contracts

Andreessen Horowitz (a16z) has supported the development of Forta Firewall, a tool designed to prevent smart contract exploits. This technology could set a new standard for securing DeFi ecosystems.

BlackRock’s BUIDL Token on Securitize

BlackRock’s BUIDL token, designed to generate synthetic dollars while earning yield from real-world assets, has gone live on Securitize’s platform. This innovation highlights the growing intersection of traditional finance and blockchain technology, creating new pathways for tokenized assets.

The crypto market is experiencing unprecedented growth, with Bitcoin achieving new highs and innovations such as tokenized treasuries and advanced ETF options reshaping investment opportunities. Regulatory changes, like Russia’s proposed tax and potential shifts at the SEC, further underline the sector’s global significance. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.