Coinbase Buyback Announced, and Stablecoin Demand Fuels T-Bills - October 31, 2024

Also, Circle increases fees on USDC, and ETH gains 2.5%.

TL;DR: Crypto Insights in Seconds

Bitcoin ETF: See record inflows as BTC flirts with its all-time high.

Coinbase: Reports strong Q3 earnings and expands its Visa offering with real-time crypto deposits.

Stablecoin: U.S. Treasury sees increased demand for T-bills from stablecoin providers.

Circle: Facing rising costs, Circle increases fees on its stablecoin services.

ETH: Gains 2.5% and analysts expect further upside.

JPMorgan: Expands tokenized treasury offerings amid regulatory talks.

Bid, Win, and Earn Crypto with Token Deal!

Looking for a fun way to win crypto? Token Deal’s gamified auctions let you bid on prizes like 1 BTC, and if you're the last bidder, the prize is yours—no further payments required! Plus, earn free Bids and USDT rewards just by participating!

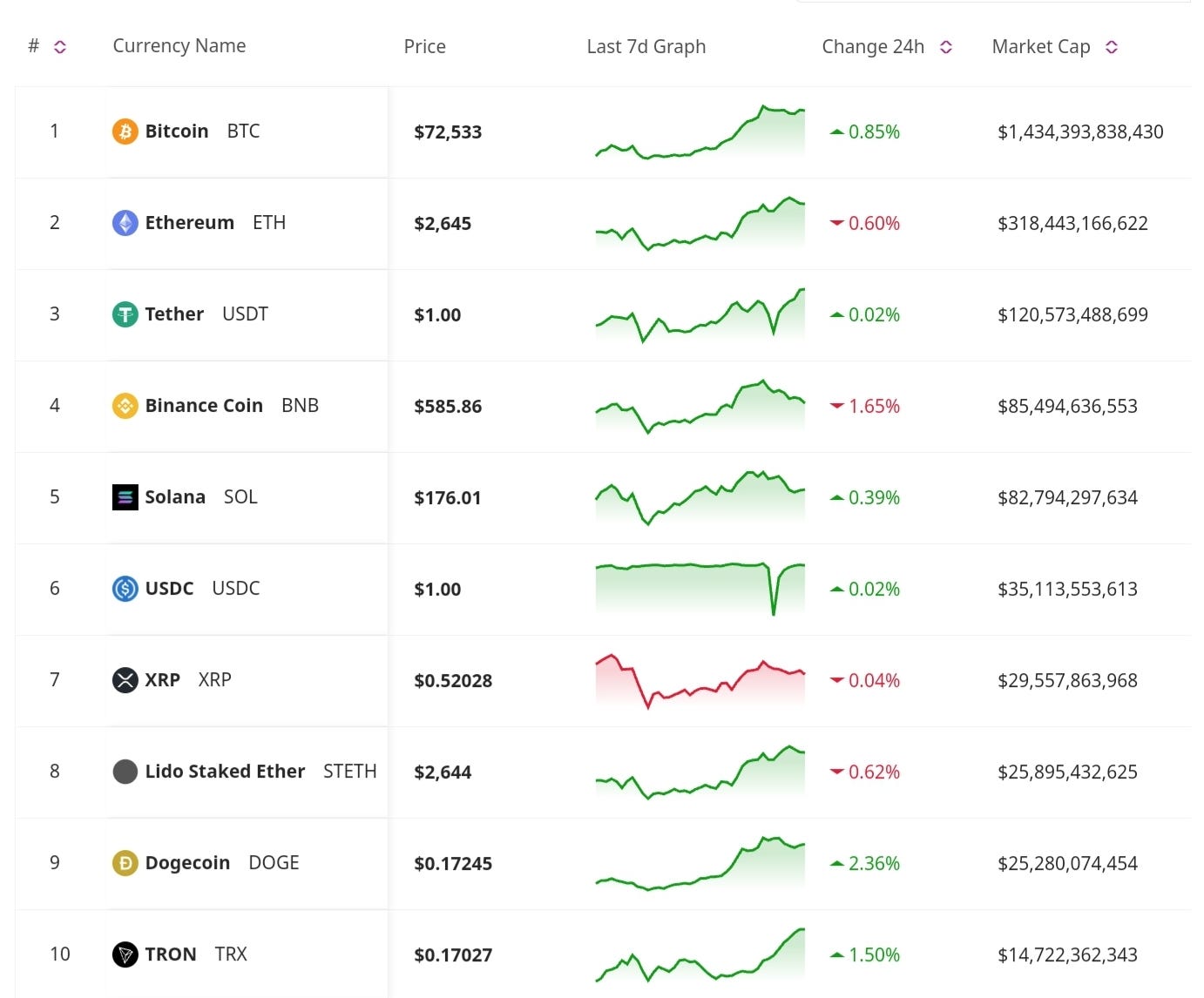

Price Update

BTC Makes Small Changes and Stays Below $73K

After briefly reaching close to a record high, Bitcoin traded in a tight range, hovering between $71,150 and $72,500 after peaking at just under $73,000 late Tuesday. It later exceeded $73,500 during the U.S. afternoon. Meanwhile, the broader crypto market showed slight movement, up 0.9% overall, with Ethereum gaining 2.5% and Solana declining over 2%.

Ethereum’s Positive Price Outlook as Short Skew Increases

Ethereum has gained 2.5% recently, with analysts pointing to an increasingly negative sentiment and short skew that could lead to a short squeeze. As traders adjust to shifting sentiment, ETH may see further upside in the coming weeks.

Market Trends

Bitcoin ETFs See Record $870 Million Daily Inflows, BlackRock Leads Market

Spot Bitcoin ETFs experienced a record-breaking $870 million in inflows, marking the highest daily inflow since June. BlackRock’s iBit ETF has emerged as the dominant player in the Bitcoin ETF space, capturing a significant market share. This surge supports Bitcoin’s price action, which is currently near its all-time high.

U.S. Crypto News

Stablecoin Demand Increases T-Bill Demand, Says U.S. Treasury

The U.S. Treasury has noted that the growth of stablecoins is driving increased demand for Treasury bills, as stablecoin issuers look for safe assets to back their tokens. A Treasury advisory panel is also weighing the potential of tokenization for U.S. financial markets, although members suggest that centralized oversight might be necessary to mitigate systemic risks.

Florida Official Proposes Bitcoin Stockpile for State Retirement Fund

Inspired by former President Trump, a Florida official has proposed creating a Bitcoin reserve for the state’s retirement fund. This move, if approved, would make Florida one of the first U.S. states to consider Bitcoin as part of a public fund, reflecting an increased openness to digital assets at the state level.

Business News

JPMorgan Expands Tokenized Treasury Offerings Amid Regulatory Talks

JPMorgan has introduced tokenized U.S. Treasuries, hoping to appeal to institutional investors interested in blockchain-based financial products. This initiative comes as regulatory uncertainty over tokenized money market funds continues, offering an opportunity that rises above the current challenges.

Coinbase Announces $1 Billion Share Buyback and Expands Real-Time Crypto Deposits

Coinbase has reported strong Q3 earnings closing with USD 8.2 billion in resources, and the board of directors authorized a $1 billion share buyback program. Additionally, Coinbase has partnered with Visa to enable real-time crypto deposits via debit cards, providing users with instant access to funds.

Circle Increases Fees as Fed Cuts Interest Rates

In response to rising operational costs, Circle has raised fees on its USDC stablecoin services. The company’s fee hike comes during the Federal Reserve’s recent rate cuts, which have impacted the yields that stablecoin providers generate from traditional investments.

Bitcoin’s record-breaking ETF inflows and high price signal strong institutional confidence, though market conditions could shift post-election. Coinbase’s partnership with Visa and stablecoin-driven demand for T-bills illustrates how traditional finance is adapting to the needs of digital assets. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.