BTC Struggles to Break the $100K Mark, and U.S. Prepares to Improve Regulations - February 5, 2025

Also, concerns over ETH price stability, and the gold price is near ATH.

TL;DR: Crypto Insights in Seconds

BTC: Struggles to pass the $100K mark and analysts warn about potential deeper correction.

ETH: Price rebounded 10%, but analysts warn about a potential deeper correction.

BTC Dominance: Increased to 58%, suggesting investors choose BTC above altcoins.

Gold: Price is near ATH, which is an indication of the market volatility and investors looking for a haven.

DeFi: Shows more resilience than the traditional finance market during the crisis.

U.S. Regulations: SEC's new crypto task force and lawmakers are set to improve regulations.

ETH: Increased gas limit for the first time since transitioning to PoS.

Travala: Partners with Trivago to offer users to book hotels with crypto.

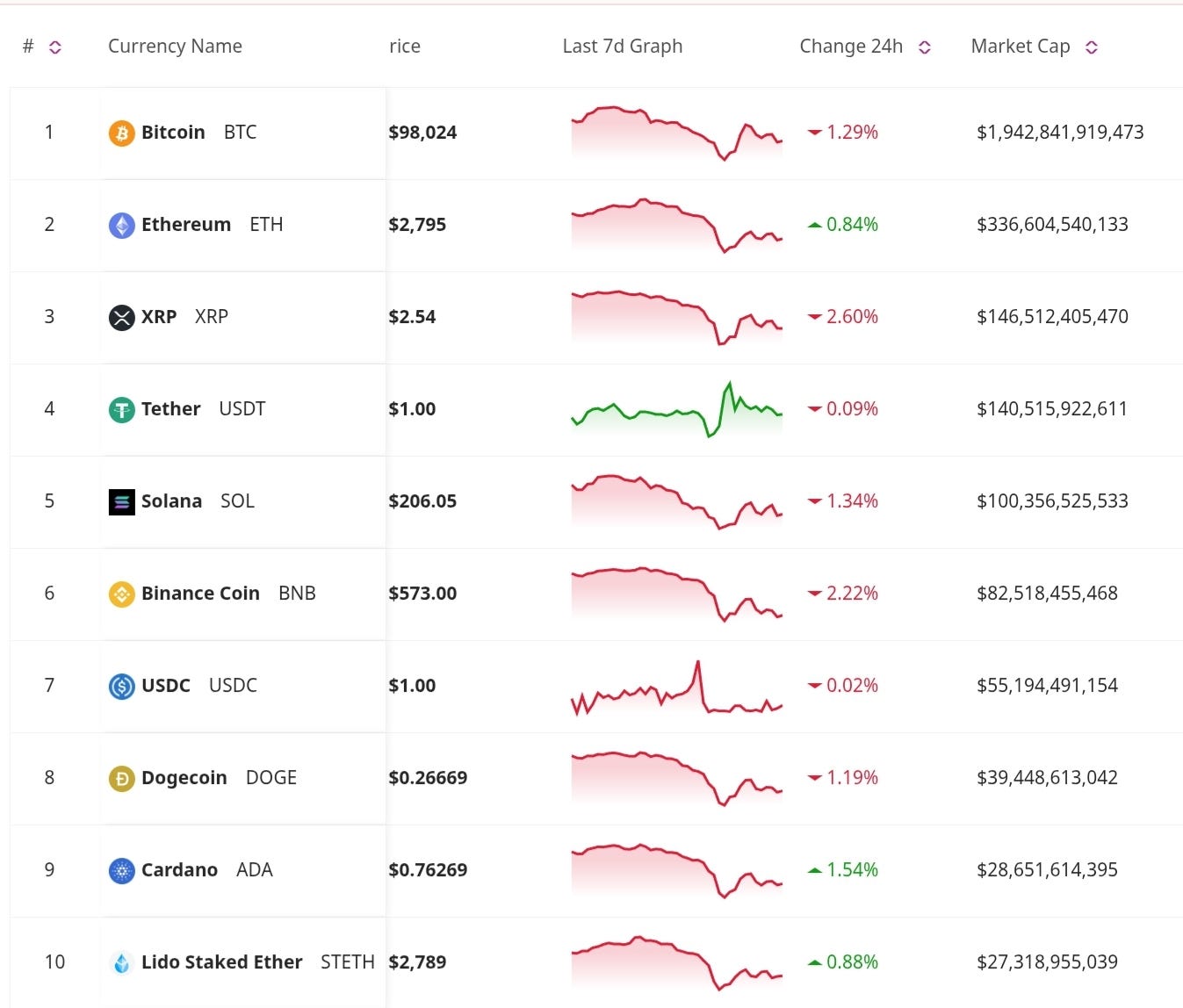

Price Update

BTC Struggles to Pass $100K After China’s Tariff Announcements

Bitcoin is experiencing increased volatility as fears of a global trade war escalate. In response to President Trump's tariffs, China’s Ministry of Finance announced up to 15% tariffs on some U.S. imports. Bitcoin briefly recovered but dipped below $100,000, with analysts warning of a potential correction below $90,000 if market uncertainty persists. Experts suggest that while trade tensions could weaken traditional markets and strengthen Bitcoin as a hedge against inflation, short-term volatility remains high.

ETH Rebounded but Concerns Aren’t Over

Analysts warn that Ether has rebounded over 10% after hitting a three-month low but must stay above $2,700 to avoid further declines. A drop below this level could trigger nearly $500 million in leveraged long liquidations, with even steeper losses expected under $2,650. Analysts argue that while short-term price swings are inevitable, Ethereum’s strong fundamentals and growing financial ecosystem will drive long-term value.

Market Trends

BTC Market Dominance Increased

Bitcoin's market dominance has increased to 58.8%, up from 51% in December, while the overall crypto market capitalization remains steady at $3.5 trillion. This shift suggests capital is moving from altcoins to Bitcoin, though Bitcoin’s price stability between $90,000 and $100,000 indicates this is more due to altcoin weakness. In contrast, legacy coins like XRP, Litecoin, and LEO have outperformed Bitcoin, showing that established cryptocurrencies are gaining favor.

Gold Price is Near ATH

Gold is holding above $2,820, reaching a new all-time high as investors flock to safe-haven assets amid rising volatility in both Bitcoin and global equities. This jump is largely driven by increased demand after China imposed retaliatory tariffs on U.S. goods, with markets now waiting for key U.S. jobs data later this week.

Founders Find DeFi More Resilient than TradFi in Crisis

During the sell-off, several DeFi protocols performed well, with systems like Sky and Aave showing resilience. For example, Sky maintained over $10 billion in collateral, and Aave processed around $210 million in liquidations, significantly lower than the $263 million liquidated in the previous two years. DeFi's ability to handle such stress, without bias or forced liquidations like in TradFi, demonstrated its growth and reliability.

Regulatory Updates

SEC’s Crypto Task Force

The U.S. SEC has established a new task force to clarify regulatory clarity regarding crypto. The team will focus on how digital assets should be classified as securities and prioritize investigations into stablecoins, DeFi, and other digital assets. The goal is to refine and enforce existing regulations.

U.S. Lawmakers Working Group to Draft Crypto and Stablecoin Bills

U.S. lawmakers have formed a working group between the House and Senate to draft comprehensive bills on crypto regulation, with a special focus on stablecoins. This collaboration will seek to bring more legal certainty to this sector.

Don’t Miss Anything

Ethereum Increases Gas Limit

Ethereum has raised its gas limit for the first time since transitioning to Proof-of-Stake, allowing for more transactions to be processed in each block. This change is expected to improve network efficiency and reduce congestion, benefiting users and developers alike.

Trivago Partners with Travala to Offer Crypto Payment Options

Travel platform Trivago is partnering with Travala to allow users to book hotels using cryptocurrencies. The collaboration marks a significant step in expanding crypto adoption in the travel industry.

The crypto market is navigating turbulent waters due to macroeconomic and political factors, with traders alert to the next movements and opportunities. The following days will be crucial for all investors since we will have Trump’s meeting with President Xi Jinping, and the U.S. jobs data announcement which could prompt further volatility. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.