BTC Price Consolidates, and Crypto Institutional Adoption Grows - December 13, 2024

Also, Ethena becomes the third largest stablecoin, and BTC ETFs surpass 500,000 BTC.

TL;DR: Crypto Insights in Seconds

BTC: Bulls ignore economic signs and consolidate the BTC price to around $102K.

Ethena: Becomes the third largest stablecoin by market cap.

BTC ETFs: Exceed half a million BTC in inflows.

Ukraine: Moving forward with crypto regulation by 2025.

U.S.: Trump wants to create a strategic cryptocurrency reserve and a Texas bill is proposing it.

Australia: AMP superannuation fund is now the latest institution investing in BTC.

BlackRock: The giant recommends a 1-2% BTC allocation to hedge against volatility.

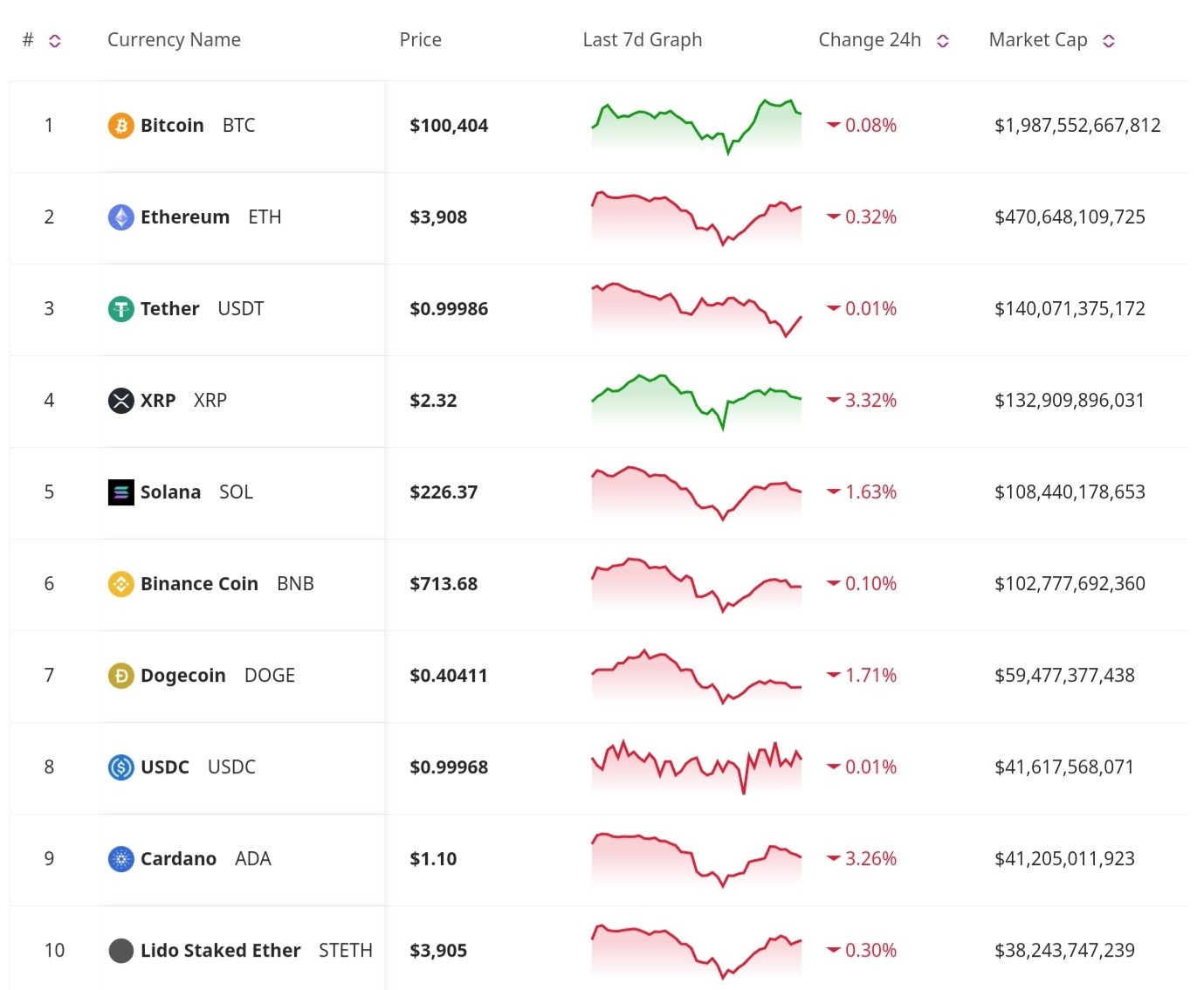

Price Update

Bitcoin Bulls Eye $102K Despite Economic Signals

Bitcoin bulls remain undeterred by lackluster U.S. Producer Price Index (PPI) data, as BTC consolidates just below $102K. Large-scale whale activity continues to support the rally, signaling confidence in Bitcoin’s mid-term trajectory.

Market Trends

Ethena’s USDE Overtakes DAI

Ethena’s USDE stablecoin has surpassed MakerDAO’s DAI to become the third-largest stablecoin by market cap. This is a significant shift in the stablecoin market, showing the growing appeal of innovative algorithmic-backed stablecoins.

Bitcoin ETFs Exceed Half a Million BTC

U.S. spot Bitcoin ETFs have amassed over 500,000 BTC in cumulative net inflows, reflecting growing investor demand and confidence in regulated Bitcoin investment products.

Regulatory and Legal News

Ukraine’s Eyes Crypto Legalization by 2025

Ukraine is set to legalize cryptocurrency by 2025, adopting a securities-based taxation model. This decision will position the country as a progressive player in Europe’s blockchain ecosystem, promoting innovation while ensuring regulatory clarity.

Trump’s Crypto Reserve Vision for the U.S.

Former President Trump’s team is advancing plans for a U.S. strategic cryptocurrency reserve, emphasizing Bitcoin’s role in strengthening national leadership in the crypto industry. A recently proposed Texas bill aligns with this initiative, wanting to establish a state Bitcoin reserve to mitigate against economic uncertainties.

Australia Enters the Crypto Market

Australia’s AMP superannuation fund has become the latest major financial institution to invest in Bitcoin, another show of the growing institutional adoption of crypto. The fund’s move reflects Bitcoin’s evolving role as a hedge and long-term asset in traditional portfolios.

Don’t Miss Anything

BlackRock Endorses Bitcoin Allocation

Investment giant BlackRock recommends a 1-2% Bitcoin allocation in multi-asset portfolios, citing its potential as a protective instrument against traditional market volatility.

The crypto market continues its dynamic evolution, with Bitcoin nearing new heights and global interest in blockchain policies surging. From strategic reserves to stablecoin breakthroughs, the industry demonstrates resilience and innovation, setting the stage for transformative growth in 2025. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

amazing