Crypto Market Temporary Drop, and Crypto Funds Grow - January 28, 2025

Also, token related to DeepSeek hits a $1B valuation, and KuCoin pleads guilty.

TL;DR: Crypto Insights in Seconds

BTC: Price dropped to $98K and quickly bounced back to $101K.

VVV: Token related to DeepSeek hit a $1B valuation in just a couple of hours.

Crypto Market: Dropped along the tech stock market due to DeepSeek announcements.

Crypto Funds: Recorded $1.9 billion in inflows after Trump's executive order.

KuCoin: Pleads guilty and pays $300M fine.

CFTC: Will focus on crypto prediction markets.

Ripple: Expands its presence in the U.S. with key licenses.

ETFs: New fillings for leveraged ETFs including memecoins TRUMP and MELANIA.

Pudgy Penguins: Launches Ethereum layer 2, Abstract.

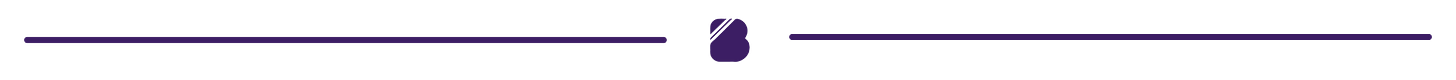

Price Update

Bitcoin's Drop Below $98K and Broad Crypto Liquidations

Bitcoin briefly fell below $98,000, raising concerns of a bearish trend. The retreat led to over $300 million in crypto liquidations. However, analysts note a lack of panic selling, suggesting the dip is temporary. Factors like resilient investor confidence and the broader market sentiment indicate potential for recovery in the short term.

Venice AI Token Tied to DeepSeek Surges to $1 Billion

The Venice AI token $VVV, developed in partnership with DeepSeek, hit a valuation of $1 billion within hours of launch. The current market cap is $306 million, with only 25 million tokens out of its 100 million. This spike shows investor interest in AI-powered blockchain solutions and confidence in projects that seem more efficient than current models.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

DeepSeek Disruption Hits AI Crypto Tokens

AI crypto tokens experienced a sell-off after a market disruption linked to DeepSeek and the tech stock market. NVIDIA shares faced selling pressure due to fears of overvaluation. The crypto market reacted equally but temporarily, with tokens bouncing back after some hours.

Crypto Markets Mirror Equities Amid FOMC Concerns

Along DeepSeek disruption, the market mirrored equities as bearish Federal Reserve expectations promoted risk aversion. Market sentiment is cautious, and traders brace for further volatility. However, Standard Chartered analysts suggest taking advantage of Bitcoin’s recent dip, describing it as a "buy the dip" opportunity.

Crypto Funds See $1.9 Billion Inflows

Global crypto funds recorded $1.9 billion in inflows last week, encouraged by optimism over President Trump’s executive orders supporting digital asset regulation and innovation. U.S.-based funds dominated, contributing $1.7 billion, with Bitcoin products leading the charge at $1.6 billion in inflows. Ethereum-based funds also saw significant growth, attracting $205 million, while XRP, Solana, Chainlink, and Polkadot funds posted smaller but notable inflows.

Legal and Regulatory Updates

KuCoin Pleads Guilty to US Charges, Pays $300M Fine

Crypto exchange KuCoin settled with US regulators, admitting to operating without proper licenses. The exchange agreed to pay $300 million in penalties while working to resolve compliance issues.

CFTC Focuses on Crypto Prediction Markets

The US Commodity Futures Trading Commission plans a series of discussions centered on crypto prediction markets. Acting Chair Rostin Behnam emphasized the need for regulatory clarity in this emerging area, particularly as these platforms gain popularity.

Ripple Expands US Presence with Key Licenses

Ripple has secured additional licenses to operate in the US, solidifying its regulatory standing. Ripple's efforts to expand its footprint in one of the world’s most significant crypto markets are strengthening its leading position in the country.

Don’t Miss Anything

Leveraged Crypto ETFs, Including TRUMP and MELANIA Memecoins

Tuttle Capital Management filed for 10 leveraged crypto ETFs, covering tokens like XRP, Solana, TRUMP, MELANIA, and more. These filings include the first-ever ETFs for tokens like Chainlink and Cardano. Bloomberg analysts highlight the SEC's potential decision as a regulatory test. Approval could come as early as April.

Pudgy Penguins Launches Ethereum Layer 2, Abstract

The popular NFT project Pudgy Penguins launched its Ethereum Layer 2 solution, Abstract, on the mainnet. This initiative seeks to improve scalability and reduce transaction costs, benefiting its growing community of collectors and traders.

The market sees a minor pullback following the tech stock market drop. However, after some hours, it bounced back and most tokens regained their price. Analysts suggest caution since today and tomorrow there are FOMC announcements that could promote further volatility. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.