Crypto Market Dips Due to New Tariffs, and Is the Altcoin Season Coming? – February 10, 2025

Also, Coinbase is worth more than the largest U.S. banks, and Telegram games struggle to generate revenue.

TL;DR: Crypto Insights in Seconds

BTC: Close to $93K support level that could lead to $1.3B in liquidations.

ETH: Analysts consider ETH to be a must-buy due to massive accumulation.

XRP: Open interest drops 37% as traders look for better investment opportunities.

Crypto Market: Concern about oversaturation since the total number of crypto reaches 11M.

U.S.: States and companies are increasing their BTC holdings.

Market Price: Crypto prices dip as Trump announces 25% tariff on steel and aluminum.

Quantum: Tether CEO points out that quantum computing could recover lost BTC wallets.

Coinbase: By AUM, the company is worth more than the 21st largest U.S. banks.

Telegram: Games on the platform are struggling to generate revenue.

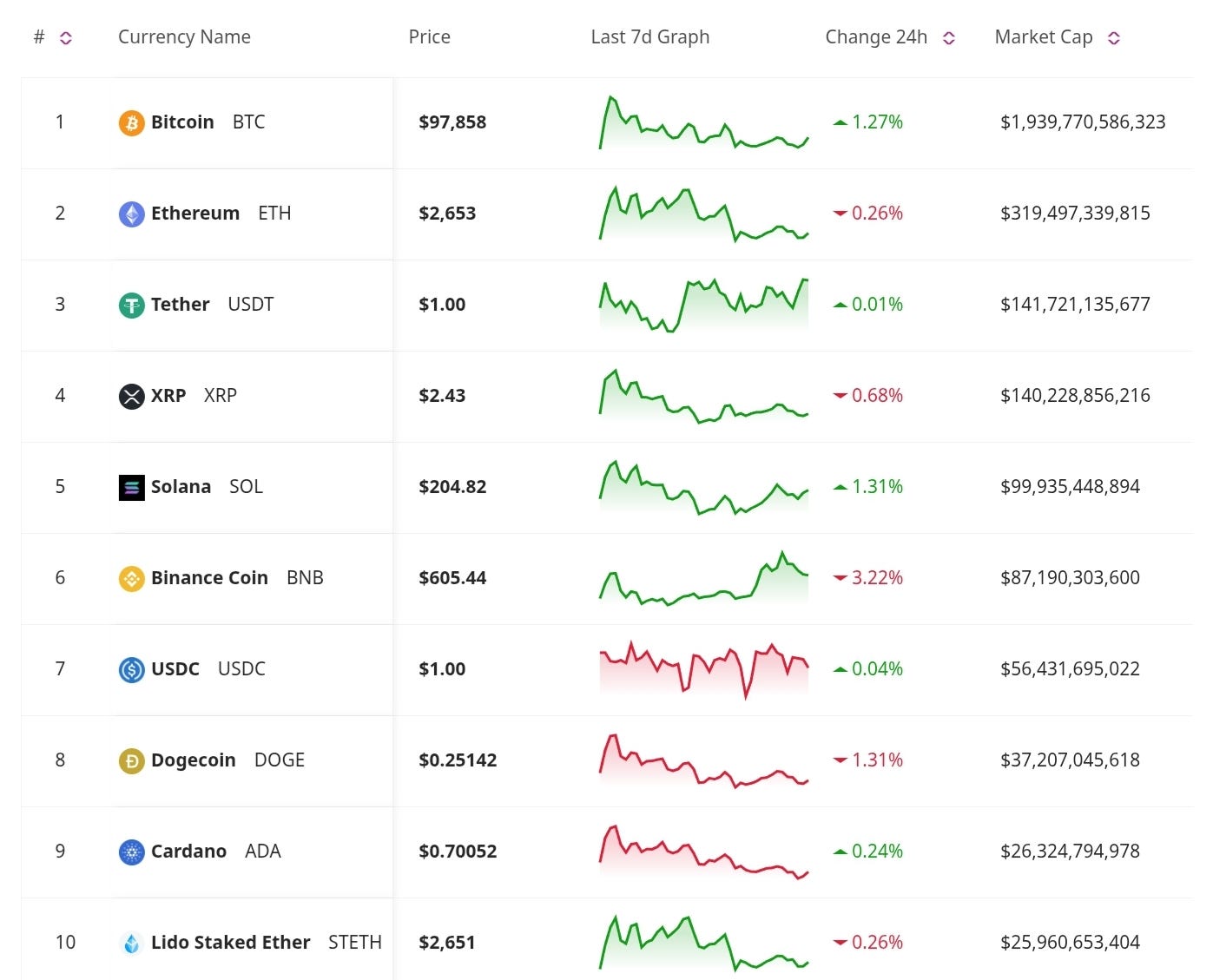

Price Update

Bitcoin Close to Key $93K Support Level

Bitcoin’s price is testing the critical $93,000 support level, with over $1.3 billion in leveraged positions at risk. Analysts warn that further downside could trigger cascading liquidations, intensifying market volatility. Regardless, Standard Chartered analysts believe Bitcoin is on track for a breakout, citing favorable bond market conditions. With increasing macroeconomic uncertainty, BTC is being viewed as a potential hedge by institutional investors.

Ethereum Sees Massive Accumulation

Ethereum accumulation addresses have recorded an inflow of 883 million ETH, showing strong investor confidence. Many analysts view this as a key buy signal, suggesting ETH could see upward momentum in the coming months.

XRP Futures Open Interest Drops 37% as Altcoin Traders Shift Strategies

Open interest in XRP futures has plunged 37%, indicating that traders may be moving away from XRP in search of better opportunities. This shift is a broader trend due to the uncertainty of the altcoin market and Bitcoin’s dominance in recent weeks. Traders are reconsidering whether the altcoin season will actually happen if BTC behavior and macroeconomic conditions continue.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Total Number of Cryptocurrencies Nears 11 Million: Is the Market Oversaturated?

The total number of cryptocurrencies is approaching 11 million, raising concerns about market oversaturation. Many projects have little utility, and experts warn that a consolidation phase could be imminent.

US States Quietly Accumulate Bitcoin Reserves

Several US states and global institutions are reportedly increasing their Bitcoin holdings, treating BTC as a strategic reserve asset. This growing trend highlights Bitcoin’s emerging role as a hedge against economic uncertainty.

Crypto Market Dips as Trump Announces 25% Tariffs on Steel and Aluminum

Crypto prices slid after Donald Trump announced a new 25% tariff on steel and aluminum imports. Market uncertainty around global trade policies appears to be weighing on investor sentiment, leading to a broader market pullback.

Don’t Miss Anything

Tether CEO: Quantum Computing Could Recover Lost BTC Wallets

Tether CEO Paolo Ardoino suggests that advancements in quantum computing might one day unlock lost Bitcoin wallets. While this remains speculative, quantum threats and opportunities are becoming a bigger discussion in crypto security.

Coinbase’s $420B AUM Surpasses the 21st Largest US Bank

Coinbase CEO Brian Armstrong highlighted that the exchange’s assets under management make the company worth more than the 21st largest US bank. This milestone underscores the growing mainstream acceptance of crypto and its financial impact.

Telegram’s Games Struggles to Generate Revenue

A recent report reveals that Telegram-based games faced major challenges in Q4, struggling with both user retention and revenue generation. Despite Telegram’s growing presence in crypto and Web3, the gaming sector has yet to gain meaningful traction.

The market remains unstable, as macroeconomic factors continue to impact the crypto space. Due to BTC's dominance and potential market oversaturation, traders are reconsidering the altcoin season. However, analysts see long-term potential across different indications, especially for the major tokens. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates.