Crypto Market Carnage: Bitcoin’s Record Plunge, Ethereum Crash, and Key Trends to Watch

Can Dogecoin Break $2 Amid Market Turmoil?

TL;DR:

Bitcoin: Largest weekly loss in history; BTC dives below $80K.

Ethereum: ETH drops 10%+ to test $2K support level.

Dogecoin: Analysts speculate on a $2 breakout if $0.16 support holds.

DeFi Turmoil: Major crypto whale risks MakerDAO liquidation.

Wall Street Crash: Stocks tank, fueling correlations with crypto.

Coinbase Futures Launch: 24/7 Bitcoin and Ethereum trading now live.

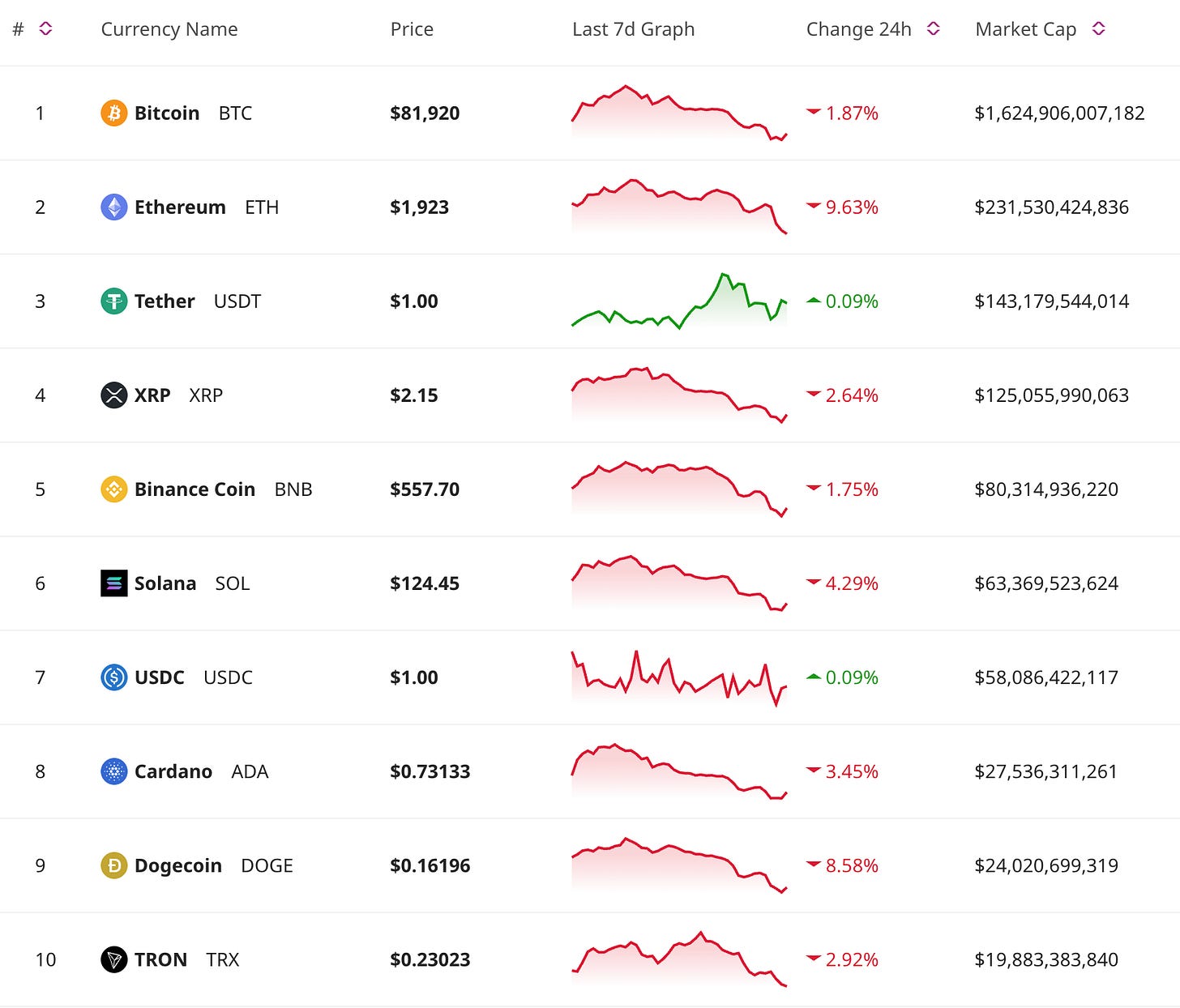

Price Update

Bitcoin Prints Record Weekly Loss, Drops Below $80K

Bitcoin just experienced its largest weekly red candle on record, shedding over 14% in value during the past seven days. After failing to sustain momentum above $85K, BTC plunged below key support at $80K, now hovering around $76K-$78K.

Some contributing factors include mass liquidations tied to over-leveraged long positions, Macroeconomic fears, triggered by Wall Street’s extended sell-off, and Weak buying interest, indicating higher downside potential.

While some bulls see this as a healthy correction following Bitcoin’s meteoric rise, others warn that breaking below $78K could lead to a fall toward $72K-$75K. Keep your eye on short-term support zones to gauge the trend reversal.

Ethereum Dives Over 10%; Will $2K Support Hold?

Ethereum saw steep declines, shedding over 10% as traders dumped positions. ETH faces heightened bearish pressure, caused by:

Low spot demand despite active on-chain metrics like transaction volume.

Market-wide turbulence, dragging down major altcoins.

A lack of bullish catalysts, with no Ethereum ETF approvals on the horizon.

However, whale wallets are showing signs of accumulation at these lower levels, suggesting long-term investors may be bargain hunting. The key battle lies at the $2K support zone; losing this could accelerate ETH’s dip to $1,850 or lower, while holding above it might fuel short-term recovery.

Dogecoin’s Fate Hinges on $0.16 Support—$2 Possible?

Amidst the broader crypto meltdown, Dogecoin has shown surprising resilience. If it successfully maintains $0.16 support, analysts suggest a potential rally to $2 in the coming months. However, this depends heavily on several factors social media engagement driving meme coin enthusiasm, overall market stabilization that reignites retail interest and the ability to defend critical levels, particularly $0.16.

On the flip side, losing this support level could see DOGE retracing to $0.12, marking a potential buying opportunity for speculators.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Wall Street Woes Spill Into Crypto

The crypto market mirrored Wall Street’s pain as U.S. equities fell sharply. Key losses were seen across the S&P 500, Nasdaq, and Dow Jones, with tech stocks like Tesla suffering significantly. Bitcoin’s high correlation to traditional financial markets is once again under scrutiny. Major triggering factors include: recession fears, driven by the Fed’s hawkish tone, Tesla’s 15% stock dip, dampening tech market momentum, and Capital flight from risk assets, leaving crypto exposed.

These developments highlight a critical debate for investors—is Bitcoin a hedge or just another speculative asset?

DeFi Whales Under Pressure Amid ETH Volatility

A major Ethereum whale is facing liquidation risk on MakerDAO after pledging $4 million in ETH as collateral for a loan. With ETH’s price decline, the situation underscores the peril of high-risk DeFi strategies.

If ETH continues to slide, the whale may need to inject more collateral to avoid being liquidated, adding further pressure on the market.

Don’t Miss Anything

Coinbase Introduces 24/7 Futures for BTC and ETH

Amid the bearish trend, Coinbase is breaking new ground by offering 24/7 futures trading for Bitcoin and Ethereum on its CFTC-regulated exchange. Potential benefits include:

Enhancing institutional participation and liquidity in the market.

Boosting round-the-clock trading opportunities for global investors.

Providing diversified exposure for U.S. traders beyond spot market activities.

Ethena (ENA) Traders Square Off in Tug-of-War

Ethena has become a focal point for volatility, as derivative traders expect prices to bounce, while spot sellers intensify selling pressure. This dynamic could result in significant price moves, creating both risks and opportunities for traders paying attention to the data.

This week’s market volatility highlights both challenges and opportunities in crypto. Bitcoin’s record drop, Ethereum’s $2K battle, and Wall Street’s impact emphasize the importance of staying informed and strategic.

Amid the chaos, innovations like Coinbase’s 24/7 futures and signs of whale accumulation offer glimmers of potential. Will you buy the dip, stay on the sidelines, or wait it out?