BTC Stagnates at $61K, IMF Pushes El Salvador on Bitcoin Regulation, and SWIFT Trials Digital Asset Transactions - October 4, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

El Salvador: IMF reiterates concerns about Bitcoin’s adoption in the country.

PayPal: Completes first business transaction with PYUSD.

U.S. Spot Bitcoin ETFs: See $91M in outflows.

Grayscale: Launches new fund offering exposure to Aave.

SWIFT: Global banking network SWIFT to run live trials for digital assets with major banks.

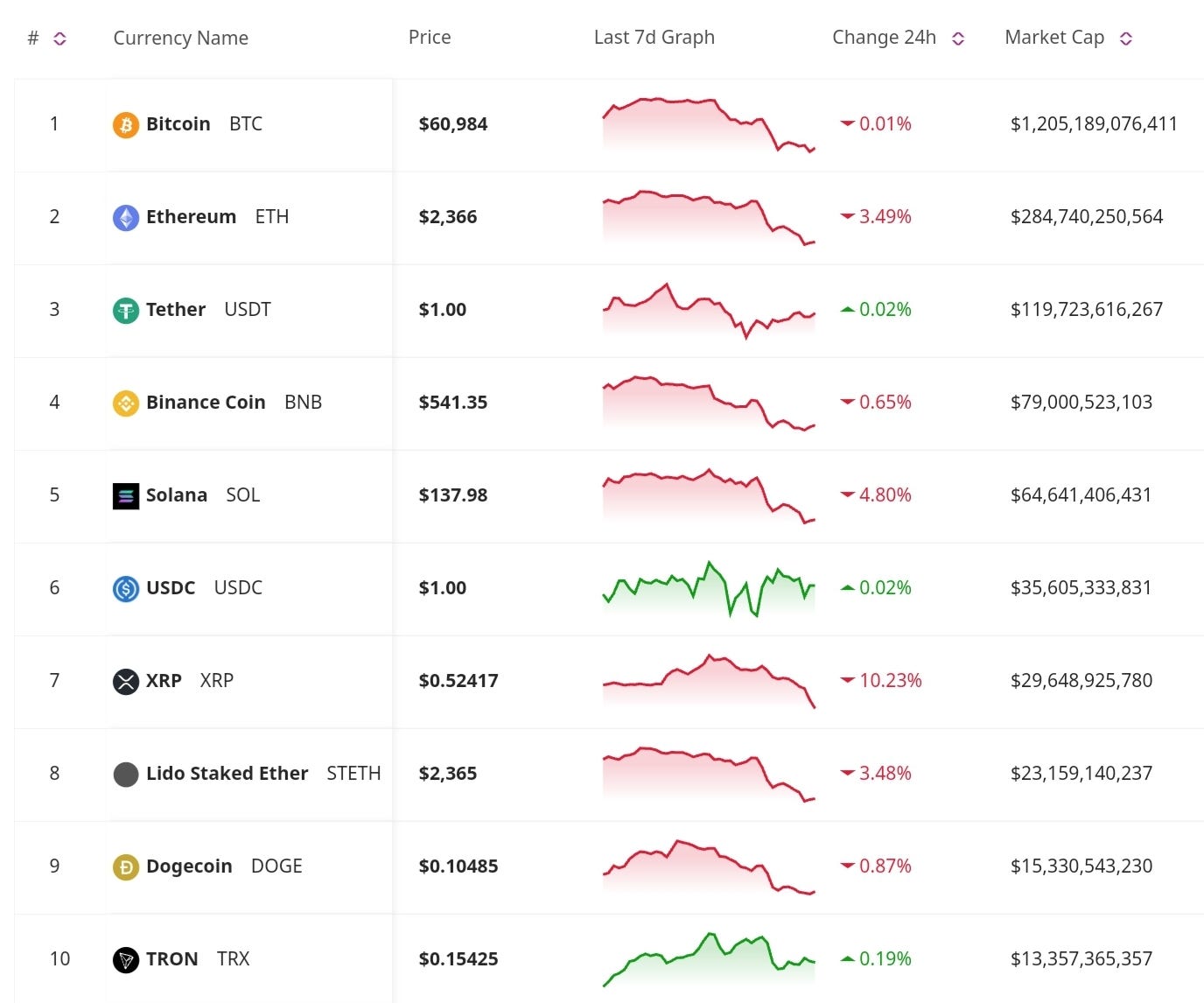

Price Update

Bitcoin Stuck at $61K as Geopolitical Uncertainty Lingers

Bitcoin remains flat near $61K despite increased whale accumulation. Analysts note that geopolitical risks, particularly in the Middle East, are causing market anxiety, pushing some investors away from crypto and into traditional safe havens like gold. While whales continue to buy Bitcoin, retail and institutional demand remains subdued.

Regulatory Updates

IMF Urges El Salvador to Strengthen Bitcoin Oversight

The International Monetary Fund (IMF) has once again called on El Salvador to improve its regulatory framework and supervision of Bitcoin. Despite El Salvador's enthusiastic adoption of Bitcoin as legal tender, the IMF remains concerned about potential financial risks and the need for better protections.

Market Trends

Bitcoin Not a Safe Haven from Geopolitical Risks, but ‘Buy the Dip’

Standard Chartered analysts argue that while Bitcoin has not proven to be a reliable hedge against geopolitical risks, current price levels may offer a buying opportunity for long-term investors. They suggest that Bitcoin could dip further, potentially below $60K, creating an attractive entry point. JPMorgan analysts argue that gold and Bitcoin could both benefit in the long term as hedges against sustained geopolitical risk.

U.S. Spot Bitcoin ETFs See $91M in Outflows

U.S. spot Bitcoin ETFs recorded $91 million in net outflows yesterday, with ARK Invest’s ARKB leading the exodus.

SWIFT to Trial Digital Asset Transactions by 2025

SWIFT, the global banking network, announced that it will begin live trials for digital asset transactions by 2025, in collaboration with several major banks. This initiative will explore how digital currencies can be integrated into the traditional financial infrastructure, providing greater efficiency and transparency for cross-border payments.

New Launches

Grayscale Launches New Fund Offering Exposure to Aave Governance Token

Grayscale has launched a new investment fund focused on governance tokens, starting with Aave. The fund wants to provide institutional investors with exposure to decentralized finance governance protocols, a growing sector within the crypto space.

Don’t Miss Anything

HBO Documentary Claims to Unveil Satoshi Nakamoto’s True Identity

An upcoming HBO documentary, ‘Money Electric: The Bitcoin Mystery’, is set to explore the mystery of Bitcoin’s creator, Satoshi Nakamoto, and potentially reveal their true identity. The documentary has sparked interest and debate in the crypto community, as the identity of Nakamoto has remained one of the greatest unsolved mysteries in the industry. The documentary will be out next Wednesday, Oct. 9.

PayPal Executes First Business Transaction Using PYUSD Stablecoin

PayPal has successfully executed its first business transaction using its PYUSD stablecoin. This marks a significant milestone in PayPal's push to integrate digital currencies into mainstream business operations.

The crypto market remains on edge as Bitcoin struggles to break past $61K, with macroeconomic and geopolitical uncertainties driving investor caution. However, the growing adoption of digital assets, from PayPal’s PYUSD transactions to SWIFT’s upcoming trials, highlights the sector's ongoing evolution. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc