Cross-Border Strategic Shifts and Regulatory Dynamics

Also, Coinbase's S&P 500 Entry, Robinhood’s WonderFi Acquisition, and Tether's Bitcoin Mining Expansion.

TL;DR: Crypto Moves in Seconds

Coinbase enters the S&P 500, potentially unlocking $9 billion in institutional inflows as passive funds allocate exposure.

Robinhood expands in Canada with its acquisition of WonderFi, strengthening its position in decentralized finance.

Tether doubles down on its Bitcoin-centric strategy with its investment in a German mining firm, integrating deeper into the energy stack.

Solana's memecoin ecosystem captures retail investor excitement, with outsized returns highlighting its edge over Ethereum for speculative actions.

U.S. lawmakers intensify calls for crypto tax clarity, amplifying pressure on the Treasury to address longstanding industry gaps.

The unexpected drop in U.S. inflation prompts new market dynamics, influencing crypto’s appeal as a macro hedge.

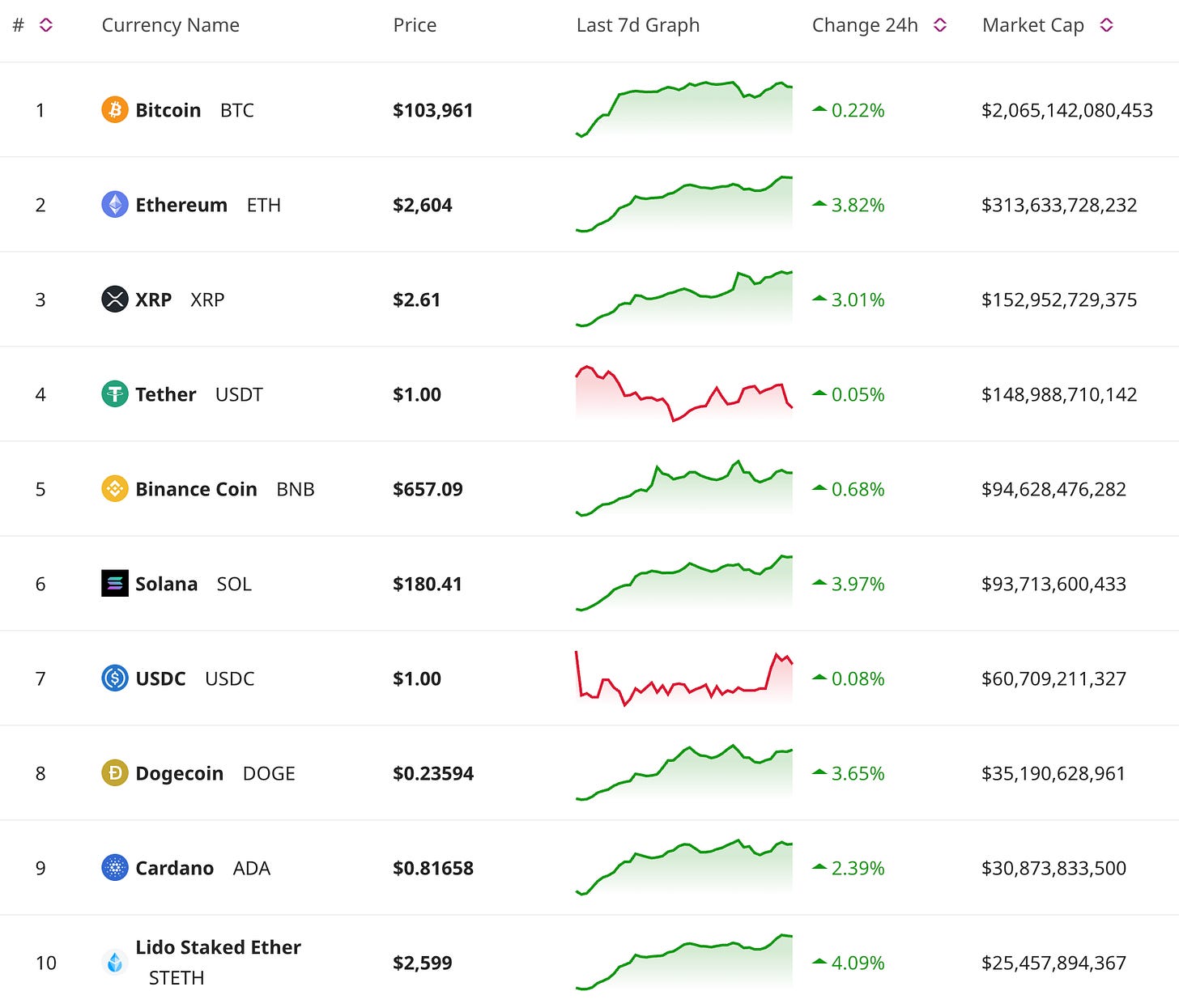

Price Update

Coinbase Joins S&P 500, Projected to Unlock $9 Billion in Institutional Capital

Bitcoin is firmly consolidating above the $100K mark, buoyed by growing institutional confidence. A major catalyst? Coinbase’s inclusion in the S&P 500, marking a symbolic and financial leap for crypto. Analysts estimate this shift could catalyze $9 billion in passive inflows as index-tracking funds reallocate their portfolios.

For institutional players, this development signals increasing validation of crypto infrastructure as part of the broader financial ecosystem. Combined with persistent macro uncertainties—from inflation to global tensions—the case for Bitcoin as a macro asset continues to grow.

Solana Leads Retail Speculation with High-Volatility Memecoins

Solana’s stature as the go-to platform for retail traders remains unmatched, fueled by the rise of memecoins like GoonCoin, where a $330 investment recently skyrocketed to $190K. With its low fees and high throughput, Solana provides an ideal environment for fast-moving, high-risk speculative trading.

While Ethereum retains its dominance in smart contract applications and DeFi, Solana’s retail focus on memecoin trading is an increasingly distinct niche. For retail traders chasing rapid gains, Solana is cementing its reputation as the infrastructure of choice for high-volume, meme-native ecosystems.

Market Trends

Coinbase and Robinhood Target Canada’s Crypto-Friendly Regulatory Landscape

Northward expansion is a growing trend, with both Coinbase and Robinhood making decisive moves into Canada.

Coinbase fortified its presence through an investment in Valor, a Canadian stablecoin issuer, leveraging Canada’s crypto-friendly policies to diversify and strengthen its portfolio.

Robinhood, meanwhile, finalized a $72 million equity-based acquisition of WonderFi, gaining traction within Canada’s advanced DeFi ecosystem.

These moves highlight Canada’s increasing appeal amidst the U.S.’s unpredictable regulatory climate. By aligning with jurisdictions offering regulatory clarity, both platforms can pursue innovation without the lingering uncertainties of U.S. regulation.

PumpSwap Redefines Decentralized Exchange Architecture

Emerging DEX platform PumpSwap has unveiled an innovative liquidity mechanism designed to prevent rug-pulls and safeguard microcap token ecosystems. By employing algorithmic controls and game-theoretic incentives, PumpSwap aims to establish trust and integrity in speculative token markets.

This innovation sets a potential benchmark for platforms navigating the high-risk, high-reward world of memecoins, offering structured protections while preserving the ethos of decentralized trading.

Tether Expands into Bitcoin Mining

Tether has taken a bold step into Bitcoin mining with its investment in Twenty One Capital, a German mining operation. This move aligns with Tether’s vision of vertical integration, spanning everything from renewable energy sourcing to operational network infrastructure.

The strategy bolsters USDT’s decentralized collateralization, ensuring stability while addressing geopolitical energy concerns. Furthermore, it positions Tether as a significant player in the ongoing narrative around blockchain energy efficiency and independence.

Don’t Miss Anything

Crypto Tax Policy Debate Heats Up in the U.S.

The U.S. crypto sector faces escalating pressure for tax policy clarity as legislators push for overdue guidance. Bipartisan leaders, including Senators Cynthia Lummis and Kirsten Gillibrand, are lobbying the Treasury to resolve ambiguities tied to new reporting rules from the Infrastructure Investment and Jobs Act.

The absence of coherent tax frameworks hinders compliance and innovation, with industry leaders warning that unclear policies may drive capital offshore. The coming months will be pivotal for establishing a regulatory environment that supports both institutional investment and retail adoption.

U.S. Inflation and its Impact on Crypto Adoption

Recent CPI data indicates a surprising decline in U.S. inflation, despite pressure from populist economic policies. This unexpected shift is reshaping projections around interest rates and monetary policy. For crypto investors, lower inflation strengthens Bitcoin’s narrative as a hedge against fiat instability while shifting focus back to risk-on assets like altcoins.

Retail Traders Favor Solana Over Ethereum for Speculative Gains

Retail engagement is tilting sharply toward Solana, with Ethereum’s slower transaction speeds and higher gas fees leaving it disadvantaged in speculative markets. This evolving dynamic could drive more retail capital into Solana’s ecosystem, particularly during the next memecoin boom.

The crypto landscape is evolving at lightning speed, with groundbreaking developments shaping the future of finance, technology, and global markets. From Coinbase's institutional milestone to Solana's retail-driven momentum, staying informed has never been more critical.

Join the conversation, share your thoughts, and connect with fellow enthusiasts who are navigating these shifts. Be sure to subscribe for more in-depth updates, analysis, and actionable insights that keep you ahead of the curve. Let's stay ahead together.