BTC Ends January Above $100K, and Tether Reports $13 Billion Profits - February 3, 2025

Also, Grayscale launches DOGE trust, and WLF purchases more ETH.

TL;DR: Crypto Insights in Seconds

BTC: Ends January above the $100K, giving positive signs for further growth.

El Salvador: Rescinded Bitcoin’s status as a full legal tender.

DOT: 21Shares files for the first Polkadot U.S. ETF.

DOGE: Grayscale launches Dogecoin trust.

UBS: Launches blockchain-based product to trade gold.

WLF: Purchase $10M in ETH.

Tether: Reported $13B profits in 2024.

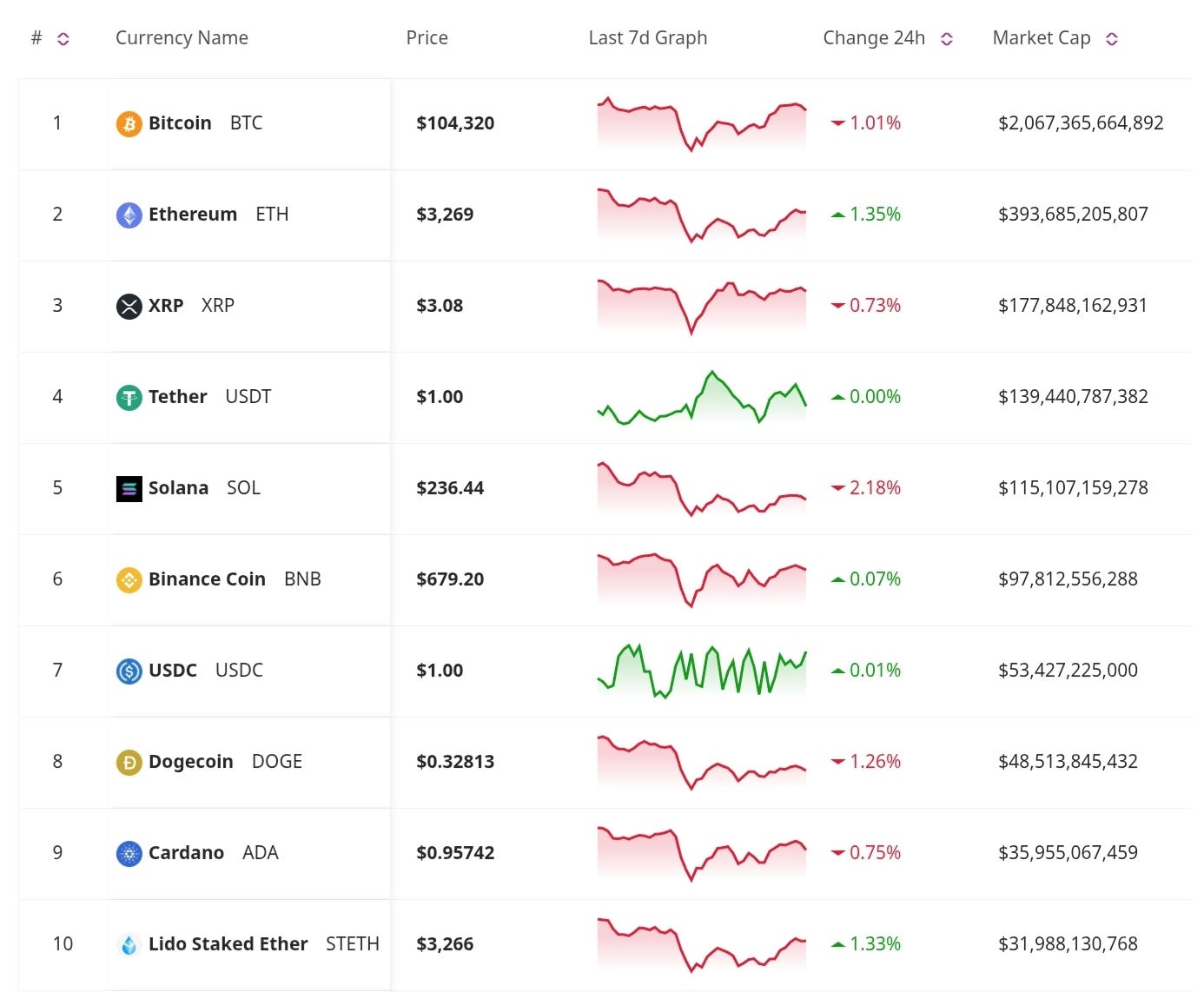

Price Update

Bitcoin Closes First Month Above $100K

For the first time ever, Bitcoin has closed a monthly candle above $100,000, showing strong bullish momentum. Analysts see this as a key psychological level, potentially paving the way for further price appreciation.

Legal and Regulatory Updates

El Salvador Reaches IMF Deal While Keeping Bitcoin Strategy

El Salvador has secured a deal with the International Monetary Fund (IMF) without giving up its Bitcoin adoption. The agreement provides financial support while allowing the country to continue using BTC as a legal tender.

21Shares Eyes First Spot Polkadot ETF, Awaits SEC Approval

21Shares has applied for a spot Polkadot (DOT) ETF in the U.S., pending SEC approval. If approved, this would be the first ETF providing direct exposure to Polkadot, expanding crypto investment options.

Grayscale Launches Dogecoin Trust

Grayscale has introduced a Dogecoin Trust, offering institutional investors exposure to the popular memecoin. This decision was fueled by the growing interest in memecoins and their potential to diversify portfolios.

New Developments

UBS Backs Blockchain Gold Investment with zkSync on Ethereum

Swiss banking giant UBS is launching a blockchain-based gold investment product using zkSync on Ethereum. This allows investors to trade digital gold tokens efficiently while benefiting from blockchain transparency and reduced costs.

WLF Firm Increases Ethereum Holdings

World Liberty Financial, a firm associated with Donald Trump, has made another large Ethereum purchase of $10 million. This aligns with Trump's recent embrace of crypto, sparking speculation about future blockchain-related initiatives.

Tether reported over $13 billion in profits for 2024

Tether announced its 2024 profit, reporting $13 billion in gains, with $6 billion generated in Q4. The firm’s U.S. Treasury exposure hit a record $113 billion, and its excess reserve buffer grew 36% to surpass $7 billion. Tether issued $23 billion in USDT in Q4, reaching $45 billion for the year.

The market saw a solid end of the month with BTC above $100K, a signal that could indicate investor trust and possible further gains. We are also seeing other companies and firms taking bold steps embracing crypto, creating ETFs, investing, and opening the doors for a thriving industry. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.