Crypto Market at a Crossroads: Bitcoin’s Path to $100K, Solana’s DeFi Challenge, and Ethereum Outshines Gold

Also DeFi TVL rebounds, blockchain gaming adoption takes off, and Nasdaq moves forward with crypto regulation proposals.

TL;DR: Quick Crypto Insights

Bitcoin ($BTC): Technical charts signal a rally to $100K as early as May, with critical pre-halving momentum driving sentiment.

Solana ($SOL): Struggles with a $5.8M DeFi hack, testing investor confidence as price flirts with breaking key support.

Ethereum ($ETH): Strengthens its "digital gold" narrative, outperforming gold as a favored store of value among millennials and Gen Z.

DeFi Recovery: Total Value Locked (TVL) bounces back above $100 billion, led by Ethereum, Solana, and Arbitrum projects.

Regulation: Nasdaq proposes a four-tier crypto classification roadmap, seeking greater regulatory clarity for institutional adoption.

Blockchain Gaming: Giants like Ubisoft and Peaky Blinders double down on Web3 integration, reshaping the $200B+ gaming industry.

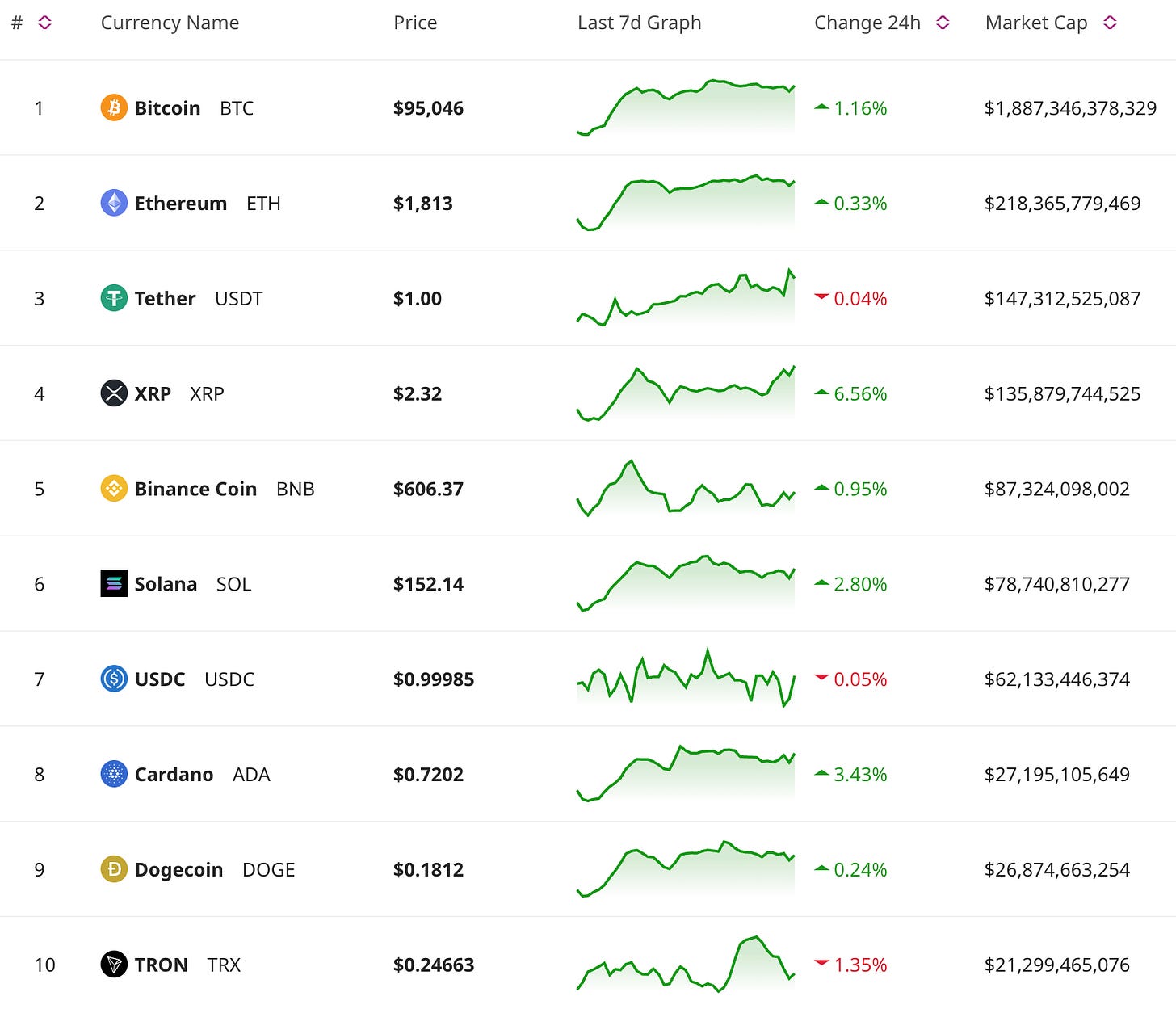

Price Update

Bitcoin Inches Toward $100K Before the Halving

Bitcoin ($BTC) is gearing up for a historic push as multiple technical indicators predict a rally toward $100K. Patterns like the golden cross (where short-term moving averages rise above long-term ones) and ascending triangle formations suggest bullish momentum.

Analysts highlight pre-halving confidence, thin liquidity, and BTC dominance nearing 50% as critical drivers for this surge. However, volatility remains a reality for traders. Altcoins such as SUI, AVAX, and TAO could follow Bitcoin’s lead if the breakout solidifies. Traders are eyeing the $35,000 resistance level as a key milestone on the way to $100K.

Solana ($SOL): A Critical Test of Resilience

Solana ($SOL) is facing mounting pressure after the $5.8 million Loopscale DeFi hack. Confidence in Solana DeFi’s security has taken a hit, raising tough questions about the ecosystem’s ability to handle institutional-level trust and adoption.

After a month of turbulence, SOL is testing critical $20 support levels. If this level breaks, analysts warn a deeper plunge toward $15 could follow. Sentiment remains fragile, with investors weighing Solana’s impressive speed and scalability against ongoing security vulnerabilities.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Ethereum ($ETH): Beating Gold as Modern-Day "Digital Gold"

Ethereum’s dominance in the store-of-value conversation continues to grow. Since the Merge, Ethereum has shifted into a deflationary supply model, burning over 3 million ETH, increasing its scarcity. Many younger investors now favor Ethereum over traditional gold due to its programmability, yield-generating potential, and integration in DeFi and NFTs.

Data shows ETH outperformed physical gold by 8% over the past six months, solidifying its appeal as a dynamic alternative. This shift underscores a generational trend in wealth preservation strategies.

DeFi TVL Roars Back Above $100B

After a rocky April, Total Value Locked (TVL) in DeFi has surged past $100 billion, fueled by renewed investor confidence and real-world asset (RWA) tokenization. Ethereum remains the leader, hosting over 60% of DeFi TVL, but Solana, Arbitrum, and Base are gaining traction with inflows and user activity.

Yield farming opportunities, improved cross-chain interoperability, and risk appetite among investors all contributed to this rebound.

Nasdaq’s Crypto Framework Could Change the Game

Nasdaq has introduced a four-tier crypto classification system, aiming to streamline how regulators like the SEC approach digital assets. By categorizing cryptocurrencies based on levels of decentralization and security characteristics, this proposal could provide much-needed clarity.

If successful, the framework could accelerate institutional crypto adoption and pave the way for smoother ETF approvals. Industry insiders are hailing Nasdaq’s move as a crucial step forward for regulatory consistency.

Don’t Miss Anything

Blockchain Gaming Sees Massive Adoption

The $200B+ gaming industry is undergoing a Web3 transformation. Major developers like Ubisoft and Peaky Blinders are spearheading blockchain integrations, aiming to redefine how players interact with games.

Ubisoft’s newest "Might & Magic" installment incorporates NFT ownership and on-chain trading, while "Peaky Blinders" plans to weave NFT-driven narratives into gameplay. Blockchain gaming is quickly becoming the norm for next-gen player ecosystems.

The crypto market remains an exhilarating mix of opportunity and risk. With Bitcoin leading the charge, Ethereum solidifying its place as digital gold, and DeFi recovering, the next few weeks could see significant momentum shifts.

Stay sharp, stay informed, and we’ll see you tomorrow for more updates.