Cardano Shifts to Decentralized Governance, SEC Warns FTX, and Bitcoin ETFs See Outflows - September 2, 2024

A quick and digestible recap of the weekend’s crypto news.

TL;DR: Market Insight in Seconds

Cardano: Transitions to decentralized governance as Chang hard fork goes live.

SEC: Warns FTX against repaying creditors in stablecoins or other cryptocurrencies.

BTC and ETH ETFs: BTC logs monthly losses, and ETH ETFs are ignored following the outflow streak.

Elon Musk: Cleared in a Dogecoin class-action lawsuit, securing a win for Tesla and himself.

BlackRock's iBit: Logs its first daily outflows since May amid continued spot Bitcoin ETF outflows.

Russia: Explores using crypto to circumvent international sanctions.

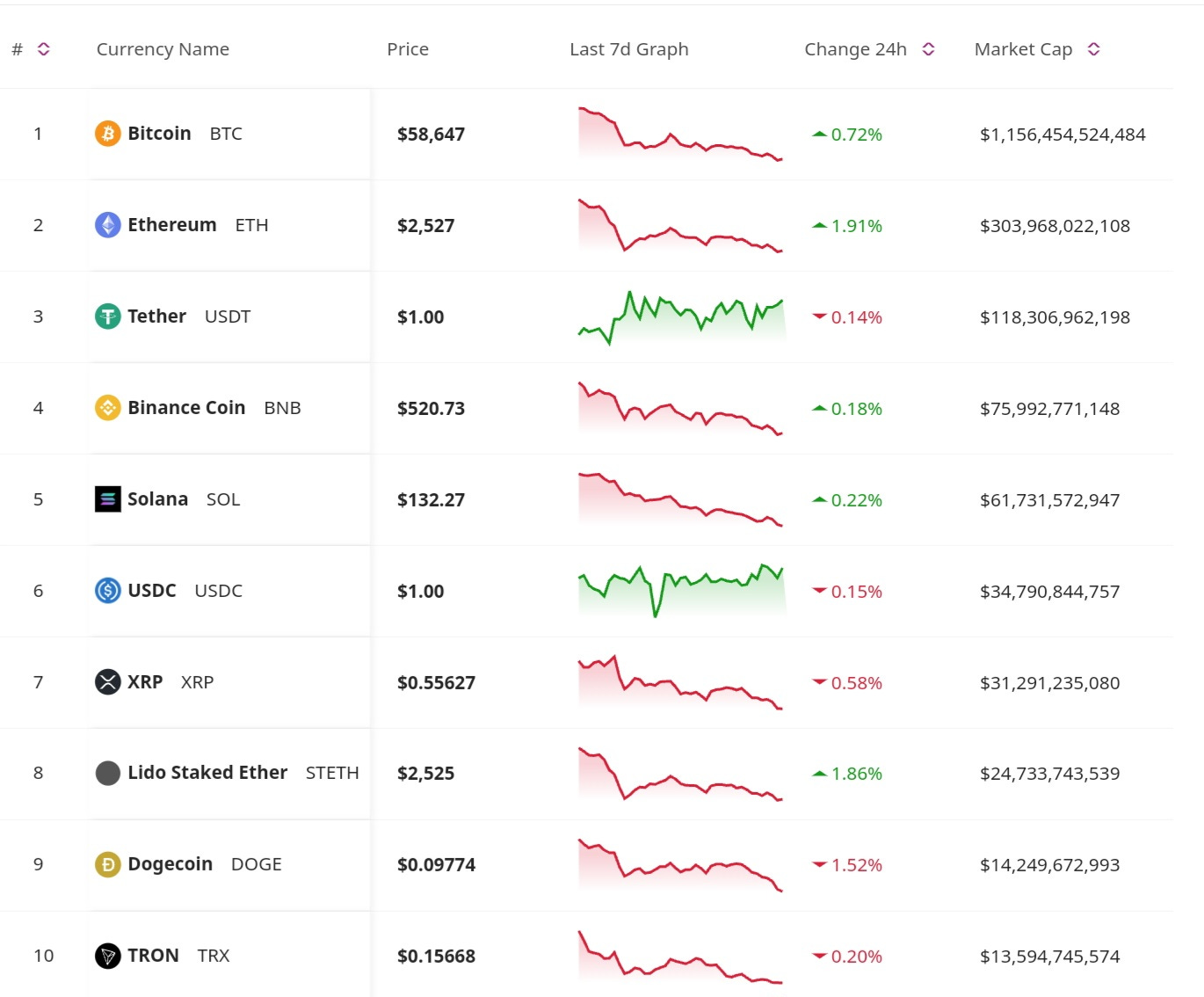

Price Update

Bitcoin Slips Back to $58K During Broad Market Pressure

Bitcoin has slipped back to $58,000, continuing its underwhelming performance in recent weeks. The cryptocurrency's decline is part of a broader trend of market underperformance, with Bitcoin lagging behind traditional stocks since early August. The ongoing event has contributed to the downward pressure, as traders reduce their exposure to mitigate risks. Despite the current market conditions, some analysts believe next week could bring upside excitement for Bitcoin, depending on economic data releases and market sentiment.

Market Trends

Bitcoin and Ethereum ETFs Experience Outflows

Bitcoin ETFs have logged monthly losses, while Ethereum ETFs have been largely ignored following a streak of outflows. The recent trend reflects waning investor interest in crypto ETFs, which have struggled to maintain momentum amid market volatility and regulatory uncertainty. BlackRock's iBit, one of the prominent Bitcoin ETFs, recorded its first daily outflows since May, signaling a potential shift in investor sentiment. The decline in demand for Bitcoin ETFs may be attributed to a combination of factors, including regulatory concerns, market volatility, and changing investor preferences.

Regulatory News

Elon Musk Cleared in Dogecoin Market Manipulation Lawsuit

Elon Musk and Tesla have won the dismissal of a lawsuit alleging that they manipulated the Dogecoin market. The lawsuit, which accused Musk of using his influence to inflate Dogecoin's price, has been a significant legal challenge for the billionaire. The court's ruling in favor of Musk is a notable victory, affirming that his actions did not constitute market manipulation under the law.

SEC Warns FTX Against Repaying Creditors in Stablecoins

The U.S. SEC has issued a warning to FTX, advising the exchange against repaying its creditors in stablecoins or other cryptocurrencies. The warning comes as FTX navigates its financial troubles and seeks ways to settle its debts. The SEC's stance shows concerns about the volatility and regulatory status of cryptocurrencies, particularly stablecoins which are lately under scrutiny.

Don’t Miss Anything

Russia Plans to Use Crypto to Bypass Sanctions

Russia is reportedly exploring the use of cryptocurrencies to evade international sanctions. The move is seen as a strategy to circumvent financial restrictions imposed by Western countries, allowing Russia to engage in cross-border transactions without relying on traditional banking systems. The use of crypto for sanctions evasion raises significant legal and regulatory questions, particularly regarding compliance with international laws and norms. The development has caught the attention of global regulators, who are closely monitoring Russia's actions and considering potential responses.

Cardano Shifts to Decentralized Governance with Chang Hard Fork

Cardano has successfully implemented the Chang hard fork, marking a significant shift towards decentralized governance for the blockchain. The hard fork introduces a new governance model that allows Cardano holders to vote on protocol updates and changes. The transition to decentralized governance is a key milestone for Cardano, positioning it as a leading blockchain in terms of security, scalability, and transparency.

The cryptocurrency market is navigating a period of significant developments. SEC’s warning to FTX reflects the evolving landscape of blockchain governance and regulatory compliance. Market movements, including Bitcoin’s decline to $58K and the outflows from crypto ETFs, highlight the uncertainty facing investors. Meanwhile, geopolitical strategies involving crypto, such as Russia’s potential use of digital currencies to bypass sanctions, show us the complex interplay between technology, law, and global politics. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc