Crypto’s Crossroads: Regulation, AI, and Market Resilience

Explore Bitcoin’s price struggles, Ethereum’s resistance test, the SEC’s shift to collaborative regulation, and the rise of AI and real-world asset adoption in DeFi.

TL;DR: Crypto Insights at a Glance

Bitcoin (BTC): Slips from $88.5K to $85.8K, hinting at consolidation.

Ethereum (ETH): Reclaims realized price but hits resistance at $2,300.

SEC: Schedules four roundtables to explore more defined crypto regulations.

Polygon (MATIC): Struggles to break through resistance at $0.285-$0.30.

Star Atlas x AI: Solana’s blockchain game integrates AI NPCs via SingularityNET.

Chronicle Rises: Secures funding to push real-world asset (RWA) tokenization.

Nubank Expands: Brings ADA, NEAR, ATOM, and ALGO to over 100M users.

Stargate x Telos: Launches Hydra protocol, enhancing Telos’ DeFi capabilities.

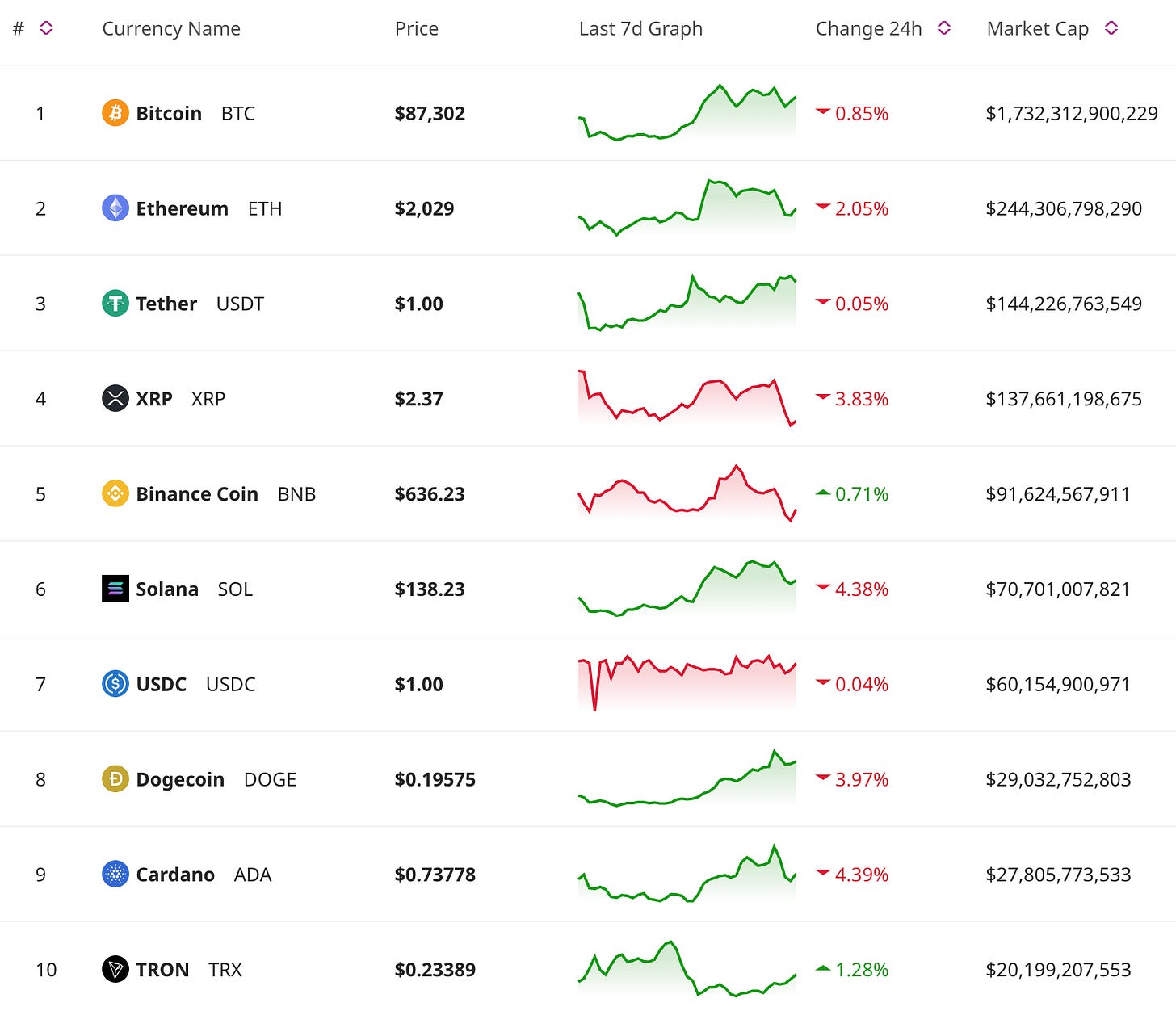

Price Update

Bitcoin Price Analysis: Why BTC Falters Below $86K

Bitcoin fell to $85.8K after briefly touching $88.5K, unsettling many traders. Despite earlier optimism from macroeconomic shifts, BTC’s momentum has slowed. Lower retail engagement and declining trade volume suggest the market could be entering a consolidation phase. BTC’s trading activity dropped nearly 10% this week. Institutions continue to dominate, but all eyes are on support levels near $85K and key resistance at $88K.

Ethereum’s Progress Stalls at $2,300

Ethereum has shown promise after reclaiming its realized price of $2,200. However, the $2,300 mark remains a tough barrier to overcome. This level will likely determine whether ETH can spark a larger rally or face renewed selling pressure. A breakout above $2,300 could drive ETH toward $2,500. Conversely, slipping below $2,200 could trigger bearish sentiment.

Polygon Fights Resistance at $0.30

Polygon (MATIC) briefly gained bullish momentum but struggled to move past the $0.285-$0.30 resistance zone. While still viable in the long term, the lack of a decisive breakout keeps bears in control for now.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Why Bitcoin and Ethereum Had a Subpar Q1

Q1 2025 was underwhelming for both Bitcoin and Ethereum after an optimistic start. Factors such as stagnant on-chain activity, reduced retail interest, and an increasing concentration of holdings among institutions have dampened market enthusiasm.

Bitcoin declined 3% in Q1, while Ethereum eked out a 1% gain. This tepid performance leaves retail participants wondering about the stability of the current market.

Gold’s Ascent Casts a Shadow Over Bitcoin

Gold continued its upward climb, rising 8% this quarter and nearing all-time highs. While Bitcoin’s "digital gold" narrative has historically gained traction during uncertain times, it appears investors still favor physical gold as a safe haven. Until macro headwinds improve, Bitcoin could remain muted in comparison to traditional hedging assets like gold.

SEC Crypto Regulation Turns Collaborative

SEC Pivots to Industry Dialogue with Roundtable Events

The U.S. SEC has announced four major roundtable discussions to clarify digital asset regulations. These sessions will tackle pressing issues, such as classifying tokens, creating registration pathways, and designing disclosure requirements. This collaborative approach signals a welcome shift from its earlier enforcement-heavy stance.

Collaboration with industry stakeholders might create a stable regulatory framework, boosting confidence in crypto’s long-term future.

New SEC Chair Advocates for Clear Crypto Policies

Paul Atkins, the recently appointed Chair of the SEC, is bringing a fresh perspective to the regulatory arena. Known for supporting fair market practices, Atkins aims to balance innovation and compliance by establishing a well-defined legislative framework for crypto assets. Atkins’ leadership could reduce uncertainty, a key barrier for broader institutional adoption.

Don’t Miss Anything

Nubank Drives Crypto Accessibility Across Latin America

Nubank, Latin America’s largest digital bank, has added ADA, NEAR, ATOM, and ALGO to its offerings, making these altcoins more accessible to over 100M users. This move highlights the growing interest in crypto across emerging markets. Wider adoption of these assets through Nubank could boost their native liquidity and network utility.

AI Elevates Blockchain Gameplay with Star Atlas

The Solana-based game Star Atlas has integrated SingularityNET’s AI to create smarter, more engaging NPCs. This adds dynamic, responsive player interactions that push blockchain gaming one step closer to mainstream appeal. With AI advancing so quickly, immersive blockchain games like Star Atlas are pioneering the future of GameFi ecosystems.

Chronicle Fuels RWA Tokenization with Fresh Funding

Chronicle’s latest round of investment highlights the surging demand for tools that can tokenize real-world assets. Backed by MakerDAO, Chronicle is focusing on building a reliable oracle layer to feed accurate, secure data for RWAs like tokenized treasuries and commodities.

If RWAs continue gaining momentum, projects like Chronicle could become foundational to the ecosystem’s infrastructure.

Stargate Finance Expands to Telos via Hydra Protocol

Stargate Finance has deployed Hydra on Telos, giving users access to a unified liquidity pool. This integration strengthens DeFi capabilities on Telos while providing seamless cross-chain functionality for broader liquidity solutions. Cross-chain interoperability isn’t just a trend but a necessity for DeFi ecosystems to grow sustainably.

The crypto space is at a crossroads in 2025. Despite recent price struggles, technological adoption, regulatory clarity, and evolving use cases in areas like AI and RWAs showcase a maturing ecosystem. While uncertainty can unsettle markets, innovation continues to thrive, setting the foundation for long-term growth.