DeFi Dominance Dips, SEC Charges Pyramid Scheme, and Bitcoin Nears $59K - August 13, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: Nears $59K in a selloff ahead of a busy data week.

DeFi: Dominance hits a three-year low.

SEC: Charges Novatech with allegedly operating a $650 million crypto pyramid scheme.

Solana DEX: Trading volume falls as Ethereum and Base activity increase.

Gold Vs. BTC: Gold outperforms Bitcoin.

Thailand: Launches a crypto regulatory sandbox for experimental projects.

Ethereum: Burn rate drops to its lowest levels as gas fees remain low.

Germany: German state-owned bank prepares for tokenized bond issuance in ECB trial.

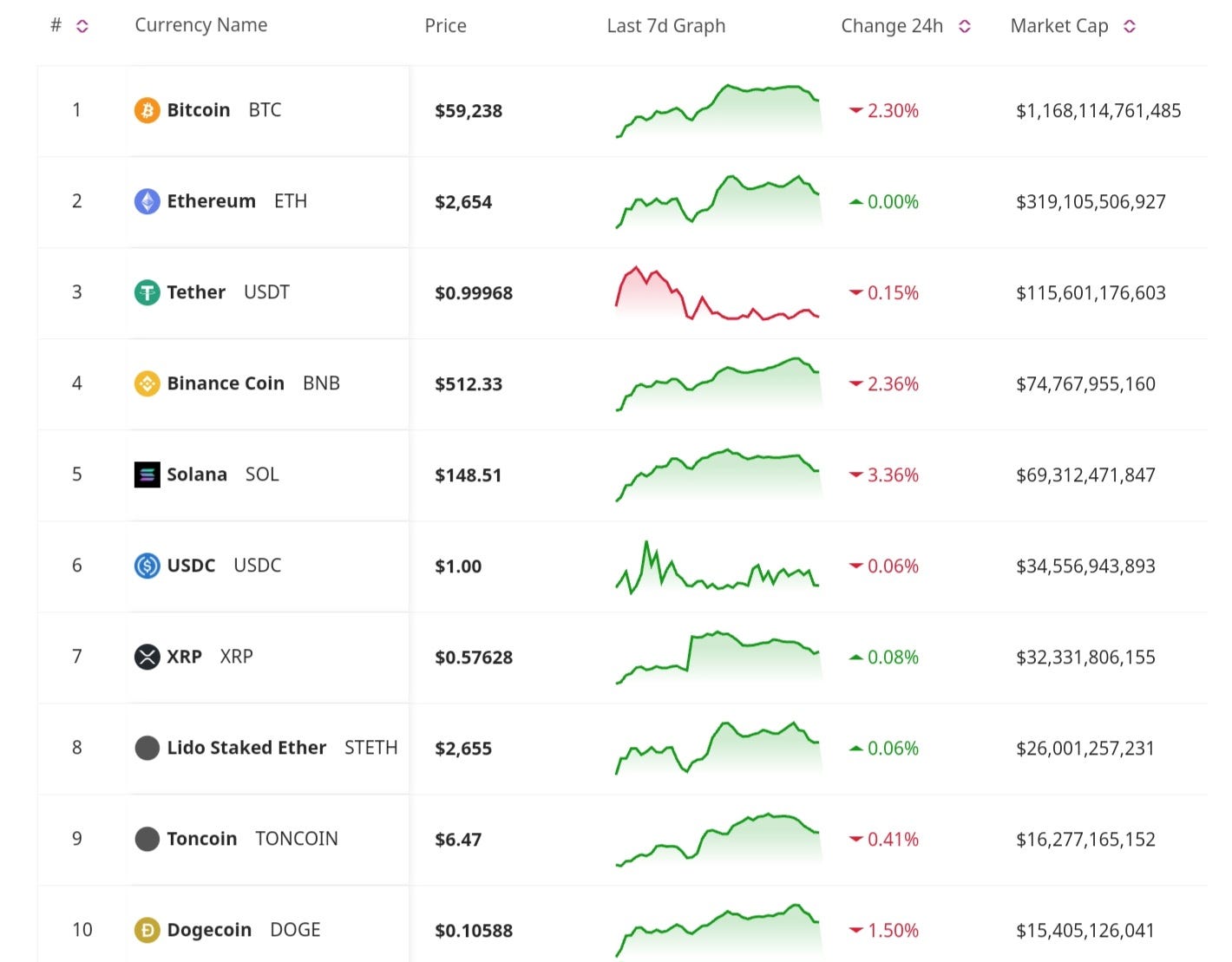

Price Update

Bitcoin Nears $59K Amid Pre-Data Week Selloff

Bitcoin is approaching $59,000 as investors prepare for a busy week of economic data releases. The selloff is caused by cautious sentiment as traders anticipate potential market-moving announcements. Despite this, Bitcoin’s price remains relatively strong, suggesting underlying support. The upcoming data could significantly influence Bitcoin’s price direction, making this week crucial for market participants.

Market Trends

Gold Outperforms Bitcoin During AI Bubble and Geopolitical Risks

Gold outperforms Bitcoin as investors look for safe havens during the AI bubble and rising geopolitical risks. The shift toward gold highlights the traditional asset’s resilience during times of uncertainty. While Bitcoin is often seen as digital gold, its performance has lagged behind physical gold in the current environment. The preference for gold suggests that some investors are prioritizing stability over the potential high returns of cryptocurrencies.

DeFi Dominance Hits a Three-Year Low

DeFi dominance has reached a three-year low, reflecting a shift in market dynamics and investor interest. The decline in DeFi’s market share could be explained by the performance of other sectors, such as NFTs and Layer-2 solutions, which are gaining traction. The decreasing dominance could also indicate challenges within the DeFi sector, including regulatory scrutiny and security concerns. Despite the dip, DeFi remains a crucial part of the crypto ecosystem, and its future growth will depend on innovation and user adoption.

Solana DEX Trading Volume Falls as Ethereum and Base Activity Increases

Solana’s DEX trading volume has decreased, while activity on Ethereum and Base has increased. This drop may be attributed to network issues, shifting user preferences, or the rise of Layer-2 solutions on Ethereum. The increase in activity on Ethereum and Base suggests that these platforms are successfully attracting traders and liquidity.

Ethereum Burn Rate Drops to Lowest Levels

Ethereum’s burn rate has dropped to its lowest levels, as gas fees hover at around 2 gwei. The reduced burn rate suggests a decrease in network activity, which could be attributed to lower demand for transactions or the increased efficiency of Layer-2 solutions. The low gas fees are beneficial for users, making Ethereum more accessible for everyday transactions. However, the decreased burn rate may also raise concerns about the long-term impact of Ethereum’s deflationary mechanism.

Regulatory and Legal News

SEC Charges Novatech in $650 Million Crypto Pyramid Scheme

The SEC has charged Novatech for allegedly operating a pyramid scheme that raised $650 million in cryptocurrency. The scheme is accused of misleading investors with promises of high returns through crypto investments. The SEC’s actions are an ongoing saga of scrutiny and regulation of the industry. The outcome of this case could have significant implications for regulatory enforcement and investor protection in the crypto space.

Thailand Launches Crypto Regulatory Sandbox

Thailand has launched a crypto regulatory sandbox to facilitate experimentation and innovation in the blockchain space. The sandbox will allow companies to test new products and services in a controlled environment, under the supervision of regulators. The sandbox is expected to attract both local and international projects, contributing to Thailand’s position as a regional leader in fintech innovation. The success of the sandbox could serve as a model for other countries looking to balance innovation with regulation.

German State-Owned Bank Prepares for Tokenized Bond Issuance

A German state-owned development bank is preparing for a tokenized bond issuance in collaboration with Boerse Stuttgart Digital, as part of an ECB trial. This initiative represents a significant step toward integrating blockchain technology into traditional finance. The tokenized bonds will offer improved transparency, efficiency, and security compared to traditional bonds. The ECB trial is expected to provide valuable insights into the potential of blockchain for large-scale financial operations.

The cryptocurrency market is experiencing significant shifts, with Bitcoin nearing $58K and gold outperforming. Regulatory developments, such as the SEC’s charges against Novatech and Thailand’s new crypto sandbox, underscore the ongoing efforts to ensure investor protection and innovation. Meanwhile, Ethereum’s decreasing burn rate raises questions about network activity and the future of its deflationary mechanism. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc