BTC Massive Sell Off and $300 Million in Liquidations - January 8, 2025

Also, BTC and ETH ETFs surpass $1 billion, and Coinbase case takes a pause.

TL;DR: Crypto Insights in Seconds

BTC: Massive sell off, leading to a drop in price and $300 million in liquidations.

Coinbase Premium: The index turns positive for the first time since December.

ETFs: U.S. BTC and ETH ETFs surpass $1 billion in net inflows.

Coinbase: Legal case with the SEC takes a pause.

FTX: EU arm of the firm was sold to Backpack Exchange.

Ripple: Partners with Chainlink for its stablecoin RLUSD.

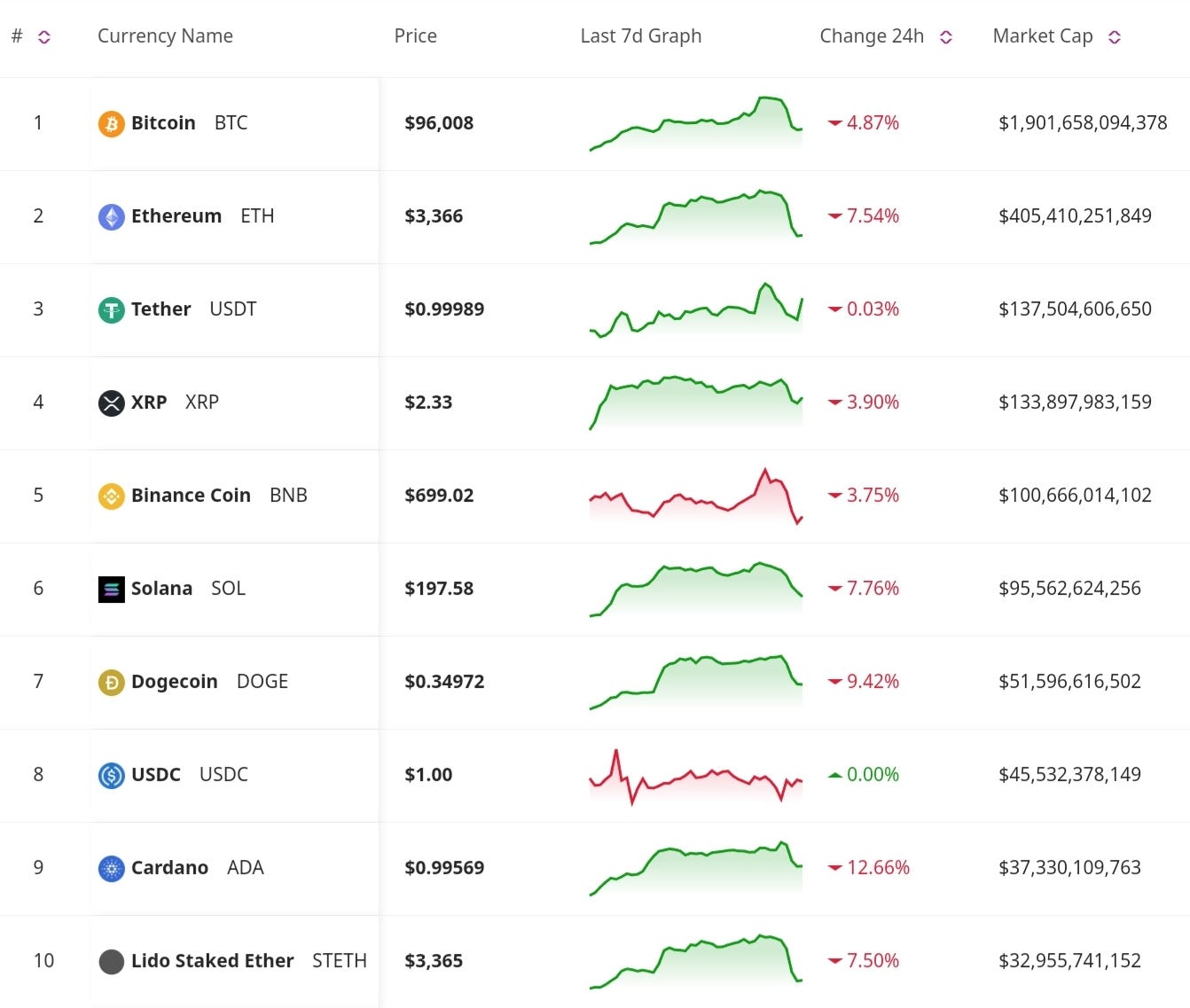

Price Update

Bitcoin Drops Below $98K Amid Strong U.S. Economic Data

Bitcoin’s brief rally to $100K triggered record monthly outflows of 5,400 BTC from exchanges due to increased accumulation by long-term holders. The massive selling led to $300 million in crypto liquidations. Analysts warn that a bearish "head and shoulders" pattern could point to a potential decline to $75K. Tech firm Kulr predicts the token could reach $200K, citing increasing demand during price corrections. The dip could be a buying opportunity for institutions and retail investors alike.

Market Trends

Coinbase Premium Index Gains Momentum in U.S.

Coinbase’s premium indicator flipped positive for the first time in weeks since December 17, suggesting renewed Bitcoin demand among U.S. investors, especially strong investors who use Coinbase for large transactions.

U.S. Spot Bitcoin and Ethereum ETFs Surpass $1 Billion in Net Inflows

U.S. spot Bitcoin and Ethereum ETFs continue to attract investors, surpassing $1 billion in cumulative net inflows. After recent outflows, this only showcases the growing interest in institutional-grade crypto investment products.

Regulatory and Legal News

Coinbase Legal Case Takes a Pause

A New York district court has granted Coinbase's request for an interlocutory appeal, pausing the SEC's lawsuit accusing the exchange of operating as an unregistered entity. Judge Katherine Polk Failla cited significant legal uncertainties regarding the Howey Test's application to crypto assets, underscoring the need for the Second Circuit Court of Appeals to resolve these issues.

Don’t Miss Anything

FTX EU Sold to Backpack Exchange for European Derivatives Expansion

FTX EU, the European arm of the now-defunct crypto exchange, has been acquired by Backpack Exchange. The new owners plan to take advantage of the platform for a regulated push into crypto derivatives across Europe, showing potential growth in compliant trading services.

Ripple Taps Chainlink for Stablecoin Growth

Ripple is collaborating with Chainlink to expand the DeFi utility of its RLUSD stablecoin. By adopting Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Ripple seeks to improve cross-chain capabilities and bolster liquidity for RLUSD in decentralized ecosystems.

The crypto market activity shows significant price volatility and ongoing developments across DeFi, institutional interest, and regulatory landscapes. From Bitcoin’s potential correction to Coinbase’s legal case and Ripple’s push into stablecoin utility, the ecosystem remains dynamic as 2025 starts to unfolds. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

i love it here