BTC Wavers at $62K, Canary Capital Files for XRP ETF, and Scroll SCR Governance Token - October 9, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

XRP ETF: Canary Capital has filed for a spot XRP ETF with the SEC.

Tokenized Assets: Midas expands to Tokenized RWAs to retail investors.

Bitcoin ETFs: See $235M in inflows.

Scroll: Launching SCR governance token on Binance Launchpad on Oct. 19.

DCA: Survey shows investors prefer DCA as an investment strategy.

Crypto.com: Sues SEC after receiving Wells Notice.

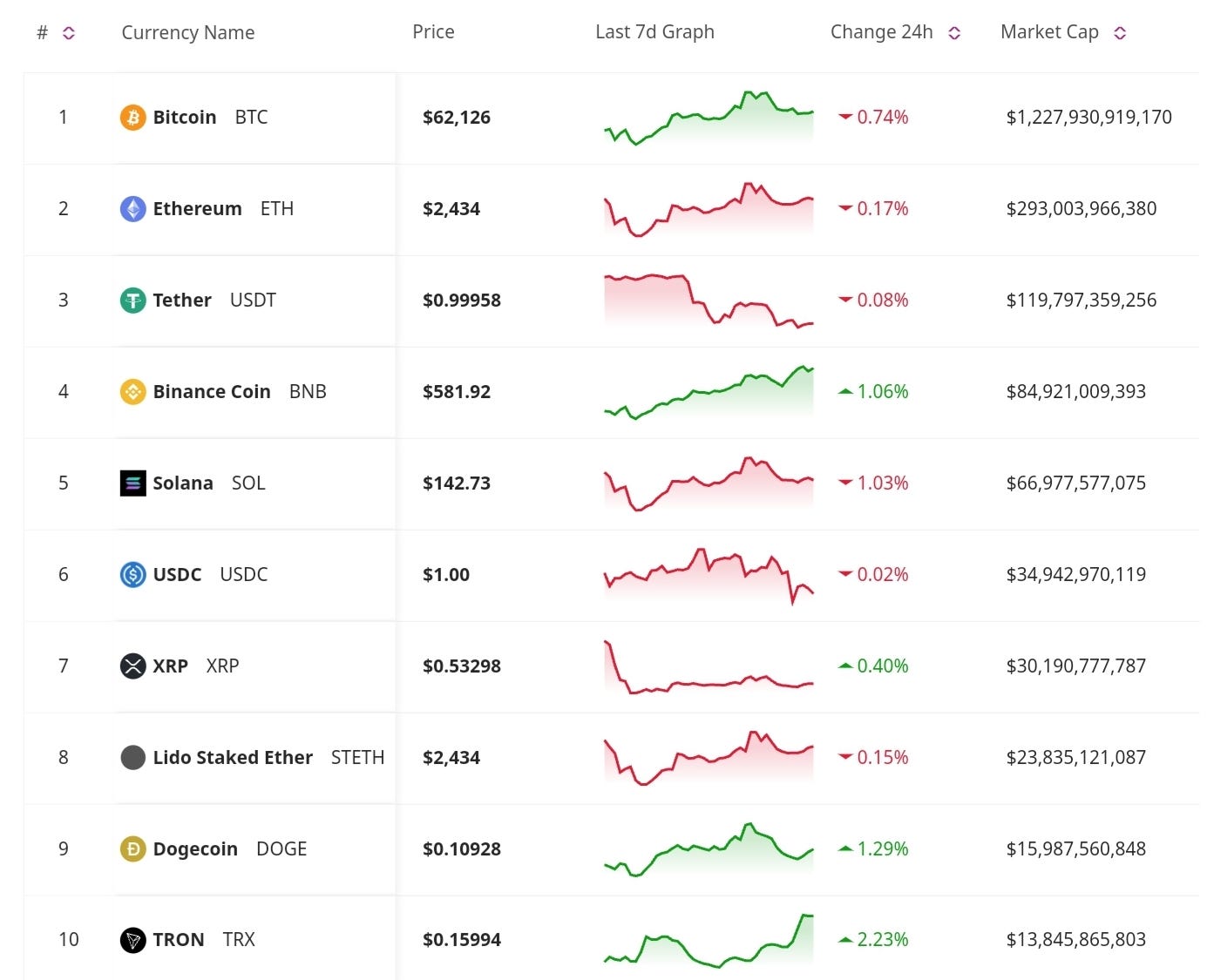

Price Update

Bitcoin Wavers at $62K With Volatile Markets

Bitcoin remains flat at around $62,000 as swings in traditional markets—stocks and gold—keep the cryptocurrency from finding a clear direction. Memecoins, which have seen explosive gains recently, are also cooling off as investors take profits, further dampening the market’s mood. Despite Bitcoin being up 40% year-to-date, gold continues to outperform Bitcoin when adjusted for risk.

Market Trends

Bitcoin ETFs See $235M in Inflows

U.S. spot Bitcoin ETFs saw $235 million in net inflows yesterday, led by Fidelity's FBTC fund. This uptick shows the continued institutional interest in Bitcoin, despite the asset’s recent price stagnation.

Survey Highlights DCA Popularity Among Crypto Investors

A recent Kraken survey reveals that 83% of crypto investors use dollar-cost averaging (DCA), with 59% adopting it as their primary investment strategy. This method helps reduce emotional decision-making and promotes long-term investment. Participants earning under $50,000 value DCA for encouraging consistent habits, while higher-income investors use it to protect against market volatility.

Regulatory and Legal Updates

Canary Capital Files for Spot XRP ETF with the SEC

Canary Capital has become the latest firm to file for a spot XRP ETF with the SEC, seeking to capitalize on recent interest in XRP-related products. This follows similar moves by other fund managers and reflects the growing anticipation that a regulated XRP ETF could soon hit the market.

Crypto.com Sues SEC After Receiving Wells Notice

Crypto.com has filed a lawsuit against the SEC following the receipt of a Wells Notice, a formal warning indicating potential enforcement action. This legal battle is another chapter in the ongoing regulatory tension in the crypto industry, as firms push back against the SEC’s aggressive stance.

Don’t Miss Anything

Scroll Debuts Plans for Governance Token Airdrop

Scroll, a zero-knowledge (ZK) powered Ethereum Layer 2 solution, is launching its SCR governance token on Binance Launchpad. The distribution plan includes two community airdrops, funding for projects on Scroll, and allocations for the Scroll DAO Treasury and contributors. SCR will serve as a governance mechanism, enabling users to vote and participate in Scroll’s ecosystem development. The airdrop eligibility snapshot is set for October 19, with claims opening on October 22.

Midas Expands Tokenized Assets to Retail Users with Regulatory Approval

Midas, a real-world asset (RWA) issuer, has received regulatory approval in Europe to offer tokenized investment products to retail investors. This expansion opens up access to a wider base of users, allowing them to invest in tokenized versions of real-world assets like real estate, infrastructure, and more.

The crypto market remains in a holding pattern as Bitcoin struggles to break past $62K in the middle of global market volatility. Meanwhile, Canary Capital’s XRP ETF filing and Midas’ expansion of tokenized assets to retail investors reflect the growing institutional and retail interest in the crypto space. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc