BTC Faces Sell Pressure, and the SEC Considers Relief Measures - February 6, 2025

Also, U.S. is focusing on stablecoins, and Ondo Finance launches a new platform.

TL;DR: Crypto Insights in Seconds

BTC: Analysts warn that the token is facing selling pressure and it could lead to a second drop.

SEC: Considers token relief measures for projects that aren’t pure speculation.

CFTC: Acting Chair suggests a less aggressive enforcement approach to crypto regulation.

U.S.: Trump’s administration wants to focus on stablecoin regulation and innovation.

Sen. Warren: Criticizes banks for closing accounts related to crypto.

BlackRock: Planning to launch BTC ETP for European market.

Ondo: Launches new tokenization platform for U.S. securities.

XRP: Ledger briefly halted due to a bug but it was quickly fixed without major complications.

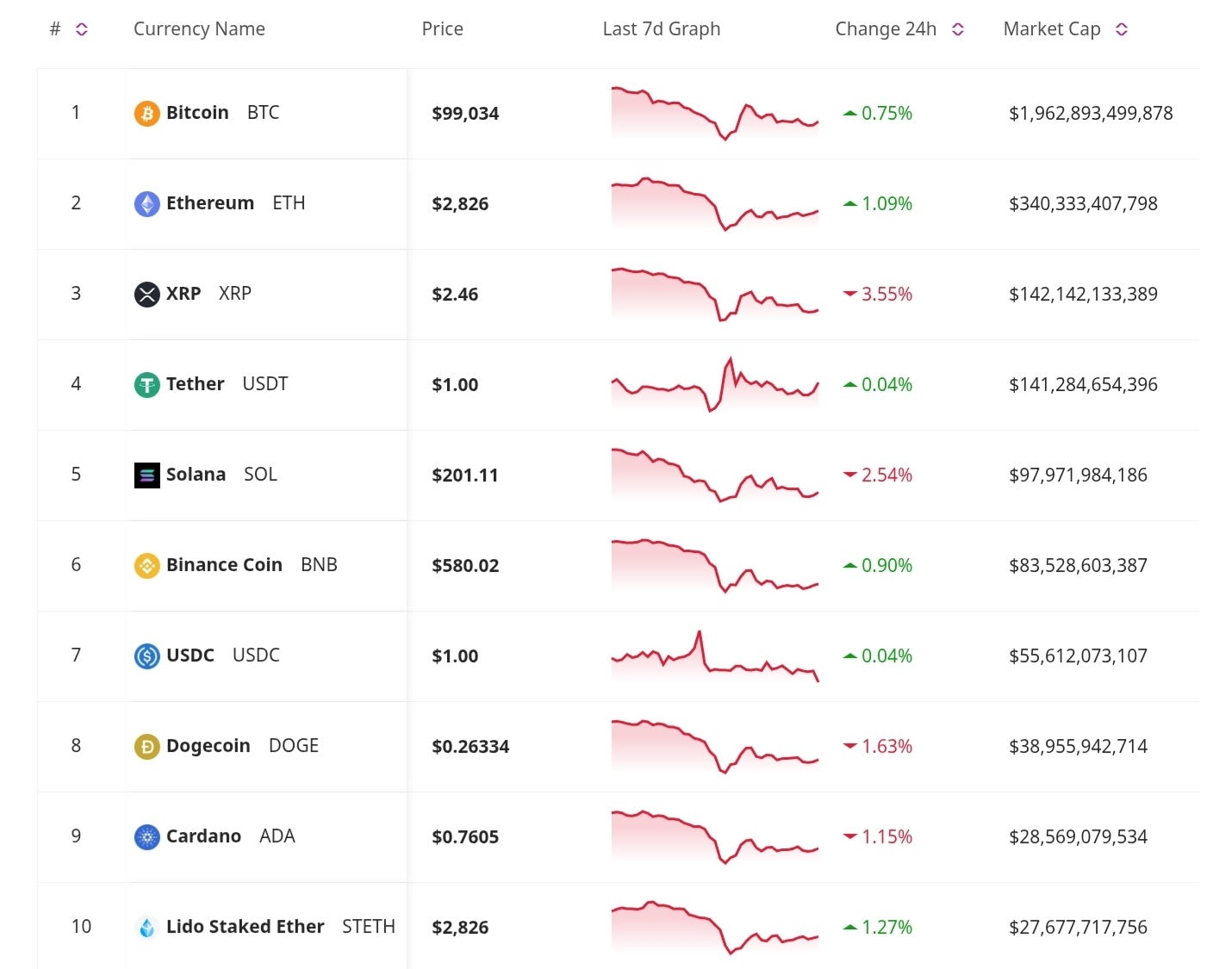

Price Update

Analysts Warn that Bitcoin Sell Pressure Could Intensify

A large on-chain transfer of nearly 50,000 BTC has raised concerns about potential selling pressure in the market. While the purpose of the transaction remains unclear, similar movements in the past have led to significant price swings. The market analysts still debate whether another crash is imminent. While some indicators suggest increased sell pressure, others argue that long-term fundamentals remain strong, making any dips temporary.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Regulatory Updates

SEC Token Relief Could Benefit Crypto Firms

The SEC is reportedly considering new relief measures that could provide clarity and regulatory flexibility for crypto firms. If approved, this could ease compliance burdens and encourage innovation in the sector. However, Franco Jofré, an attorney and a senior adviser at Miller & Chevalier assured that only projects that show strong utility cases instead of pure speculation would benefit.

CFTC Acting Chair Suggests Less Enforcement-Driven Crypto Regulation

The acting chair of the CFTC has indicated a shift away from aggressive enforcement in crypto regulation. Instead, the agency may focus on providing clearer guidelines for digital asset markets, potentially benefiting exchanges and traders.

U.S. Crypto Developments

Trump Administration’s Stablecoin Plan and Its Impact on the US Dollar

The Trump administration, guided by crypto advisor David Sacks, plans to regulate stablecoins and encourage their development within the United States, focusing on U.S. dollar-backed digital assets. Sacks highlighted the potential of stablecoins to enhance the dollar's global dominance by extending its reach digitally. This could generate trillions in new demand for U.S. Treasurys, thereby supporting national debt and reducing long-term interest rates.

Sen. Warren Criticizes Banks for Closing Crypto Accounts

Senator Elizabeth Warren criticized major banks for closing crypto-related accounts, calling it "crypto debanking." She argued that cutting off access to banking services harms innovation and consumer choice. Banks defend the move, citing fraud risks and money laundering concerns. Warren urged policymakers to ensure fair access to banking for legitimate crypto businesses.

Don’t Miss Anything

BlackRock Plans to Launch Bitcoin ETP for European Market

BlackRock is reportedly planning to launch a Bitcoin exchange-traded product for the European market. While details remain scarce, BlackRock's expansion into Europe follows the success of its U.S. spot Bitcoin ETF. The firm has yet to confirm the launch, but the product could provide European investors with regulated Bitcoin exposure.

Ondo Finance Launches Tokenization Platform for U.S. Securities

Ondo Finance has launched a new platform for tokenizing real-world assets. The platform will offer tokenized exposure to assets like U.S. Treasuries and corporate bonds, allowing institutional and retail investors to access them on-chain.

XRP Ledger Briefly Pause Due to a Bug

The XRP Ledger briefly halted on Feb. 5 due to a bug triggered by an automated security check, causing a temporary disruption in transaction processing. Validators quickly identified the issue, and a fix was implemented, restoring network functionality. Despite the halt, no funds were lost, and developers are working on a long-term solution to prevent future incidents.

The market has a brief pause in volatility as traders realign and wait for new developments before making decisions. Analysts suggest that in the long term, the market is ready and strong to reach new ATH, however, short volatility is still a factor to consider. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.